- Hong Kong

- /

- Construction

- /

- SEHK:8601

Increases to CEO Compensation Might Be Put On Hold For Now at Boltek Holdings Limited (HKG:8601)

Key Insights

- Boltek Holdings' Annual General Meeting to take place on 26th of April

- Salary of HK$2.76m is part of CEO Kwan Tar Cheung's total remuneration

- Total compensation is 232% above industry average

- Boltek Holdings' EPS grew by 5.6% over the past three years while total shareholder return over the past three years was 44%

Under the guidance of CEO Kwan Tar Cheung, Boltek Holdings Limited (HKG:8601) has performed reasonably well recently. As shareholders go into the upcoming AGM on 26th of April, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders may still want to keep CEO compensation within reason.

Check out our latest analysis for Boltek Holdings

How Does Total Compensation For Kwan Tar Cheung Compare With Other Companies In The Industry?

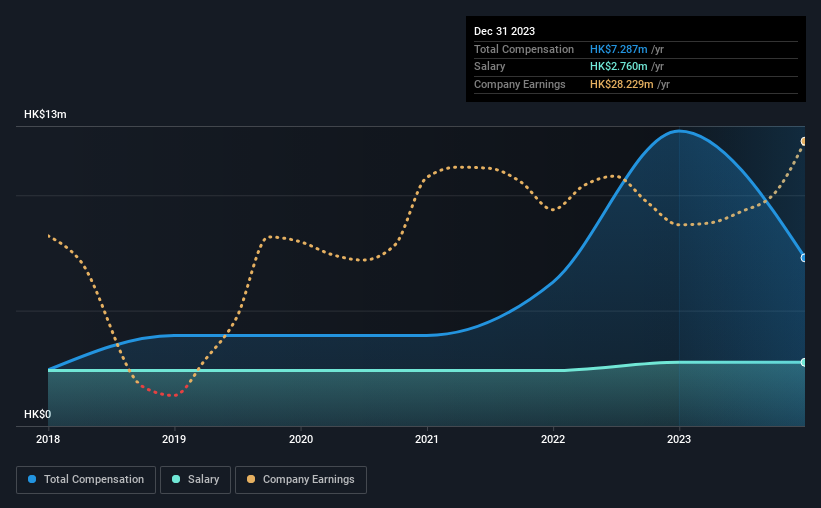

According to our data, Boltek Holdings Limited has a market capitalization of HK$228m, and paid its CEO total annual compensation worth HK$7.3m over the year to December 2023. We note that's a decrease of 43% compared to last year. While we always look at total compensation first, our analysis shows that the salary component is less, at HK$2.8m.

For comparison, other companies in the Hong Kong Construction industry with market capitalizations below HK$1.6b, reported a median total CEO compensation of HK$2.2m. This suggests that Kwan Tar Cheung is paid more than the median for the industry. Furthermore, Kwan Tar Cheung directly owns HK$154m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | HK$2.8m | HK$2.8m | 38% |

| Other | HK$4.5m | HK$10m | 62% |

| Total Compensation | HK$7.3m | HK$13m | 100% |

Talking in terms of the industry, salary represented approximately 84% of total compensation out of all the companies we analyzed, while other remuneration made up 16% of the pie. Boltek Holdings sets aside a smaller share of compensation for salary, in comparison to the overall industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Boltek Holdings Limited's Growth

Boltek Holdings Limited's earnings per share (EPS) grew 5.6% per year over the last three years. It achieved revenue growth of 14% over the last year.

We think the revenue growth is good. And, while modest, the EPS growth is noticeable. So while performance isn't amazing, we think it really does seem quite respectable. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Boltek Holdings Limited Been A Good Investment?

We think that the total shareholder return of 44%, over three years, would leave most Boltek Holdings Limited shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. However, any decision to raise CEO pay might be met with some objections from the shareholders given that the CEO is already paid higher than the industry average.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 3 warning signs for Boltek Holdings (of which 2 make us uncomfortable!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Valuation is complex, but we're here to simplify it.

Discover if Boltek Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8601

Boltek Holdings

An investment holding company, provides engineering design, landscape architecture, and consultancy services in Hong Kong.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success