Stock Analysis

Amidst a backdrop of fluctuating global markets, Hong Kong's Hang Seng Index has shown resilience, recently marking a 2.77% increase. This positive movement highlights the region's adaptability in challenging economic climates and sets an interesting stage for investors looking at high-yield dividend stocks on the SEHK. In such an environment, selecting stocks that offer robust dividends can be particularly appealing as they may provide potential income stability amidst market volatility.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| CITIC Telecom International Holdings (SEHK:1883) | 9.37% | ★★★★★★ |

| China Construction Bank (SEHK:939) | 7.85% | ★★★★★☆ |

| S.A.S. Dragon Holdings (SEHK:1184) | 9.31% | ★★★★★☆ |

| China Electronics Huada Technology (SEHK:85) | 8.82% | ★★★★★☆ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 7.65% | ★★★★★☆ |

| International Housewares Retail (SEHK:1373) | 9.18% | ★★★★★☆ |

| China Overseas Grand Oceans Group (SEHK:81) | 8.38% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 7.30% | ★★★★★☆ |

| China Mobile (SEHK:941) | 6.22% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 4.95% | ★★★★★☆ |

Click here to see the full list of 93 stocks from our Top SEHK Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Lion Rock Group (SEHK:1127)

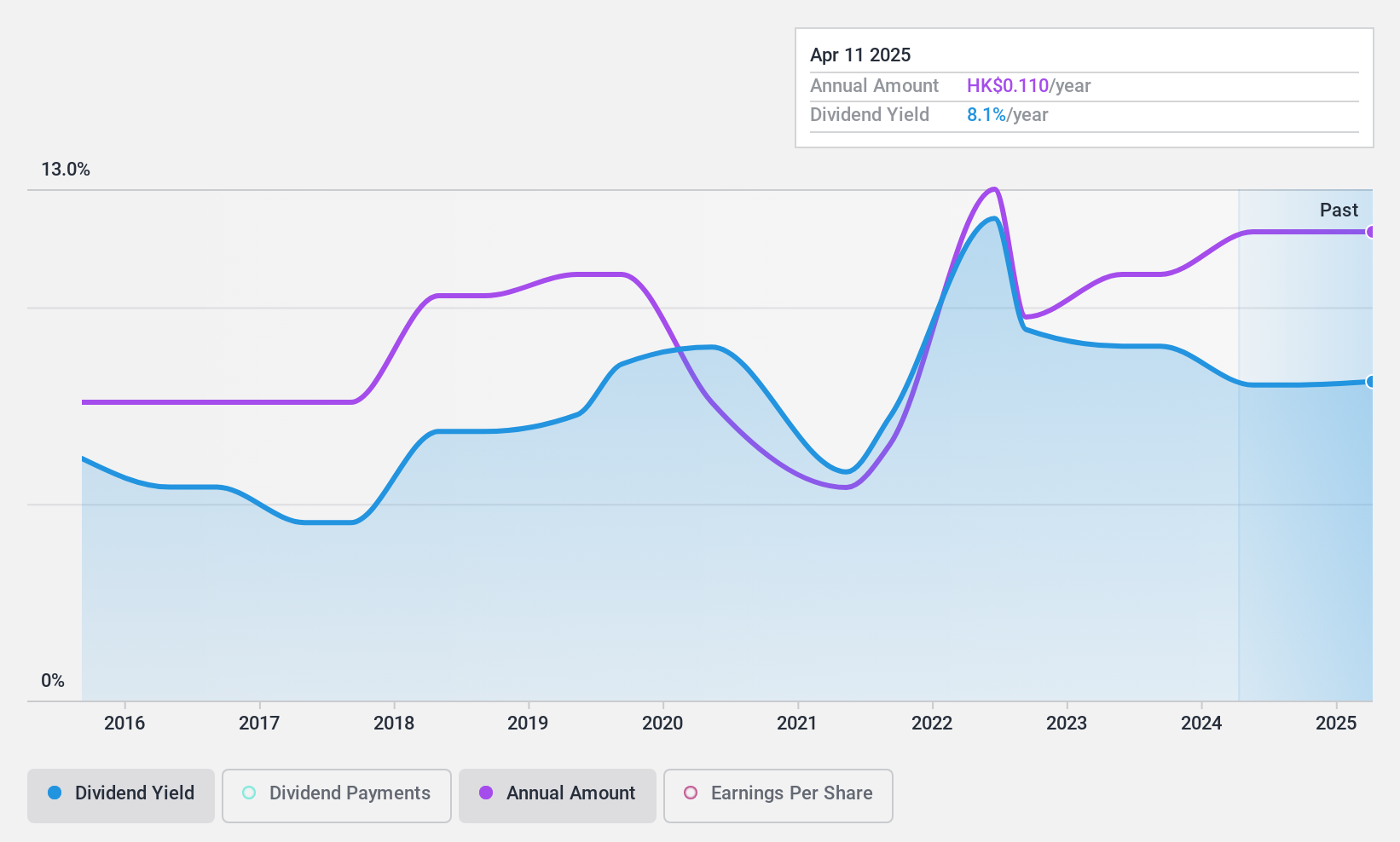

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lion Rock Group Limited, an investment holding company, offers printing services to a range of clients including international book publishers and print media companies, with a market cap of approximately HK$1.13 billion.

Operations: Lion Rock Group Limited generates revenue primarily through its printing and publishing segments, with HK$1.77 billion from printing services and HK$0.95 billion from publishing activities.

Dividend Yield: 7.5%

Lion Rock Group declared an 8 HK cents per share final dividend for 2023, reflecting a modest yield of 7.48% in the Hong Kong market. Despite trading at a significant discount to its estimated fair value, the company's dividends are not top-tier and have shown volatility over the past decade. However, both earnings and cash flows provide good coverage with payout ratios of 44.1% and 31.2%, respectively, supporting the sustainability of future payouts despite past inconsistencies in dividend reliability.

- Click here and access our complete dividend analysis report to understand the dynamics of Lion Rock Group.

- In light of our recent valuation report, it seems possible that Lion Rock Group is trading behind its estimated value.

Ever Sunshine Services Group (SEHK:1995)

Simply Wall St Dividend Rating: ★★★★☆☆

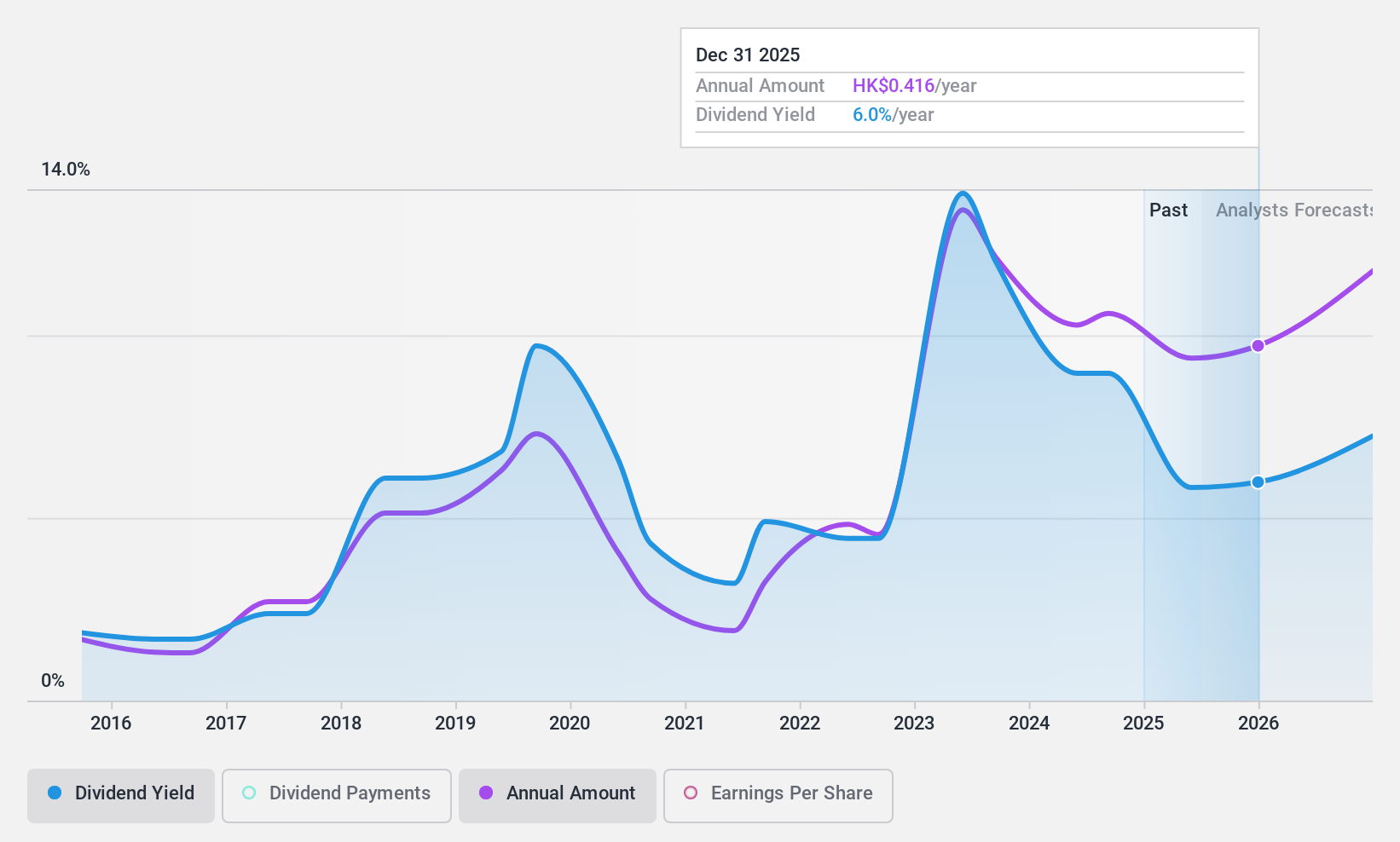

Overview: Ever Sunshine Services Group Limited, operating in the People's Republic of China, is an investment holding company specializing in property management services with a market capitalization of approximately HK$2.82 billion.

Operations: Ever Sunshine Services Group Limited generates CN¥6.54 billion in revenue primarily through its property management services.

Dividend Yield: 8.3%

Ever Sunshine Services Group recently declared a dividend of HK$0.0914 per share, underpinned by a sustainable payout ratio of 49.8% and cash payout ratio of 25.2%, indicating strong earnings and cash flow coverage. Despite trading below its fair value, the company's dividend history is short and marked by volatility, having only initiated payouts five years ago with inconsistent annual growth. Recent shareholder-approved share repurchases could potentially enhance future earnings per share, supporting ongoing dividend commitments.

- Unlock comprehensive insights into our analysis of Ever Sunshine Services Group stock in this dividend report.

- Our expertly prepared valuation report Ever Sunshine Services Group implies its share price may be lower than expected.

Fufeng Group (SEHK:546)

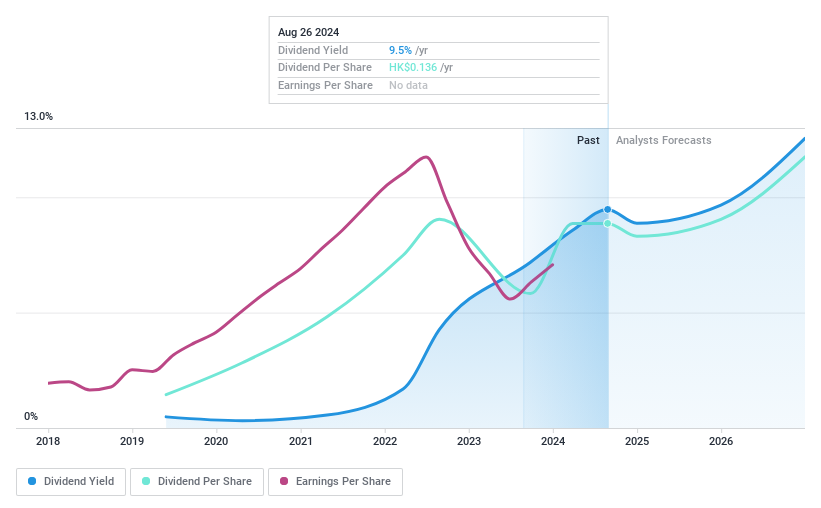

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fufeng Group Limited is an investment holding company specializing in the production and sale of fermentation-based food additives, biochemical, and starch-based products across China and globally, with a market capitalization of approximately HK$11.79 billion.

Operations: Fufeng Group Limited generates its revenue primarily through the sale of food additives (CN¥13.50 billion), animal nutrition products (CN¥8.90 billion), colloids (CN¥2.83 billion), and high-end amino acids (CN¥1.97 billion).

Dividend Yield: 9.4%

Fufeng Group Limited anticipates a net profit drop for the first half of 2024, primarily due to lower market prices impacting gross profits. Despite a low payout ratio of 33.1%, indicating potential coverage, the company's dividend history is inconsistent with payments showing volatility over the last decade. Additionally, while Fufeng offers a high yield (9.41%) compared to its Hong Kong peers, this dividend is not adequately supported by free cash flows, raising concerns about sustainability amidst declining earnings forecasts.

- Dive into the specifics of Fufeng Group here with our thorough dividend report.

- Upon reviewing our latest valuation report, Fufeng Group's share price might be too pessimistic.

Make It Happen

- Explore the 93 names from our Top SEHK Dividend Stocks screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Fufeng Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:546

Fufeng Group

An investment holding company, engages in the manufacture and sale of fermentation-based food additive, and biochemical and starch-based products in the People’s Republic of China and internationally.

Adequate balance sheet average dividend payer.