- Hong Kong

- /

- Construction

- /

- SEHK:8601

Is Boltek Holdings Limited's (HKG:8601) Latest Stock Performance A Reflection Of Its Financial Health?

Most readers would already be aware that Boltek Holdings' (HKG:8601) stock increased significantly by 15% over the past three months. Since the market usually pay for a company’s long-term fundamentals, we decided to study the company’s key performance indicators to see if they could be influencing the market. In this article, we decided to focus on Boltek Holdings' ROE.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

Check out our latest analysis for Boltek Holdings

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Boltek Holdings is:

12% = HK$16m ÷ HK$135m (Based on the trailing twelve months to September 2020).

The 'return' is the yearly profit. That means that for every HK$1 worth of shareholders' equity, the company generated HK$0.12 in profit.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

A Side By Side comparison of Boltek Holdings' Earnings Growth And 12% ROE

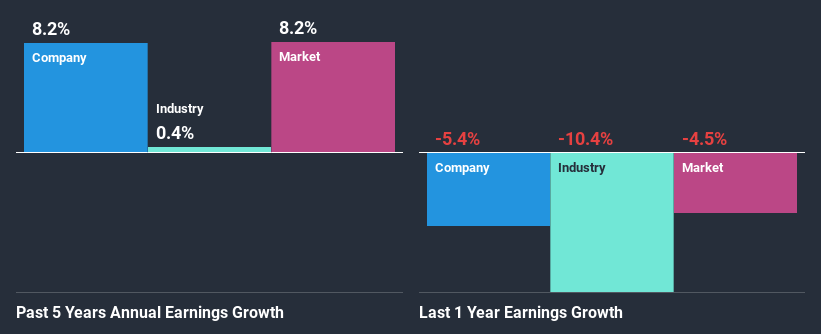

To start with, Boltek Holdings' ROE looks acceptable. Even when compared to the industry average of 10% the company's ROE looks quite decent. This certainly adds some context to Boltek Holdings' moderate 8.2% net income growth seen over the past five years.

As a next step, we compared Boltek Holdings' net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 0.4%.

Earnings growth is an important metric to consider when valuing a stock. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. If you're wondering about Boltek Holdings''s valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Boltek Holdings Using Its Retained Earnings Effectively?

Conclusion

Overall, we are quite pleased with Boltek Holdings' performance. In particular, it's great to see that the company is investing heavily into its business and along with a high rate of return, that has resulted in a sizeable growth in its earnings. If the company continues to grow its earnings the way it has, that could have a positive impact on its share price given how earnings per share influence long-term share prices. Not to forget, share price outcomes are also dependent on the potential risks a company may face. So it is important for investors to be aware of the risks involved in the business. To know the 2 risks we have identified for Boltek Holdings visit our risks dashboard for free.

When trading Boltek Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Boltek Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:8601

Boltek Holdings

An investment holding company, provides engineering design, landscape architecture, and consultancy services in Hong Kong.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives