Stock Analysis

- Hong Kong

- /

- Real Estate

- /

- SEHK:1908

3 High Yield Dividend Stocks In Hong Kong With Up To 9% Yield

Reviewed by Simply Wall St

Amidst a backdrop of global economic fluctuations and regional uncertainties, the Hong Kong market has shown resilience, making it an intriguing area for investors looking for dividend yields. In this context, selecting stocks that not only offer high yields but also demonstrate stability and strong fundamentals becomes crucial.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| China Construction Bank (SEHK:939) | 7.83% | ★★★★★★ |

| Agricultural Bank of China (SEHK:1288) | 7.74% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.80% | ★★★★★★ |

| CITIC Telecom International Holdings (SEHK:1883) | 9.84% | ★★★★★★ |

| Playmates Toys (SEHK:869) | 8.82% | ★★★★★☆ |

| S.A.S. Dragon Holdings (SEHK:1184) | 8.58% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 6.81% | ★★★★★☆ |

| China Mobile (SEHK:941) | 6.51% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 4.00% | ★★★★★☆ |

| International Housewares Retail (SEHK:1373) | 8.62% | ★★★★★☆ |

Click here to see the full list of 91 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

C&D International Investment Group (SEHK:1908)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: C&D International Investment Group Limited operates as an investment holding company, focusing on property development, real estate industry chain investment services, and industry investment activities across Mainland China, Hong Kong, Macau, Taiwan, and internationally with a market capitalization of approximately HK$29.61 billion.

Operations: C&D International Investment Group Limited generates revenue primarily from its property development segment, totaling CN¥134.43 billion.

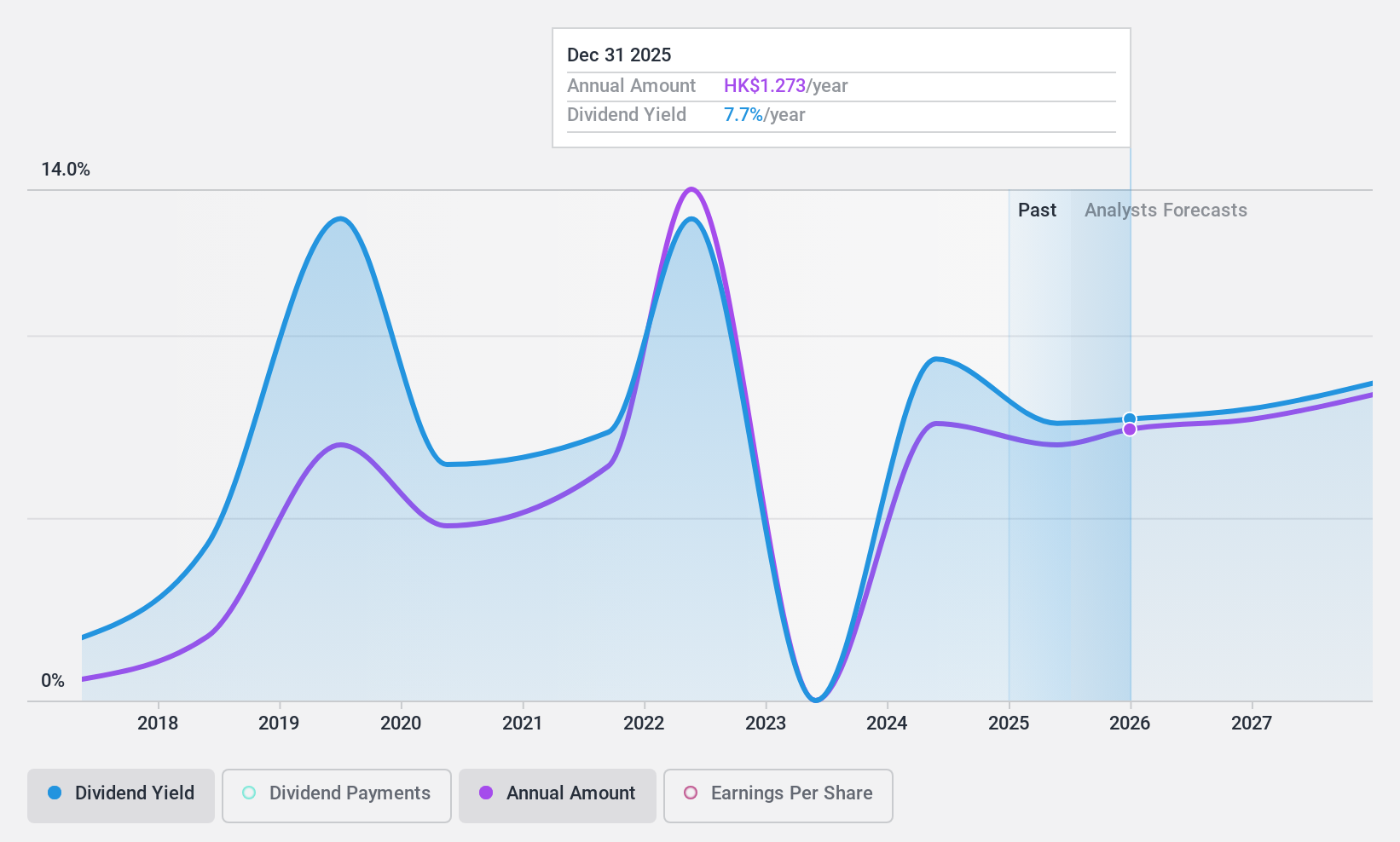

Dividend Yield: 8.2%

C&D International Investment Group recently affirmed a final dividend of HK$1.3 per share for 2023, with payment due on July 8, 2024. Despite this, the company's dividend history has been marked by volatility over the past decade. Financially, C&D reported a modest earnings growth of 2.8% last year and anticipates a future annual earnings increase of 13.03%. The dividends are well-supported by both earnings and cash flows, with payout ratios at 45.2% and cash payout ratios at just 9.3%, respectively. However, recent sales figures showed a significant decline in both revenue and floor area sold, suggesting potential challenges ahead in maintaining financial stability and dividend payments.

- Dive into the specifics of C&D International Investment Group here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of C&D International Investment Group shares in the market.

Wasion Holdings (SEHK:3393)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wasion Holdings Limited is an investment holding company that specializes in the research, development, production, and sale of energy metering and energy efficiency management solutions across China, Africa, the United States, Europe, and other parts of Asia; it has a market capitalization of approximately HK$7.02 billion.

Operations: Wasion Holdings Limited generates revenue primarily through three segments: Advanced Distribution Operations (CN¥2.48 billion), Power Advanced Metering Infrastructure (CN¥2.67 billion), and Communication and Fluid Advanced Metering Infrastructure (CN¥2.21 billion).

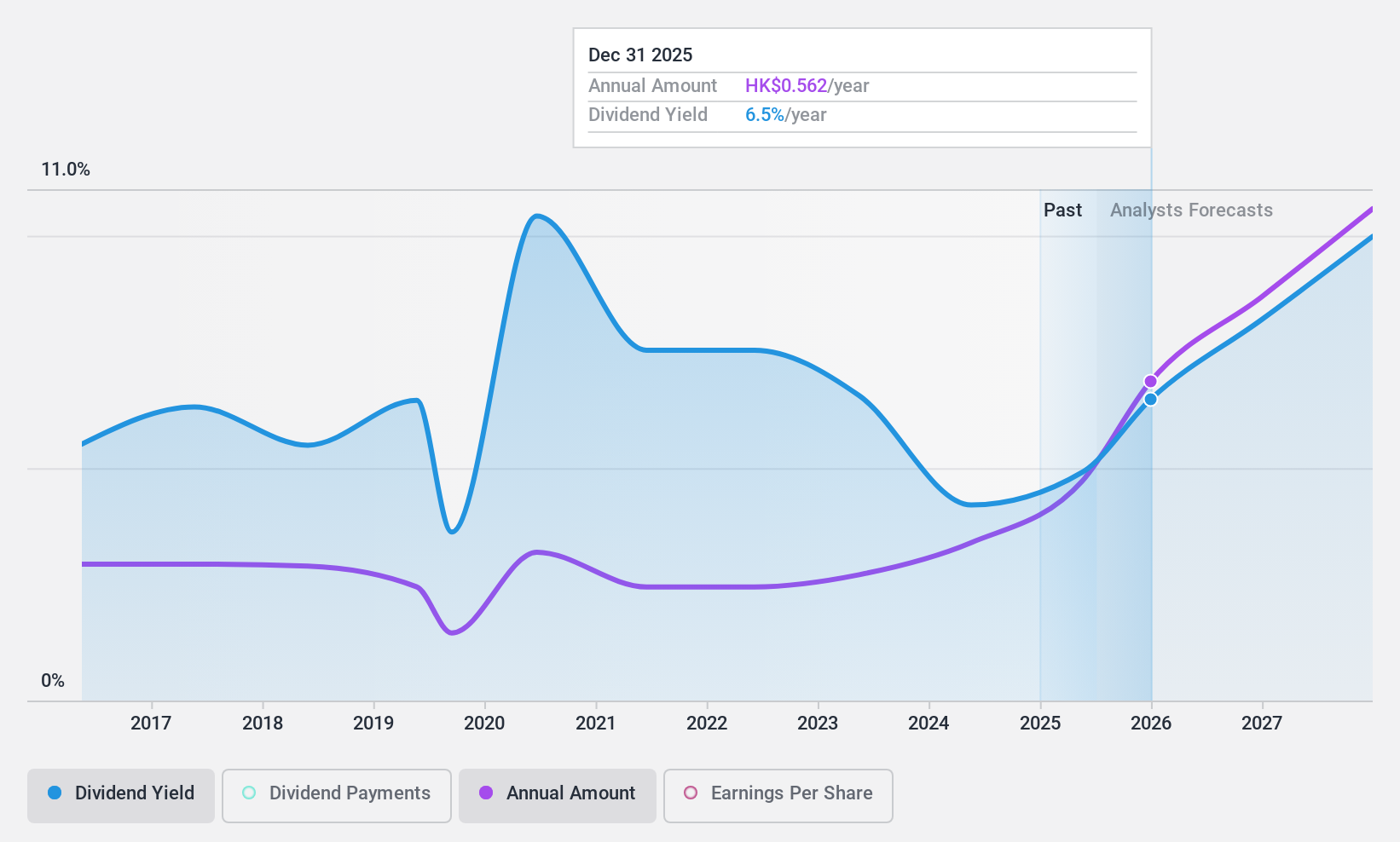

Dividend Yield: 3.9%

Wasion Holdings Limited's recent dividend declaration of HK$0.28 per share reflects a positive aspect amidst its mixed dividend history, which has seen volatility over the past decade. The company's dividends are supported by earnings and cash flows with payout ratios of 48.9% and 27.6% respectively, indicating a sustainable level despite historical inconsistencies. Additionally, Wasion secured significant contracts worth approximately HK$445.79 million in 2024 from the State Grid Corporation of China, enhancing its financial stability and supporting future dividends.

- Click here and access our complete dividend analysis report to understand the dynamics of Wasion Holdings.

- Our valuation report here indicates Wasion Holdings may be undervalued.

Leoch International Technology (SEHK:842)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Leoch International Technology Limited operates as an investment holding company, focusing on power solutions and recycled lead business across regions including Mainland China, Europe, the Middle East, Africa, the Americas, and Asia-Pacific, with a market cap of approximately HK$2.11 billion.

Operations: Leoch International Technology Limited generates revenue primarily through the manufacture, development, and sale of lead-acid batteries and related items, totaling CN¥13.47 billion.

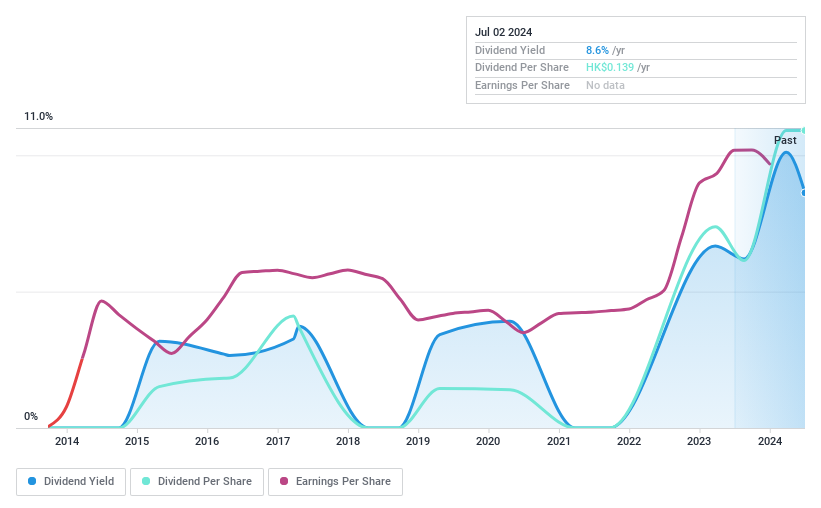

Dividend Yield: 9%

Leoch International Technology Limited offers a dividend yield of 9.03%, ranking in the top 25% of Hong Kong dividend payers. Despite a stable earnings growth of 11.3% last year, its dividends have shown volatility and unreliability over its nine-year history, with a recent reduction to HK$0.07 per share as approved on May 16, 2024. The dividends are well-covered by both earnings and cash flows, with payout ratios at 25.4% and 54.5%, respectively, but the company carries a high level of debt which may concern investors looking for stability in dividend payments.

- Get an in-depth perspective on Leoch International Technology's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Leoch International Technology's current price could be quite moderate.

Where To Now?

- Discover the full array of 91 Top Dividend Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether C&D International Investment Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1908

C&D International Investment Group

An investment holding company, engages in the property development, real estate industry chain investment services, and industry investment activities in Mainland China, Hong Kong, Macau, Taiwan, and internationally.

Very undervalued with flawless balance sheet and pays a dividend.