Sitoy Group Holdings (HKG:1023) Has Announced A Dividend Of HK$0.04

Sitoy Group Holdings Limited (HKG:1023) has announced that it will pay a dividend of HK$0.04 per share on the 23rd of December. However, the dividend yield of 9.5% is still a decent boost to shareholder returns.

View our latest analysis for Sitoy Group Holdings

Sitoy Group Holdings' Payment Could Potentially Have Solid Earnings Coverage

A big dividend yield for a few years doesn't mean much if it can't be sustained. Prior to this announcement, Sitoy Group Holdings' dividend was comfortably covered by both cash flow and earnings. This means that a large portion of its earnings are being retained to grow the business.

Unless the company can turn things around, EPS could fall by 4.0% over the next year. If the dividend continues along the path it has been on recently, we estimate the payout ratio could be 48%, which is definitely feasible to continue.

Dividend Volatility

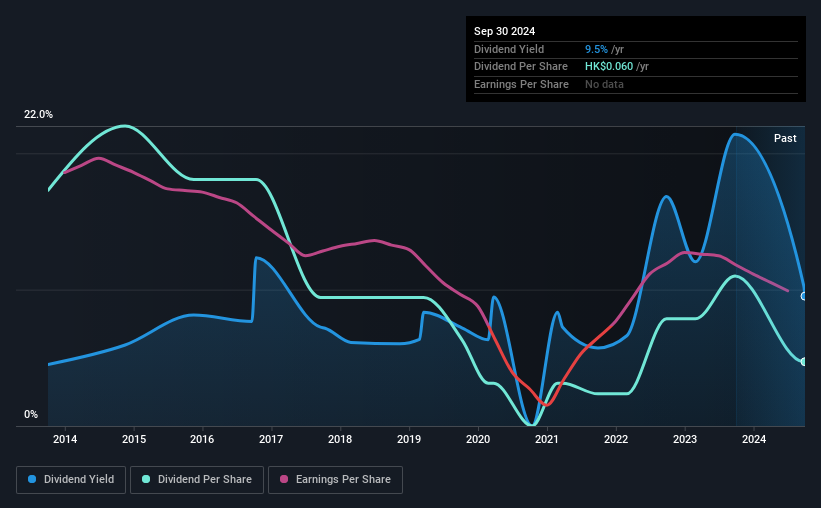

The company has a long dividend track record, but it doesn't look great with cuts in the past. The dividend has gone from an annual total of HK$0.22 in 2014 to the most recent total annual payment of HK$0.06. The dividend has fallen 73% over that period. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

Sitoy Group Holdings May Find It Hard To Grow The Dividend

Given that the track record hasn't been stellar, we really want to see earnings per share growing over time. It's not great to see that Sitoy Group Holdings' earnings per share has fallen at approximately 4.0% per year over the past five years. Declining earnings will inevitably lead to the company paying a lower dividend in line with lower profits.

In Summary

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. This company is not in the top tier of income providing stocks.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For instance, we've picked out 3 warning signs for Sitoy Group Holdings that investors should take into consideration. Is Sitoy Group Holdings not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1023

Sitoy Group Holdings

Engages in the research, development, design, manufacture, sale, wholesale, and retail of handbags, small leather goods, travel goods, and footwear.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives