- Hong Kong

- /

- Construction

- /

- SEHK:8316

Investors might be losing patience for China Hongbao Holdings' (HKG:8316) increasing losses, as stock sheds 17% over the past week

The China Hongbao Holdings Limited (HKG:8316) share price is down a rather concerning 30% in the last month. Looking further back, the stock has generated good profits over five years. After all, the share price is up a market-beating 68% in that time.

While this past week has detracted from the company's five-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

See our latest analysis for China Hongbao Holdings

China Hongbao Holdings wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 5 years China Hongbao Holdings saw its revenue shrink by 0.7% per year. Despite the lack of revenue growth, the stock has returned a respectable 11%, compound, over that time. It's probably worth checking other factors such as the profitability, to try to understand the share price action. It may not be reflecting the revenue.

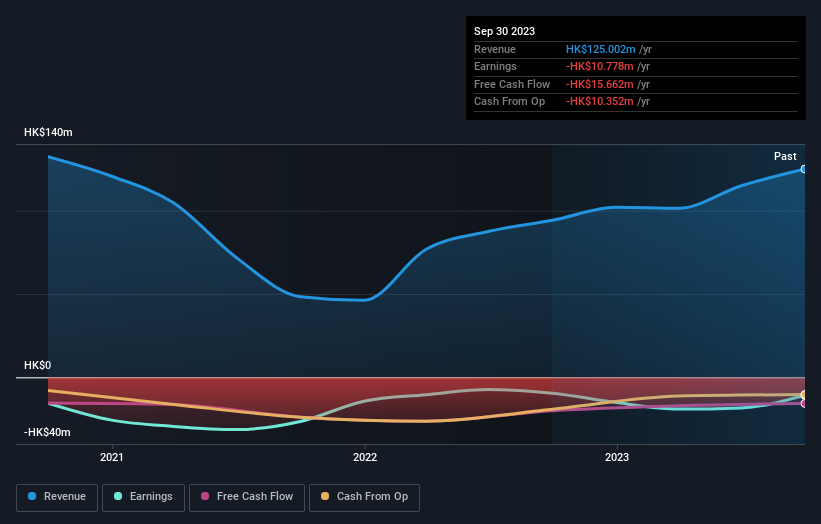

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. This free interactive report on China Hongbao Holdings' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that China Hongbao Holdings has rewarded shareholders with a total shareholder return of 11% in the last twelve months. However, that falls short of the 11% TSR per annum it has made for shareholders, each year, over five years. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 7 warning signs we've spotted with China Hongbao Holdings (including 4 which are potentially serious) .

China Hongbao Holdings is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8316

China Hongbao Holdings

An investment holding company, operates as a foundation subcontractor for private and public sectors in Hong Kong and People’s Republic of China.

Moderate with weak fundamentals.