- Hong Kong

- /

- Construction

- /

- SEHK:8023

Kwong Man Kee Group Limited (HKG:8023) Stock's Been Sliding But Fundamentals Look Decent: Will The Market Correct The Share Price In The Future?

Kwong Man Kee Group (HKG:8023) has had a rough week with its share price down 20%. However, the company's fundamentals look pretty decent, and long-term financials are usually aligned with future market price movements. Particularly, we will be paying attention to Kwong Man Kee Group's ROE today.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

How To Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Kwong Man Kee Group is:

7.0% = HK$9.1m ÷ HK$130m (Based on the trailing twelve months to March 2025).

The 'return' is the amount earned after tax over the last twelve months. Another way to think of that is that for every HK$1 worth of equity, the company was able to earn HK$0.07 in profit.

Check out our latest analysis for Kwong Man Kee Group

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Kwong Man Kee Group's Earnings Growth And 7.0% ROE

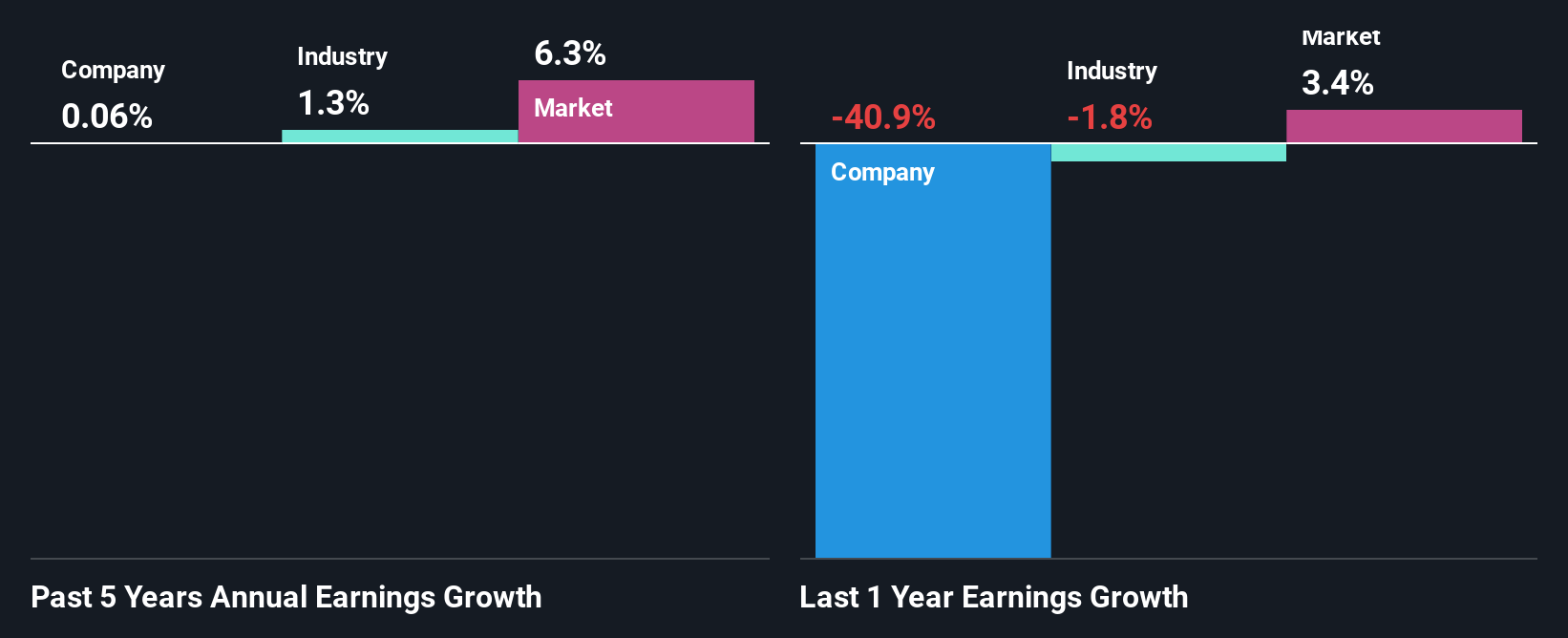

When you first look at it, Kwong Man Kee Group's ROE doesn't look that attractive. Although a closer study shows that the company's ROE is higher than the industry average of 5.8% which we definitely can't overlook. However, Kwong Man Kee Group has seen a flattish net income growth over the past five years, which is not saying much. Remember, the company's ROE is a bit low to begin with, just that it is higher than the industry average. So that could be one of the factors that are causing earnings growth to stay flat.

As a next step, we compared Kwong Man Kee Group's net income growth with the industry and were disappointed to see that the company's growth is lower than the industry average growth of 1.3% in the same period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. If you're wondering about Kwong Man Kee Group's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Kwong Man Kee Group Making Efficient Use Of Its Profits?

Despite having a normal three-year median payout ratio of 40% (implying that the company keeps 60% of its income) over the last three years, Kwong Man Kee Group has seen a negligible amount of growth in earnings as we saw above. So there could be some other explanation in that regard. For instance, the company's business may be deteriorating.

Additionally, Kwong Man Kee Group has paid dividends over a period of seven years, which means that the company's management is determined to pay dividends even if it means little to no earnings growth.

Summary

Overall, we feel that Kwong Man Kee Group certainly does have some positive factors to consider. However, while the company does have a decent ROE and a high profit retention, its earnings growth number is quite disappointing. This suggests that there might be some external threat to the business, that's hampering growth. So far, we've only made a quick discussion around the company's earnings growth. You can do your own research on Kwong Man Kee Group and see how it has performed in the past by looking at this FREE detailed graph of past earnings, revenue and cash flows.

Valuation is complex, but we're here to simplify it.

Discover if Kwong Man Kee Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8023

Kwong Man Kee Group

An investment holding company, provides engineering services to the car park flooring industry in Hong Kong, Macau, and other Asian regions.

Excellent balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success