The Hong Kong market has been experiencing a period of volatility, reflecting broader global economic uncertainties and mixed performance across various sectors. Despite these fluctuations, dividend stocks remain an attractive option for investors seeking steady income streams. In this context, selecting dividend stocks that offer strong yields and stable financial health can provide a buffer against market turbulence while generating consistent returns.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| China Construction Bank (SEHK:939) | 7.94% | ★★★★★☆ |

| China Electronics Huada Technology (SEHK:85) | 9.81% | ★★★★★☆ |

| S.A.S. Dragon Holdings (SEHK:1184) | 9.72% | ★★★★★☆ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 7.79% | ★★★★★☆ |

| China Resources Land (SEHK:1109) | 6.71% | ★★★★★☆ |

| Zhejiang Expressway (SEHK:576) | 6.88% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 7.40% | ★★★★★☆ |

| China Mobile (SEHK:941) | 6.60% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 5.35% | ★★★★★☆ |

| Tian An China Investments (SEHK:28) | 5.03% | ★★★★★☆ |

Click here to see the full list of 91 stocks from our Top SEHK Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

CIMC Enric Holdings (SEHK:3899)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CIMC Enric Holdings Limited offers transportation, storage, and processing equipment and services for the clean energy, chemicals, environmental, and liquid food sectors globally with a market cap of HK$14.48 billion.

Operations: CIMC Enric Holdings Limited generates revenue from three main segments: CN¥14.91 billion from Clean Energy, CN¥4.46 billion from Chemical and Environmental, and CN¥4.29 billion from Liquid Food.

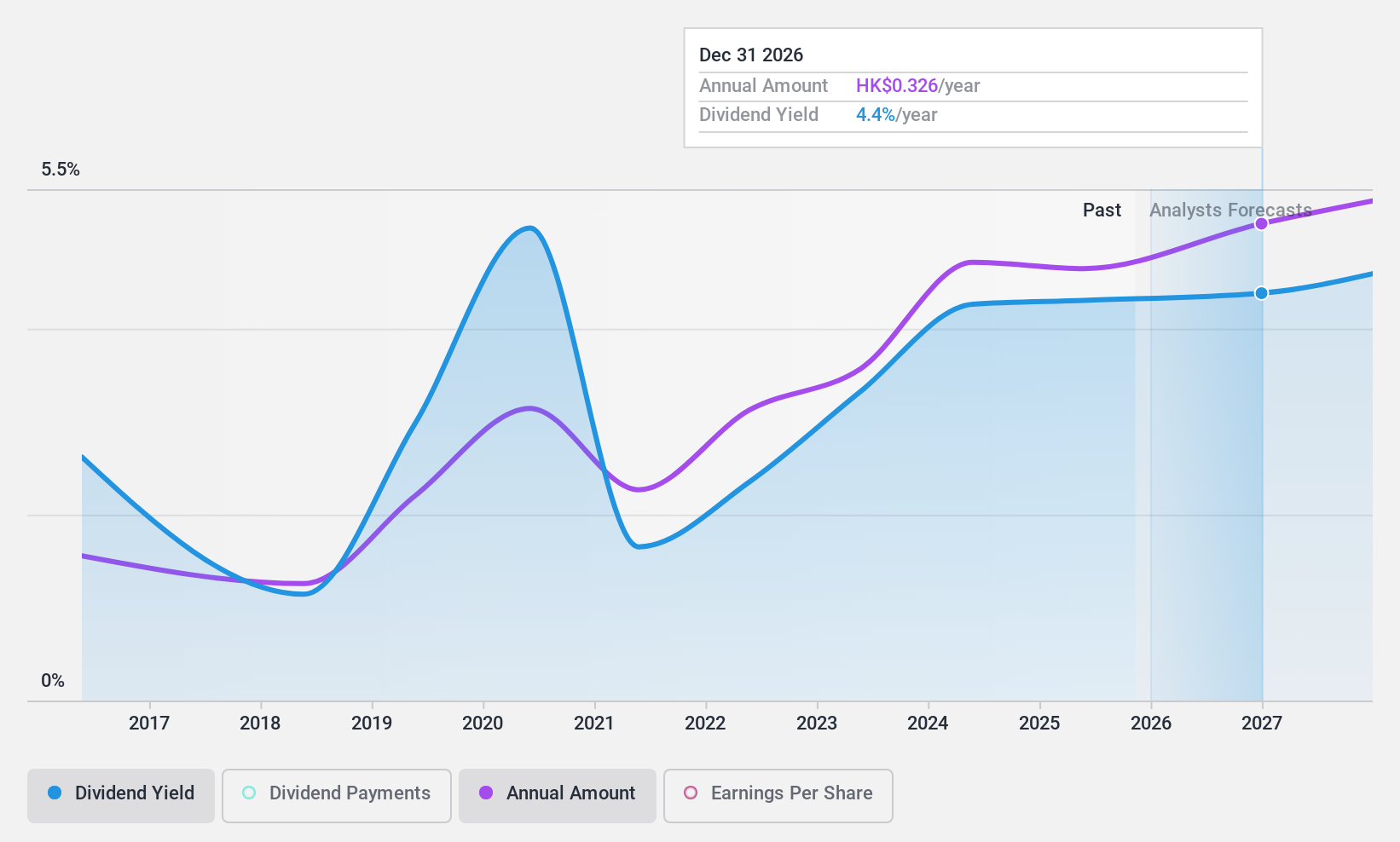

Dividend Yield: 4.1%

CIMC Enric Holdings has a reasonable cash payout ratio of 58.7%, indicating that its dividend payments are covered by cash flows. The company declared a final dividend of HK$0.30 per share for 2023, despite an unstable dividend track record over the past decade. While earnings grew by 5.6% last year and dividends have increased over the past ten years, the yield remains low compared to top-tier Hong Kong dividend payers at 4.07%.

- Unlock comprehensive insights into our analysis of CIMC Enric Holdings stock in this dividend report.

- According our valuation report, there's an indication that CIMC Enric Holdings' share price might be on the expensive side.

VSTECS Holdings (SEHK:856)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: VSTECS Holdings Limited, with a market cap of HK$6.03 billion, develops IT product channels and offers technical solution integration services in North Asia and South East Asia.

Operations: VSTECS Holdings Limited generates revenue from three primary segments: Cloud Computing (HK$3.08 billion), Enterprise Systems (HK$40.41 billion), and Consumer Electronics (HK$30.39 billion).

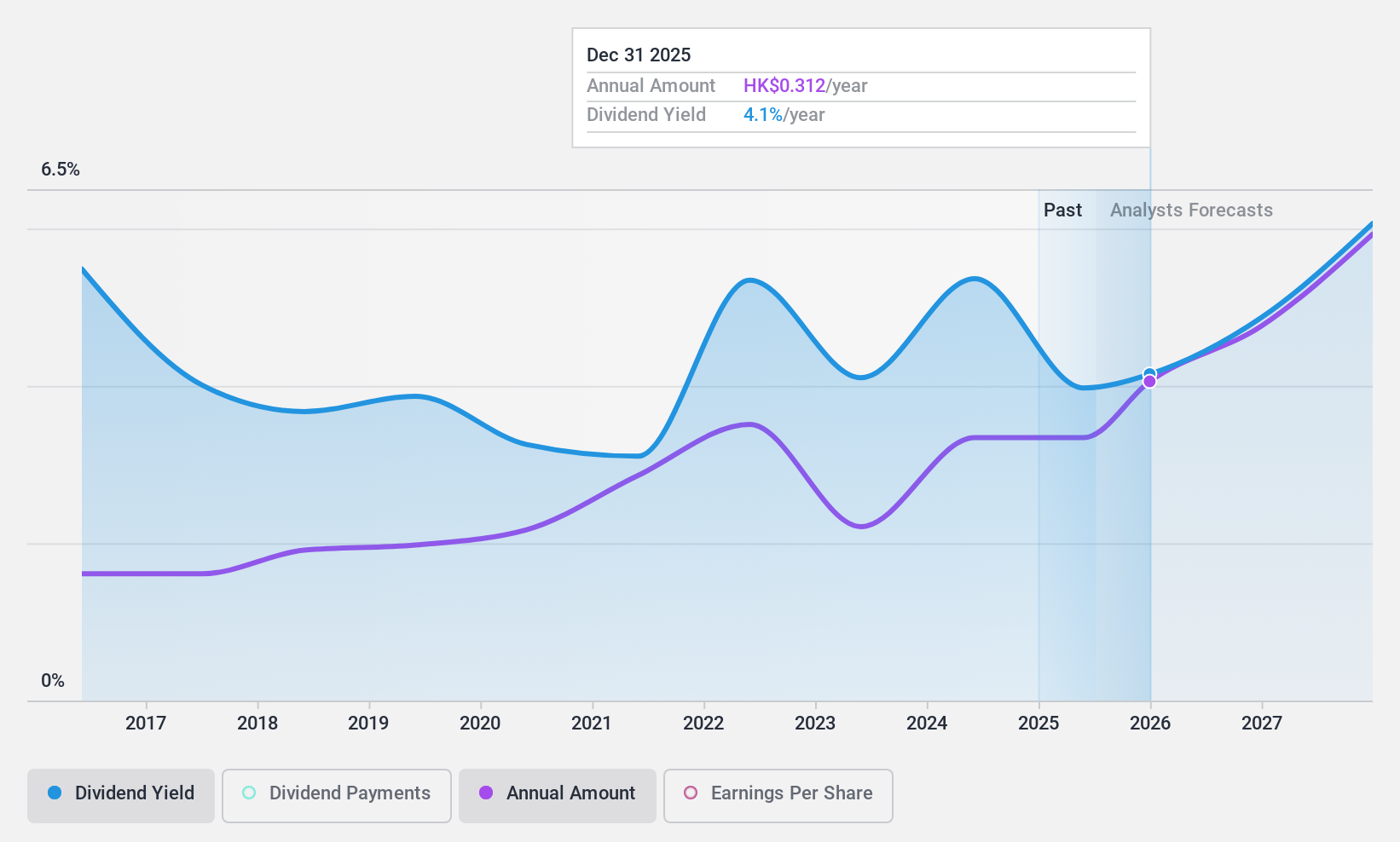

Dividend Yield: 6.1%

VSTECS Holdings has a reasonable payout ratio of 39.2%, ensuring dividends are covered by earnings, and a cash payout ratio of 61.3%, indicating coverage by cash flows. Despite volatile dividend payments over the past decade, the company approved a final dividend of HK$0.257 per share for 2023 and commenced a significant share buyback program to enhance net asset value and earnings per share. Earnings grew by 12% last year, with future growth forecasted at 11.46% annually.

- Get an in-depth perspective on VSTECS Holdings' performance by reading our dividend report here.

- The analysis detailed in our VSTECS Holdings valuation report hints at an inflated share price compared to its estimated value.

China CITIC Bank (SEHK:998)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: China CITIC Bank Corporation Limited offers a range of banking products and services both in the People’s Republic of China and internationally, with a market cap of HK$328.42 billion.

Operations: China CITIC Bank Corporation Limited generates revenue from its diverse banking products and services, catering to both domestic and international markets.

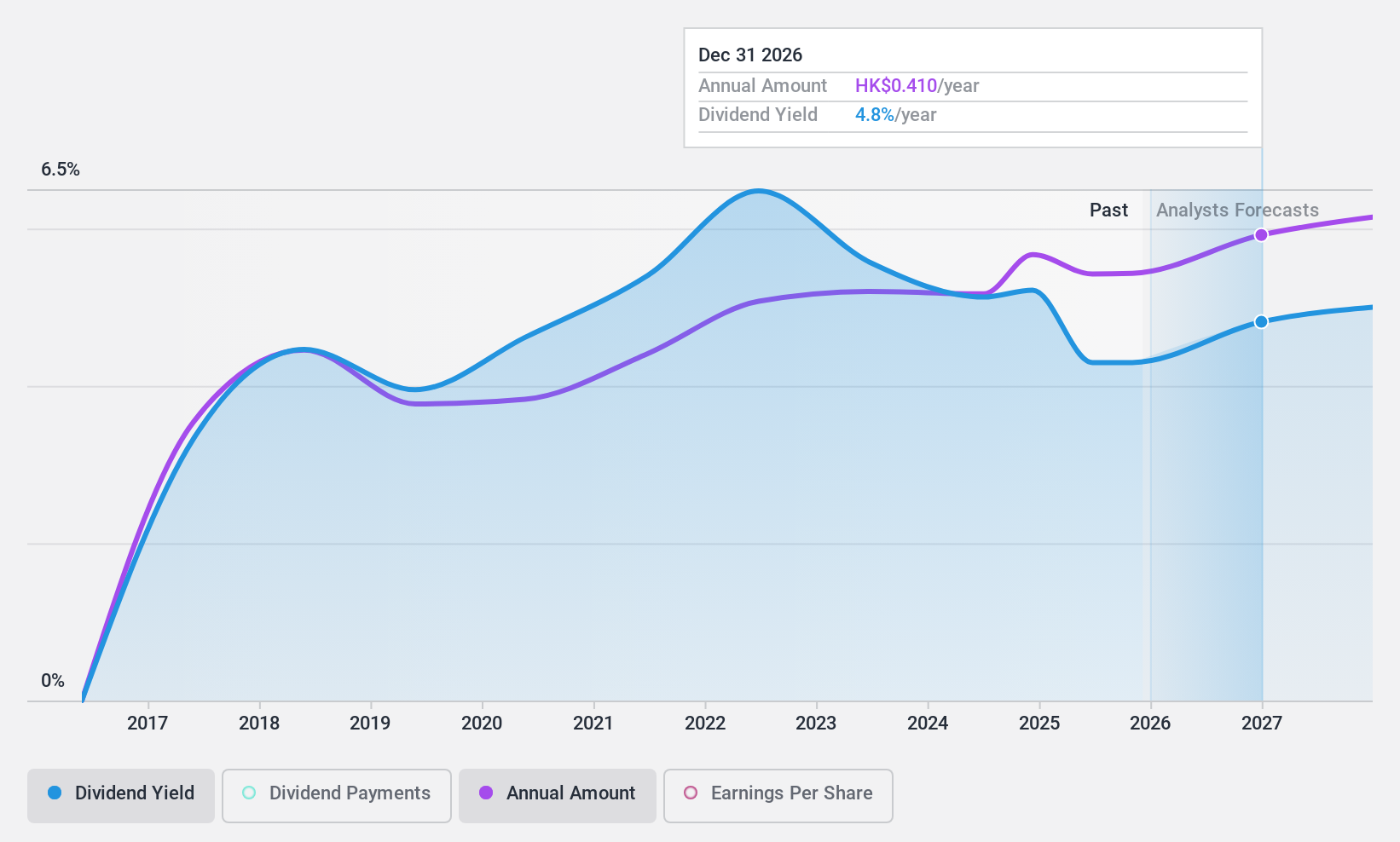

Dividend Yield: 8.3%

China CITIC Bank offers a dividend yield in the top 25% of Hong Kong payers, supported by a low payout ratio of 28%, ensuring sustainability. Despite some volatility in its dividend history, recent increases reflect stability. The bank's earnings grew by 5.4% last year and are forecasted to continue growing, enhancing future dividend coverage. Recent board changes include the election of Mr. Zhang Chun as an employee representative supervisor and the resignation of business director Mr. Liu Honghua due to retirement.

- Take a closer look at China CITIC Bank's potential here in our dividend report.

- The valuation report we've compiled suggests that China CITIC Bank's current price could be quite moderate.

Key Takeaways

- Explore the 91 names from our Top SEHK Dividend Stocks screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:998

China CITIC Bank

Provides various banking products and services in the People’s Republic of China and internationally.

Flawless balance sheet, undervalued and pays a dividend.