- Hong Kong

- /

- Trade Distributors

- /

- SEHK:8425

Hing Ming Holdings Limited (HKG:8425) Stock Rockets 91% But Many Are Still Ignoring The Company

Hing Ming Holdings Limited (HKG:8425) shareholders have had their patience rewarded with a 91% share price jump in the last month. The annual gain comes to 149% following the latest surge, making investors sit up and take notice.

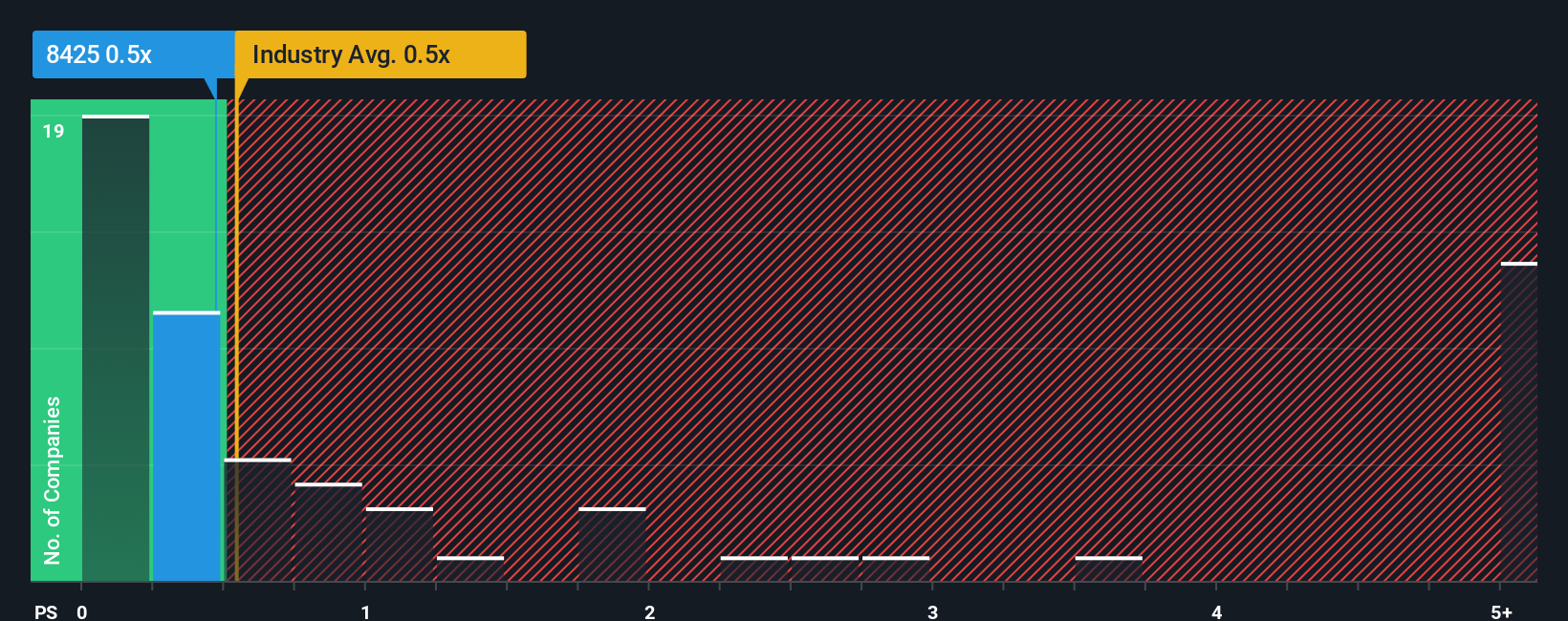

Even after such a large jump in price, it's still not a stretch to say that Hing Ming Holdings' price-to-sales (or "P/S") ratio of 0.5x right now seems quite "middle-of-the-road" compared to the Trade Distributors industry in Hong Kong, seeing as it matches the P/S ratio of the wider industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Hing Ming Holdings

How Has Hing Ming Holdings Performed Recently?

As an illustration, revenue has deteriorated at Hing Ming Holdings over the last year, which is not ideal at all. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Hing Ming Holdings' earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Hing Ming Holdings?

The only time you'd be comfortable seeing a P/S like Hing Ming Holdings' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 1.6% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 41% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 4.3% shows it's noticeably more attractive.

With this information, we find it interesting that Hing Ming Holdings is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Final Word

Hing Ming Holdings' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We didn't quite envision Hing Ming Holdings' P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Hing Ming Holdings, and understanding these should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Hing Ming Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8425

Hing Ming Holdings

An investment holding company, provides rental services for temporary suspended working platforms and other equipment in Hong Kong.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives