Stock Analysis

- Hong Kong

- /

- Commercial Services

- /

- SEHK:8128

Do Institutions Own China Geothermal Industry Development Group Limited (HKG:8128) Shares?

The big shareholder groups in China Geothermal Industry Development Group Limited (HKG:8128) have power over the company. Insiders often own a large chunk of younger, smaller, companies while huge companies tend to have institutions as shareholders. I generally like to see some degree of insider ownership, even if only a little. As Nassim Nicholas Taleb said, 'Don’t tell me what you think, tell me what you have in your portfolio.

With a market capitalization of HK$254m, China Geothermal Industry Development Group is a small cap stock, so it might not be well known by many institutional investors. In the chart below, we can see that institutional investors have not yet purchased shares. Let's take a closer look to see what the different types of shareholder can tell us about China Geothermal Industry Development Group.

View our latest analysis for China Geothermal Industry Development Group

What Does The Lack Of Institutional Ownership Tell Us About China Geothermal Industry Development Group?

We don't tend to see institutional investors holding stock of companies that are very risky, thinly traded, or very small. Though we do sometimes see large companies without institutions on the register, it's not particularly common.

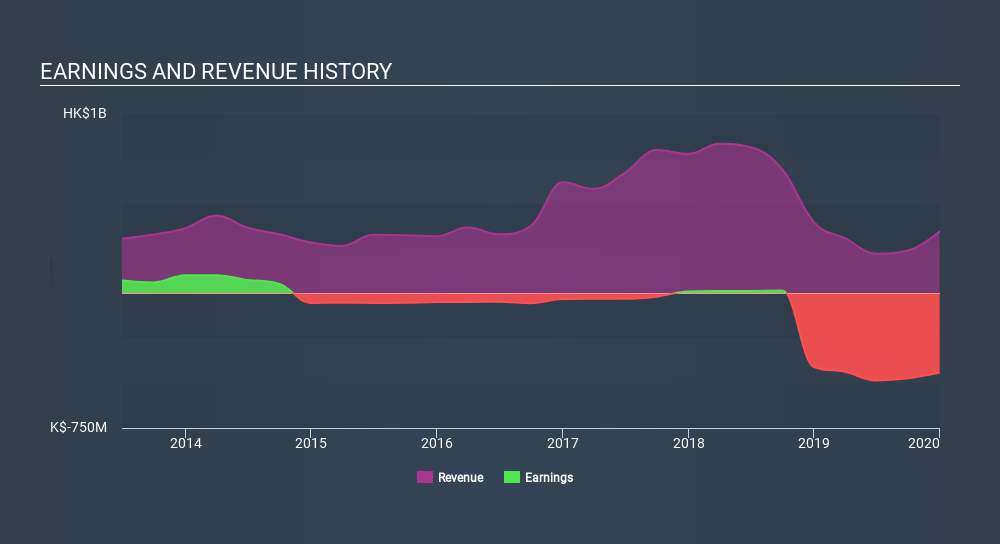

There are many reasons why a company might not have any institutions on the share registry. It may be hard for institutions to buy large amounts of shares, if liquidity (the amount of shares traded each day) is low. If the company has not needed to raise capital, institutions might lack the opportunity to build a position. Alternatively, there might be something about the company that has kept institutional investors away. Institutional investors may not find the historic growth of the business impressive, or there might be other factors at play. You can see the past revenue performance of China Geothermal Industry Development Group, for yourself, below.

Hedge funds don't have many shares in China Geothermal Industry Development Group. China Energy Conservation & Environment Protection (Hong Kong) Investment Co. Ltd. is currently the largest shareholder, with 26% of shares outstanding. Shengheng Xu is the second largest shareholder with 16% of common stock, followed by Yiying Zhang, holding 5.5% of the stock. Shengheng Xu also happens to hold the title of Chief Compliance Officer.

A deeper analysis brings to light the fact that 53% of the company is controlled by the top 4 shareholders suggesting that these owners wield significant influence on the business.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. We're not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of China Geothermal Industry Development Group

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. The company management answer to the board; and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board, themselves.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our most recent data indicates that insiders own a reasonable proportion of China Geothermal Industry Development Group Limited. Insiders own HK$72m worth of shares in the HK$254m company. It is great to see insiders so invested in the business. It might be worth checking if those insiders have been buying recently.

General Public Ownership

With a 45% ownership, the general public have some degree of sway over 8128. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Private Equity Ownership

With a stake of 26%, private equity firms could influence the 8128 board. Some investors might be encouraged by this, since private equity are sometimes able to encourage strategies that help the market see the value in the company. Alternatively, those holders might be exiting the investment after taking it public.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand China Geothermal Industry Development Group better, we need to consider many other factors. To that end, you should learn about the 4 warning signs we've spotted with China Geothermal Industry Development Group (including 1 which is is a bit unpleasant) .

Of course this may not be the best stock to buy. So take a peek at this free free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:8128

CHYY Development Group

An investment holding company, engages in the research, development, and promotion of geothermal energy as alternative energy for building’s heating applications in Mainland China.

Excellent balance sheet and fair value.