- Hong Kong

- /

- Industrials

- /

- SEHK:8095

There's Reason For Concern Over Beijing Beida Jade Bird Universal Sci-Tech Company Limited's (HKG:8095) Massive 33% Price Jump

Beijing Beida Jade Bird Universal Sci-Tech Company Limited (HKG:8095) shares have continued their recent momentum with a 33% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 58% in the last year.

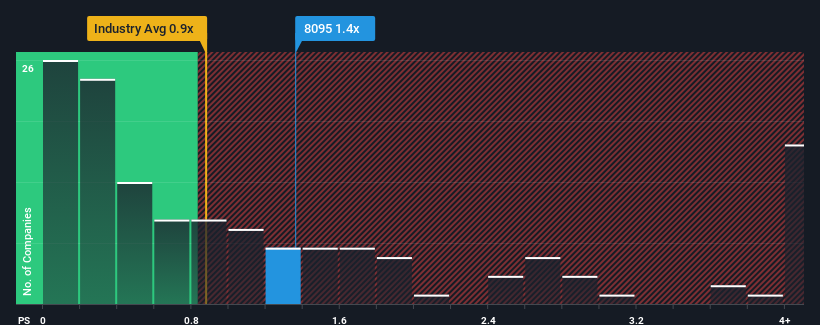

Following the firm bounce in price, when almost half of the companies in Hong Kong's Industrials industry have price-to-sales ratios (or "P/S") below 0.4x, you may consider Beijing Beida Jade Bird Universal Sci-Tech as a stock probably not worth researching with its 1.4x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Beijing Beida Jade Bird Universal Sci-Tech

What Does Beijing Beida Jade Bird Universal Sci-Tech's P/S Mean For Shareholders?

With revenue growth that's exceedingly strong of late, Beijing Beida Jade Bird Universal Sci-Tech has been doing very well. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Beijing Beida Jade Bird Universal Sci-Tech will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Beijing Beida Jade Bird Universal Sci-Tech?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Beijing Beida Jade Bird Universal Sci-Tech's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 31% last year. The latest three year period has also seen a 14% overall rise in revenue, aided extensively by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 9.7% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it concerning that Beijing Beida Jade Bird Universal Sci-Tech is trading at a P/S higher than the industry. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Final Word

Beijing Beida Jade Bird Universal Sci-Tech shares have taken a big step in a northerly direction, but its P/S is elevated as a result. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Beijing Beida Jade Bird Universal Sci-Tech revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You always need to take note of risks, for example - Beijing Beida Jade Bird Universal Sci-Tech has 1 warning sign we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Beijing Beida Jade Bird Universal Sci-Tech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8095

Beijing Beida Jade Bird Universal Sci-Tech

An investment holding company, engages in the trading of metallic products and tourism development in the People’s Republic of China, Hong Kong, and the United States.

Mediocre balance sheet with questionable track record.

Market Insights

Community Narratives