- Hong Kong

- /

- Commercial Services

- /

- SEHK:1845

Should You Rely On Weigang Environmental Technology Holding Group's (HKG:1845) Earnings Growth?

Statistically speaking, it is less risky to invest in profitable companies than in unprofitable ones. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it's not always clear whether statutory profits are a good guide, going forward. In this article, we'll look at how useful this year's statutory profit is, when analysing Weigang Environmental Technology Holding Group (HKG:1845).

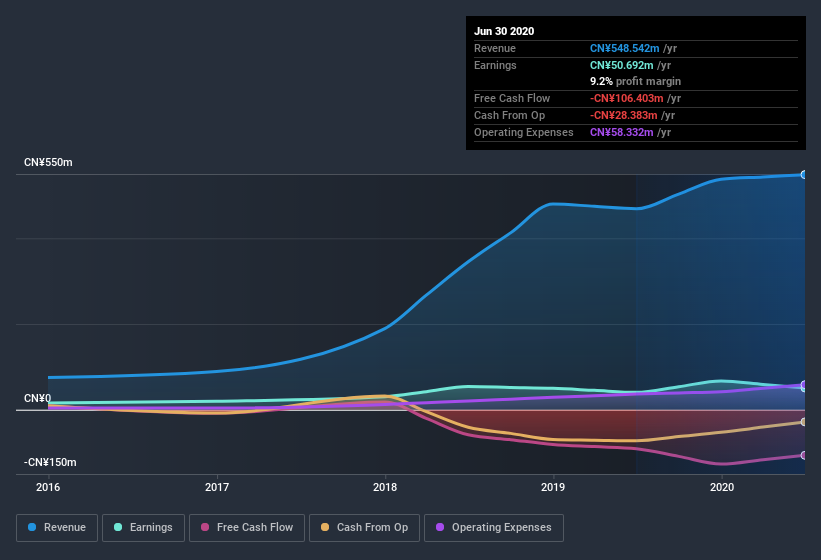

While Weigang Environmental Technology Holding Group was able to generate revenue of CN¥548.5m in the last twelve months, we think its profit result of CN¥50.7m was more important. One positive is that it has grown both its profit and its revenue, over the last few years.

View our latest analysis for Weigang Environmental Technology Holding Group

Importantly, statutory profits are not always the best tool for understanding a company's true earnings power, so it's well worth examining profits in a little more detail. As a result, we think it's well worth considering what Weigang Environmental Technology Holding Group's cashflow (when compared to its earnings) can tell us about the nature of its statutory profit. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Weigang Environmental Technology Holding Group.

Examining Cashflow Against Weigang Environmental Technology Holding Group's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

Over the twelve months to June 2020, Weigang Environmental Technology Holding Group recorded an accrual ratio of 0.45. As a general rule, that bodes poorly for future profitability. And indeed, during the period the company didn't produce any free cash flow whatsoever. Over the last year it actually had negative free cash flow of CN¥106m, in contrast to the aforementioned profit of CN¥50.7m. Coming off the back of negative free cash flow last year, we imagine some shareholders might wonder if its cash burn of CN¥106m, this year, indicates high risk.

Our Take On Weigang Environmental Technology Holding Group's Profit Performance

As we have made quite clear, we're a bit worried that Weigang Environmental Technology Holding Group didn't back up the last year's profit with free cashflow. As a result, we think it may well be the case that Weigang Environmental Technology Holding Group's underlying earnings power is lower than its statutory profit. Nonetheless, it's still worth noting that its earnings per share have grown at 44% over the last three years. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. If you'd like to know more about Weigang Environmental Technology Holding Group as a business, it's important to be aware of any risks it's facing. For instance, we've identified 4 warning signs for Weigang Environmental Technology Holding Group (1 is potentially serious) you should be familiar with.

This note has only looked at a single factor that sheds light on the nature of Weigang Environmental Technology Holding Group's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you’re looking to trade Weigang Environmental Technology Holding Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Weigang Environmental Technology Holding Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1845

Weigang Environmental Technology Holding Group

Engages in the research, design, integration, and commissioning solid waste treatment systems primarily for hazardous waste incineration in the People’s Republic of China.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives