- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:6088

3 SEHK Stocks Estimated To Be Trading At Up To 47.7% Below Intrinsic Value

Reviewed by Simply Wall St

The Hong Kong stock market has been experiencing significant fluctuations, reflecting broader global economic uncertainties and investor sentiment shifts. Amidst these volatile conditions, certain stocks are emerging as potentially undervalued opportunities for discerning investors. In this article, we will explore three SEHK stocks estimated to be trading up to 47.7% below their intrinsic value. Identifying such stocks requires a keen understanding of market fundamentals and the ability to recognize companies with strong potential despite current market headwinds.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Bosideng International Holdings (SEHK:3998) | HK$3.67 | HK$6.77 | 45.8% |

| MedSci Healthcare Holdings (SEHK:2415) | HK$1.15 | HK$2.25 | 48.8% |

| Zhaojin Mining Industry (SEHK:1818) | HK$11.78 | HK$21.41 | 45% |

| Pacific Textiles Holdings (SEHK:1382) | HK$1.49 | HK$2.85 | 47.7% |

| WuXi XDC Cayman (SEHK:2268) | HK$20.65 | HK$39.27 | 47.4% |

| Hangzhou SF Intra-city Industrial (SEHK:9699) | HK$11.00 | HK$19.88 | 44.7% |

| Innovent Biologics (SEHK:1801) | HK$41.75 | HK$80.05 | 47.8% |

| Digital China Holdings (SEHK:861) | HK$3.22 | HK$6.11 | 47.3% |

| United Company RUSAL International (SEHK:486) | HK$2.32 | HK$4.25 | 45.4% |

| Weimob (SEHK:2013) | HK$1.30 | HK$2.56 | 49.2% |

Below we spotlight a couple of our favorites from our exclusive screener.

Pacific Textiles Holdings (SEHK:1382)

Overview: Pacific Textiles Holdings Limited manufactures and trades in textile products across various countries including China, Vietnam, and the United States, with a market cap of HK$2.08 billion.

Operations: The company generates HK$4.67 billion from its manufacturing and trading of textile products.

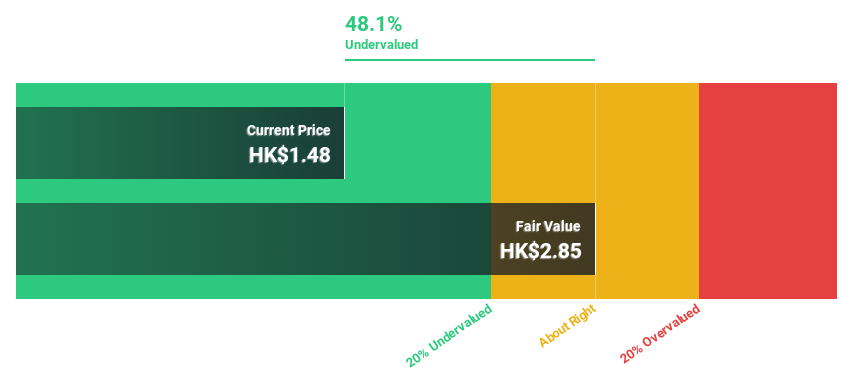

Estimated Discount To Fair Value: 47.7%

Pacific Textiles Holdings appears undervalued based on cash flows, trading at HK$1.49, significantly below its estimated fair value of HK$2.85. Despite a decline in net income to HK$167.12 million from HK$268.57 million last year and lower profit margins, the company is forecasted to grow earnings by 37.7% annually over the next three years, outpacing the Hong Kong market's average growth rate of 11.7%.

- Upon reviewing our latest growth report, Pacific Textiles Holdings' projected financial performance appears quite optimistic.

- Navigate through the intricacies of Pacific Textiles Holdings with our comprehensive financial health report here.

FIT Hon Teng (SEHK:6088)

Overview: FIT Hon Teng Limited manufactures and sells mobile and wireless devices and connectors in Taiwan and internationally, with a market cap of HK$13.67 billion.

Operations: FIT Hon Teng generates revenue from consumer products amounting to $690.95 million and intermediate products totaling $3.94 billion.

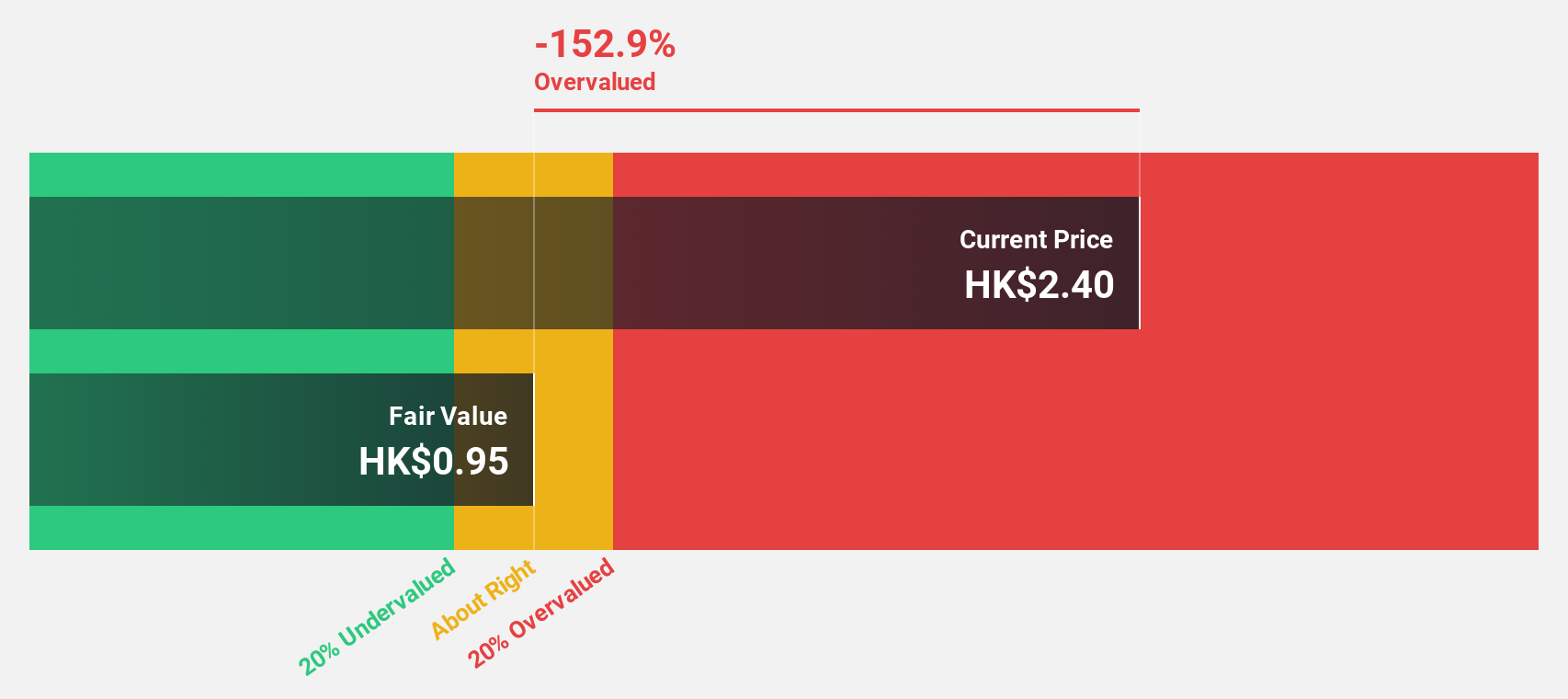

Estimated Discount To Fair Value: 23.7%

FIT Hon Teng is trading at HK$1.93, which is 23.7% below its estimated fair value of HK$2.53, indicating it may be undervalued based on cash flows. Despite recent volatility, the company has shown strong revenue growth, with sales reaching US$2.07 billion for the first half of 2024 compared to US$1.78 billion a year ago and turning a net profit of US$32.52 million from a net loss last year due to improved management and recovering market demand.

- The growth report we've compiled suggests that FIT Hon Teng's future prospects could be on the up.

- Take a closer look at FIT Hon Teng's balance sheet health here in our report.

Sany Heavy Equipment International Holdings (SEHK:631)

Overview: Sany Heavy Equipment International Holdings Company Limited manufactures and sells mining and logistics equipment, robotic and smart mine products, petroleum and new energy manufacturing equipment, and spare parts with a market cap of HK$13.40 billion.

Operations: The company's revenue segments include CN¥11.31 billion from mining equipment, CN¥6.31 billion from logistics equipment, CN¥2.01 billion from oil and gas equipment, and CN¥0.96 billion from emerging industry equipment.

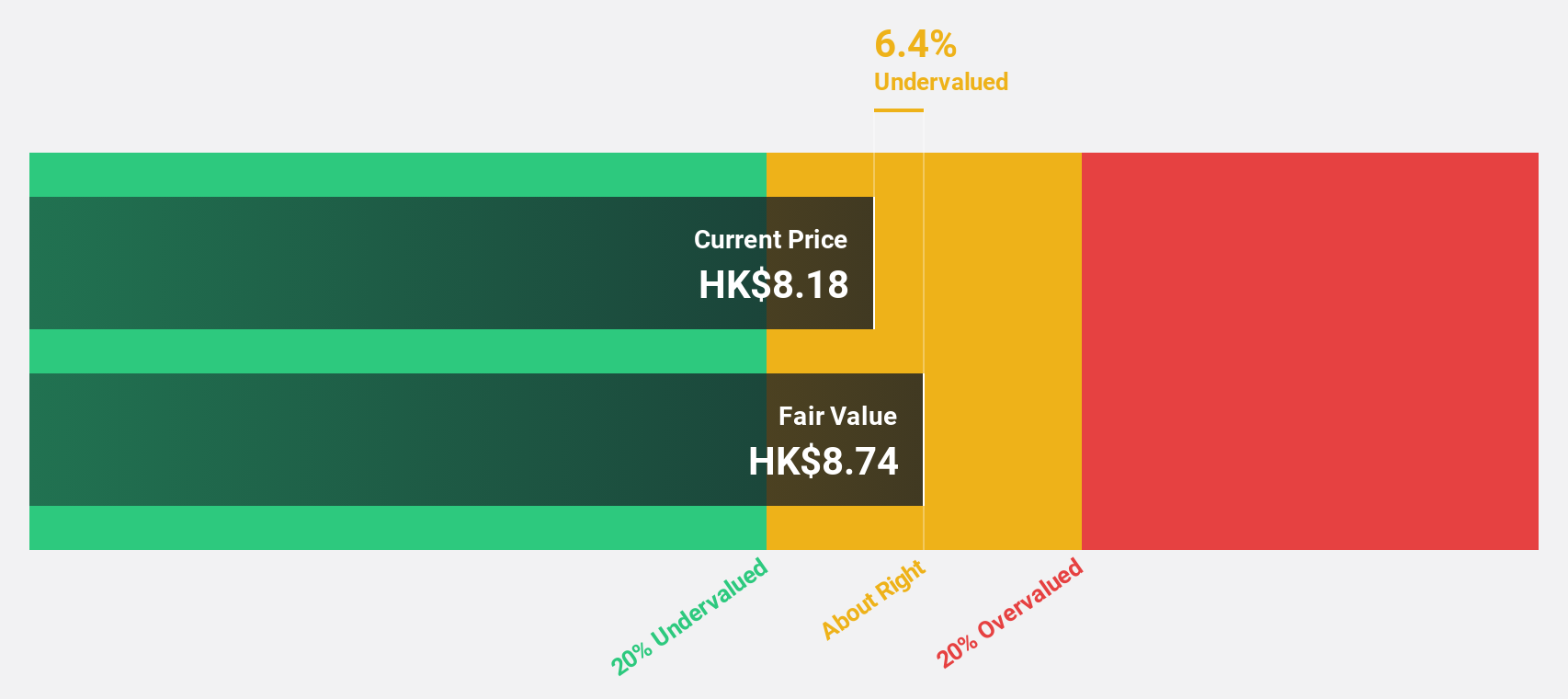

Estimated Discount To Fair Value: 11.6%

Sany Heavy Equipment International Holdings is trading at HK$4.17, 11.6% below its fair value estimate of HK$4.72, suggesting it might be undervalued based on cash flows. Despite a slight drop in sales and net income for the first half of 2024 compared to the previous year, analysts forecast significant earnings growth of 22.1% annually over the next three years, outpacing market averages and indicating potential for future appreciation.

- Our growth report here indicates Sany Heavy Equipment International Holdings may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Sany Heavy Equipment International Holdings stock in this financial health report.

Turning Ideas Into Actions

- Discover the full array of 35 Undervalued SEHK Stocks Based On Cash Flows right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6088

FIT Hon Teng

Manufactures and sells mobile and wireless devices and connectors in Taiwan and internationally.

Undervalued with excellent balance sheet.