Goodbaby International Holdings' (HKG:1086) earnings have declined over five years, contributing to shareholders 83% loss

This week we saw the Goodbaby International Holdings Limited (HKG:1086) share price climb by 20%. But will that heal all the wounds inflicted over 5 years of declines? Unlikely. Indeed, the share price is down a whopping 83% in that time. The recent bounce might mean the long decline is over, but we are not confident. The fundamental business performance will ultimately determine if the turnaround can be sustained. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

On a more encouraging note the company has added HK$133m to its market cap in just the last 7 days, so let's see if we can determine what's driven the five-year loss for shareholders.

Check out our latest analysis for Goodbaby International Holdings

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

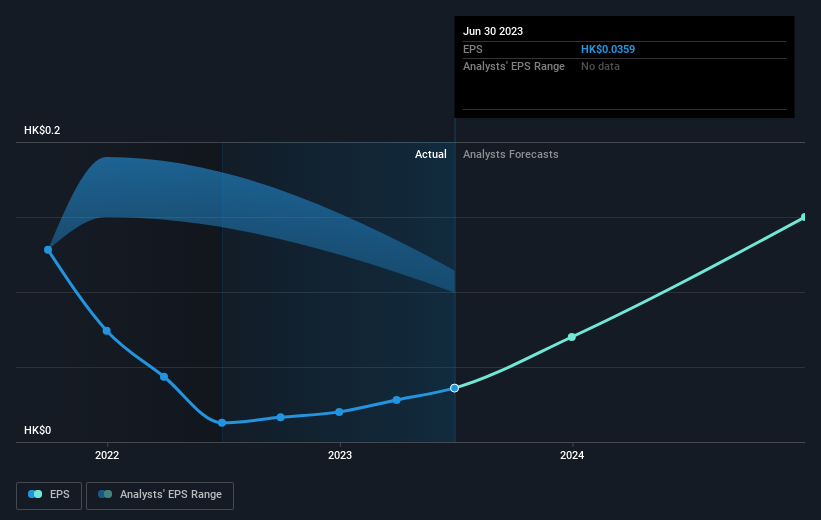

Looking back five years, both Goodbaby International Holdings' share price and EPS declined; the latter at a rate of 22% per year. This reduction in EPS is less than the 30% annual reduction in the share price. This implies that the market was previously too optimistic about the stock.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Goodbaby International Holdings has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

A Different Perspective

While the broader market gained around 5.4% in the last year, Goodbaby International Holdings shareholders lost 14%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 13% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. Is Goodbaby International Holdings cheap compared to other companies? These 3 valuation measures might help you decide.

Of course Goodbaby International Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1086

Goodbaby International Holdings

An investment holding company, researches and develops, designs, manufactures, markets, and sells durable juvenile products in Europe, North America, Mainland China, and internationally.

Undervalued with excellent balance sheet.