The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, LKS Holding Group Limited (HKG:1867) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for LKS Holding Group

How Much Debt Does LKS Holding Group Carry?

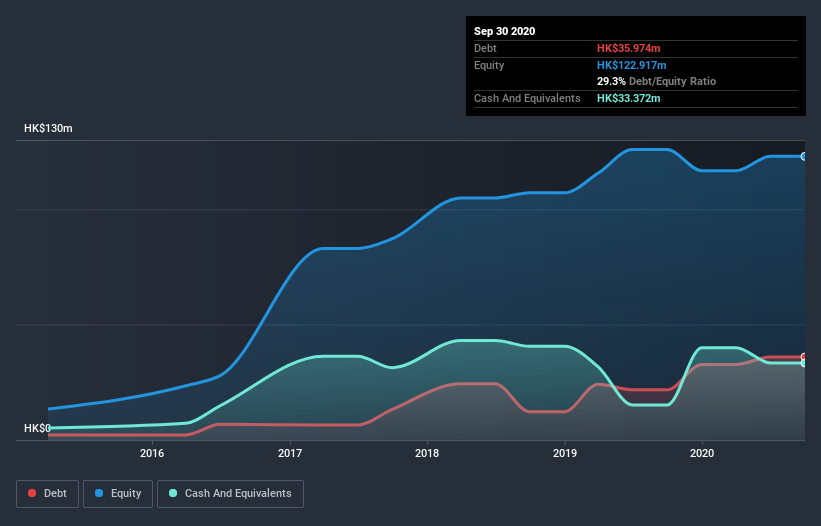

As you can see below, at the end of September 2020, LKS Holding Group had HK$36.0m of debt, up from HK$21.8m a year ago. Click the image for more detail. However, it does have HK$33.4m in cash offsetting this, leading to net debt of about HK$2.60m.

How Healthy Is LKS Holding Group's Balance Sheet?

According to the last reported balance sheet, LKS Holding Group had liabilities of HK$45.4m due within 12 months, and liabilities of HK$921.0k due beyond 12 months. On the other hand, it had cash of HK$33.4m and HK$128.8m worth of receivables due within a year. So it can boast HK$115.9m more liquid assets than total liabilities.

This surplus strongly suggests that LKS Holding Group has a rock-solid balance sheet (and the debt is of no concern whatsoever). Having regard to this fact, we think its balance sheet is as strong as an ox. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since LKS Holding Group will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year LKS Holding Group had a loss before interest and tax, and actually shrunk its revenue by 19%, to HK$258m. We would much prefer see growth.

Caveat Emptor

Not only did LKS Holding Group's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Indeed, it lost HK$2.5m at the EBIT level. That said, we're impressed with the strong balance sheet liquidity. That will give the company some time and space to grow and develop its business as need be. While the stock is probably a bit risky, there may be an opportunity if the business itself improves, allowing the company to stage a recovery. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 3 warning signs for LKS Holding Group (of which 1 shouldn't be ignored!) you should know about.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

When trading LKS Holding Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1867

Standard Development Group

An investment holding company, engages in construction and engineering related business in Mainland China and Hong Kong.

Slight risk with worrying balance sheet.

Market Insights

Community Narratives