- Hong Kong

- /

- Trade Distributors

- /

- SEHK:990

Does Deep Source Holdings Still Offer Value After 10% Drop Post Supply Chain News?

Reviewed by Simply Wall St

If you have been watching Deep Source Holdings lately, you are certainly not alone. The stock has been on quite a ride, with remarkable gains this year: a whopping 105.1% year to date and an impressive 97.5% climb over the past twelve months. That kind of performance is enough to catch anyone’s eye, whether you are a careful value investor or someone searching for growth stories that still have room to run.

But even with these eye-popping returns, not everything has moved in a straight line. Over the last month, Deep Source Holdings slipped by 10.1%, nudging some shareholders to reassess their confidence. A more muted week, down just 1.2%, suggests the market is recalibrating its view after a period of aggressive optimism. Longer term, though, the five-year return of 727.1% is almost hard to believe, cementing Deep Source’s place as one of those stocks that early believers love to talk about.

Some of this volatility has mirrored sector-wide sentiment shifts and investor reactions to recent developments in the technology supply chain, an area where Deep Source Holdings has intrinsic operations. While these events have occasionally raised risk perceptions, they have also served as reminders of the company’s potential leverage in changing markets.

For value-minded readers, it is not just about the price chart. Deep Source Holdings scores a 2 out of 6 on our simple value checklist, indicating undervaluation in two key criteria. That begs the real question: how do we get a complete picture of its valuation? Next, I will break down the main valuation approaches used by analysts and point toward an even more insightful method for understanding this stock’s worth.

Deep Source Holdings scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Deep Source Holdings Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future free cash flows and then discounting each of those back to today’s value using an appropriate rate. This offers a way to understand what Deep Source Holdings is truly worth, based on its ability to generate cash over time.

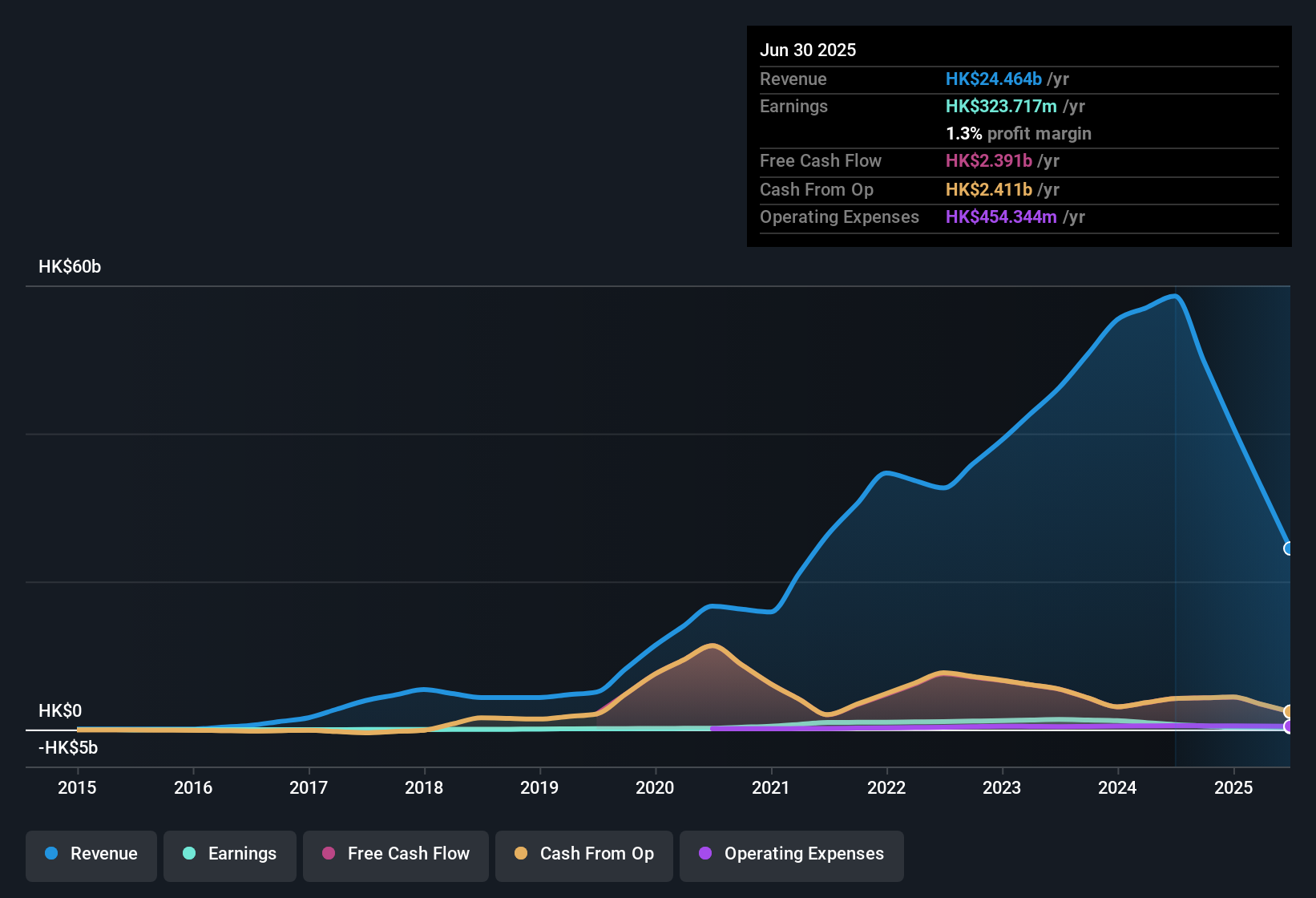

Currently, Deep Source Holdings reports a Free Cash Flow (FCF) of HK$2.4 Billion. According to the latest estimates, cash flows are expected to face short-term declines before stabilizing. For example, analysts project FCF to be around HK$1.8 Billion in 2026 and to decrease slightly to HK$1.16 Billion by 2030. These projections factor in industry expectations and historic company trends, with Simply Wall St extrapolating out to 2035 for a fuller picture.

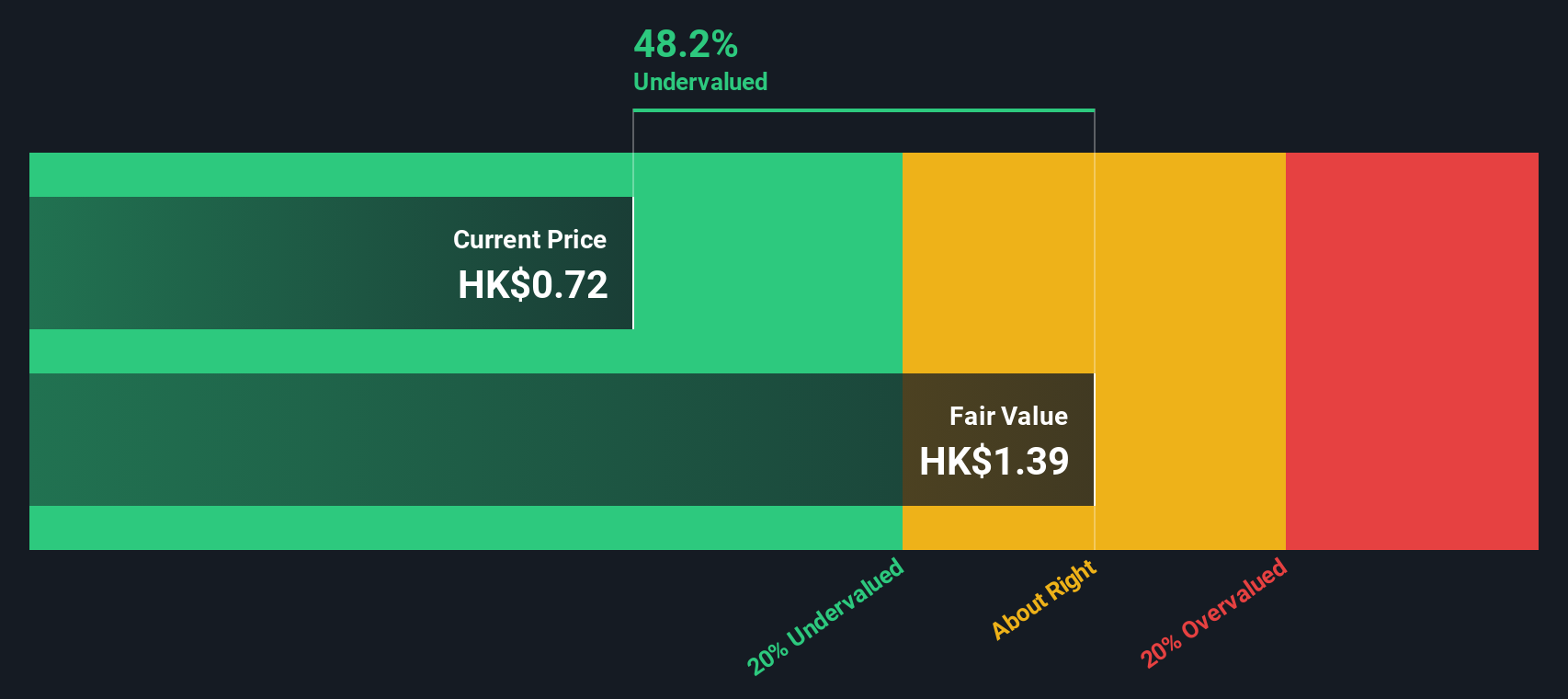

By modeling these flows and discounting them back to the present, the intrinsic value per share is estimated at HK$1.34. At current prices, this implies the stock is trading at a 40.3% discount to its DCF value, which indicates a substantial margin of undervaluation for investors considering an entry point.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Deep Source Holdings.

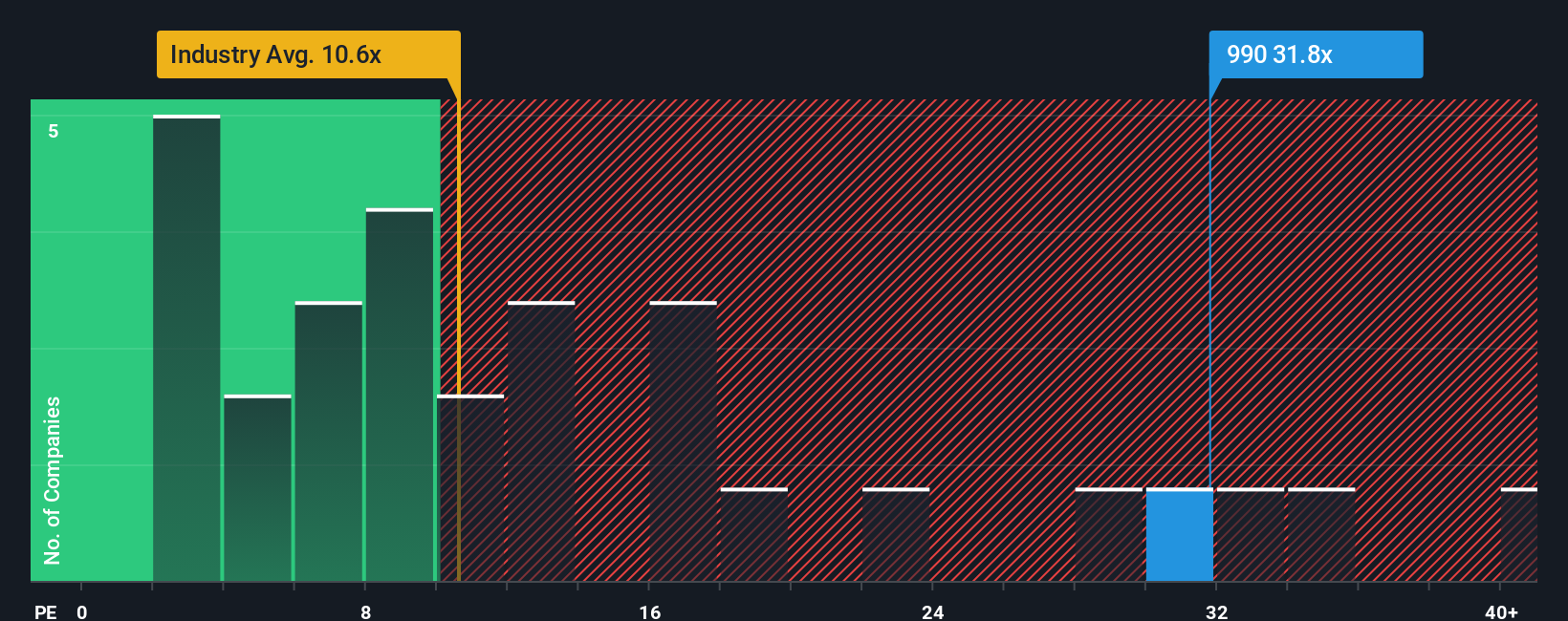

Approach 2: Deep Source Holdings Price vs Earnings

The Price-to-Earnings (PE) ratio is a well-recognized way to gauge valuation for profitable businesses like Deep Source Holdings. Since earnings underpin a company’s long-term value, the PE multiple is especially helpful for comparing stocks with stable profits or established growth paths.

It is important to remember that what counts as a “normal” or “fair” PE ratio can depend on several factors. Companies expected to grow faster or operate with less risk typically command higher PE multiples, while slower-growing or riskier firms usually trade at lower multiples. Other influences include industry trends and overall market sentiment.

Deep Source Holdings currently trades at 35.3x earnings. That is much higher than the Trade Distributors industry average of 10.4x and also above the average for its closest peers, which sits at 12.9x. On a surface level, this premium might make the shares look expensive, but benchmarks alone rarely tell the full story.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio goes beyond industry averages and peer comparisons by factoring in the company’s growth trajectory, risk profile, profit margins, market capitalization, and where it sits within its sector. This comprehensive approach recognizes that fast-growing, high-quality, or low-risk businesses can justify higher-than-average multiples.

Comparing Deep Source Holdings' actual PE with its Fair Ratio gives a clearer picture of whether the stock’s valuation is justified. In this case, the numbers are very close, indicating that the market is pricing Deep Source Holdings about right, given its prospects and risks.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your Deep Source Holdings Narrative

Earlier, we mentioned there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is simply your story: the perspective and assumptions you bring about what the future holds for Deep Source Holdings, including your estimates for its fair value, future revenue, earnings, and margins. Narratives connect a company’s real-world story with your financial forecast and show you how those views translate directly into a fair value assessment.

On Simply Wall St’s Community page, millions of investors use Narratives as an easy, accessible tool to decide when to buy or sell by comparing their fair value to the current market price. What makes Narratives powerful is how they respond dynamically to new developments, like breaking news or earnings reports, so your investment thesis stays relevant. For example, one investor might see Deep Source Holdings’ fair value at HK$1.20 based on cautious growth, while another projects HK$1.58, anticipating a strong rebound. Narratives empower you to invest based on your conviction, grounded in data but tailored to your own outlook.

Do you think there's more to the story for Deep Source Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:990

Deep Source Holdings

An investment holding company, engages in the processing, distribution, and trading of bulk commodities and related products in the People’s Republic of China, Hong Kong, and Singapore.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives