- Hong Kong

- /

- Construction

- /

- SEHK:3996

China Energy Engineering (SEHK:3996): Assessing Valuation After Revenue Growth and Lower Profits in Latest Results

Reviewed by Simply Wall St

China Energy Engineering (SEHK:3996) just posted earnings for the first nine months of 2025, reporting higher sales and revenue than last year. However, net income and earnings per share edged a bit lower.

See our latest analysis for China Energy Engineering.

China Energy Engineering’s latest report comes after a year of strong momentum, with a 20.41% share price return year to date and a three-year total shareholder return of 45.17%. While recent earnings highlight top-line growth, ongoing margin pressures have kept the share price in check in the short term, and investors are weighing the balance between growth potential and risks as the story develops.

If you’re exploring opportunities beyond infrastructure giants, now is a good time to see what’s possible with fast growing stocks with high insider ownership

With revenue growth outpacing profits and the stock coming off a strong multi-year run, investors are left to consider whether there is real value on the table or if the market has already factored in future gains.

Price-to-Earnings of 5.7x: Is it justified?

China Energy Engineering is trading at a price-to-earnings ratio of 5.7x, noticeably below both its industry peers and the wider Hong Kong market. At a last close price of HK$1.18, the stock appears undervalued based on this metric.

The price-to-earnings ratio measures how much investors are willing to pay per dollar of earnings. It is a core indicator of market expectations for future profitability. In sectors like construction, this ratio often reflects both growth prospects and perceived risk.

The current figure signals that the market may be underestimating the company’s long-term earnings power or pricing in significant risks. Compared to the industry average of 12.3x and an estimated fair ratio of 12.1x, China Energy Engineering's shares look discounted. If market conditions improve or earnings surprise on the upside, there could be room for a re-rating toward the fair ratio.

Explore the SWS fair ratio for China Energy Engineering

Result: Price-to-Earnings of 5.7x (UNDERVALUED)

However, sustained margin pressures or volatility in key project pipelines could challenge the current valuation and dampen investor enthusiasm in the future.

Find out about the key risks to this China Energy Engineering narrative.

Another View: What Does Our DCF Model Say?

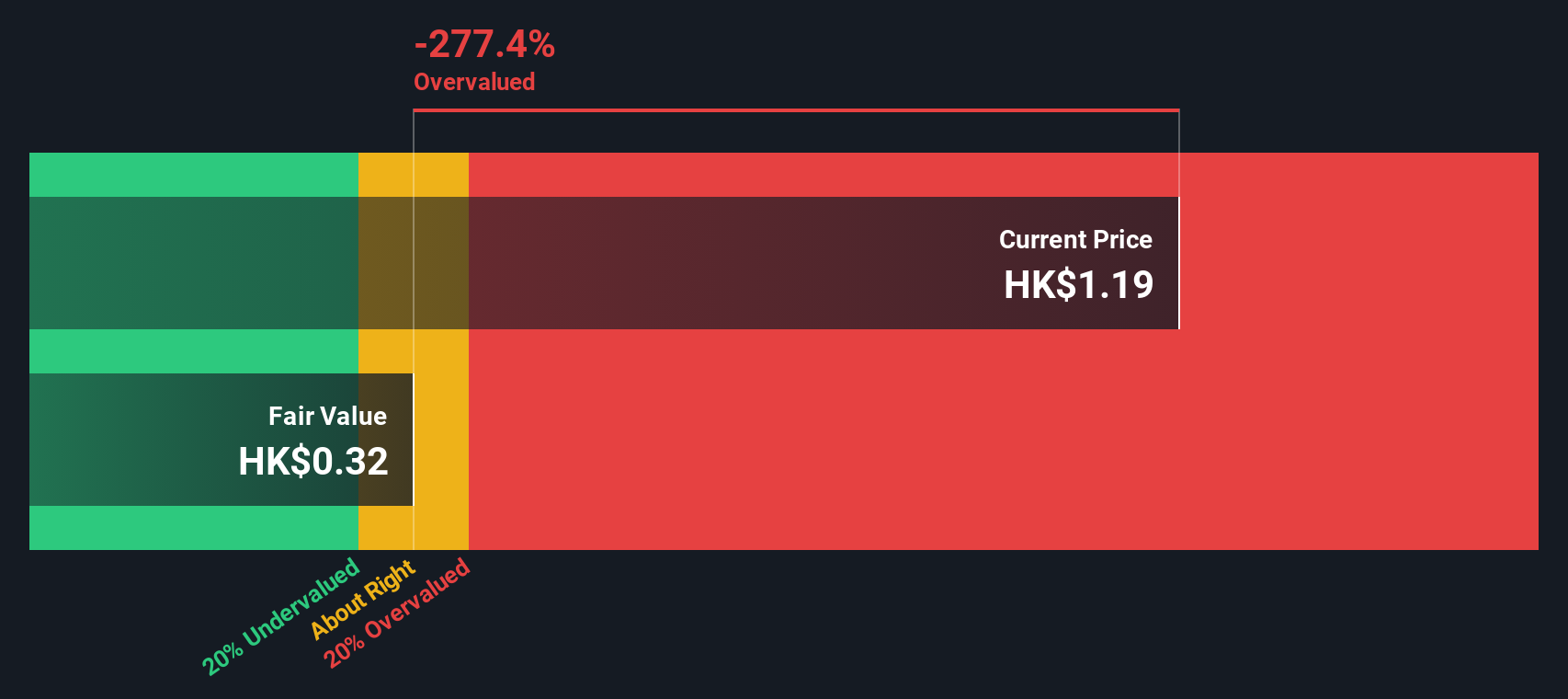

While the price-to-earnings ratio paints China Energy Engineering as undervalued, our SWS DCF model sees things differently. The DCF estimate puts fair value at just HK$0.32, well below the current market price of HK$1.18, suggesting the stock is actually overvalued on a cash flow basis. Can both perspectives be right? Or is one missing what matters most?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out China Energy Engineering for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own China Energy Engineering Narrative

If you’re keen to dive into the numbers yourself or put a different spin on the data, you can craft your own perspective in just minutes with Do it your way

A great starting point for your China Energy Engineering research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let the conversation end here. Expand your portfolio with handpicked opportunities and stay plugged into the trends shaping tomorrow’s investment landscape. You’ll want to see the stocks everyone’s watching right now.

- Seize the chance to unlock value by browsing these 876 undervalued stocks based on cash flows with strong cash flow potential at attractive prices.

- Tap into the income stream you deserve by evaluating these 16 dividend stocks with yields > 3% that consistently provide yields above 3%.

- Break into the future of finance by checking out these 82 cryptocurrency and blockchain stocks powering innovation in blockchain and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3996

China Energy Engineering

Provides solutions and services in the energy, power and infrastructure sectors in the People’s Republic of China and internationally.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives