- Hong Kong

- /

- Construction

- /

- SEHK:586

The China Conch Venture Holdings (HKG:586) Share Price Is Up 66% And Shareholders Are Holding On

By buying an index fund, you can roughly match the market return with ease. But if you buy good businesses at attractive prices, your portfolio returns could exceed the average market return. For example, the China Conch Venture Holdings Limited (HKG:586) share price is up 66% in the last three years, clearly besting than the market return of around 27% (not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 11% in the last year, including dividends.

Check out our latest analysis for China Conch Venture Holdings

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

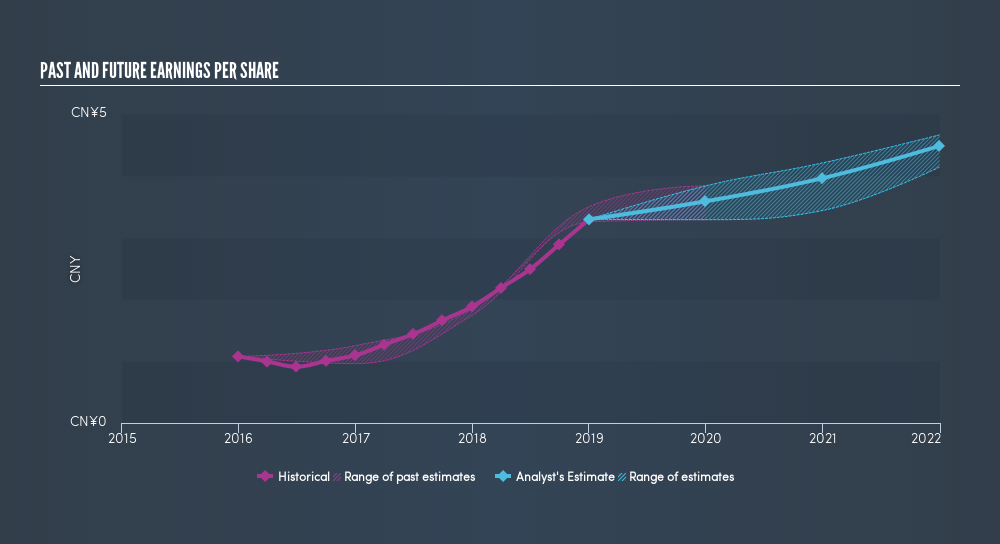

China Conch Venture Holdings was able to grow its EPS at 45% per year over three years, sending the share price higher. The average annual share price increase of 18% is actually lower than the EPS growth. Therefore, it seems the market has moderated its expectations for growth, somewhat. This cautious sentiment is reflected in its (fairly low) P/E ratio of 6.79.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our freereport on China Conch Venture Holdings's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for China Conch Venture Holdings the TSR over the last 3 years was 76%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

We're pleased to report that China Conch Venture Holdings shareholders have received a total shareholder return of 11% over one year. And that does include the dividend. That's better than the annualised return of 8.7% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Before deciding if you like the current share price, check how China Conch Venture Holdings scores on these 3 valuation metrics.

If you are like me, then you will not want to miss this freelist of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:586

China Conch Venture Holdings

An investment holding company, provides various solutions for energy conservation and environmental protection in Mainland China and the Asia-Pacific.

Fair value with limited growth.