- Hong Kong

- /

- Industrials

- /

- SEHK:363

Top Asian Dividend Stocks To Consider In November 2025

Reviewed by Simply Wall St

As Asian markets navigate a landscape marked by economic challenges and shifting investor sentiment, dividend stocks continue to attract attention for their potential to provide steady income amidst volatility. In light of recent developments, such as China's economic slowdown and Japan's fiscal policy shifts, selecting dividend stocks with strong fundamentals and consistent payout histories can be a prudent strategy for investors seeking stability in uncertain times.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 3.82% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.03% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 4.25% | ★★★★★★ |

| NCD (TSE:4783) | 4.64% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.81% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.98% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.99% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.62% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.78% | ★★★★★★ |

Click here to see the full list of 1079 stocks from our Top Asian Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Shanghai Industrial Holdings (SEHK:363)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shanghai Industrial Holdings Limited is an investment holding company involved in infrastructure and environmental protection, real estate, consumer products, and comprehensive healthcare operations with a market cap of HK$16.91 billion.

Operations: Shanghai Industrial Holdings Limited generates revenue from its real estate segment (HK$14.20 billion), infrastructure and environmental protection segment (HK$10.12 billion), and consumer products segment (HK$3.70 billion).

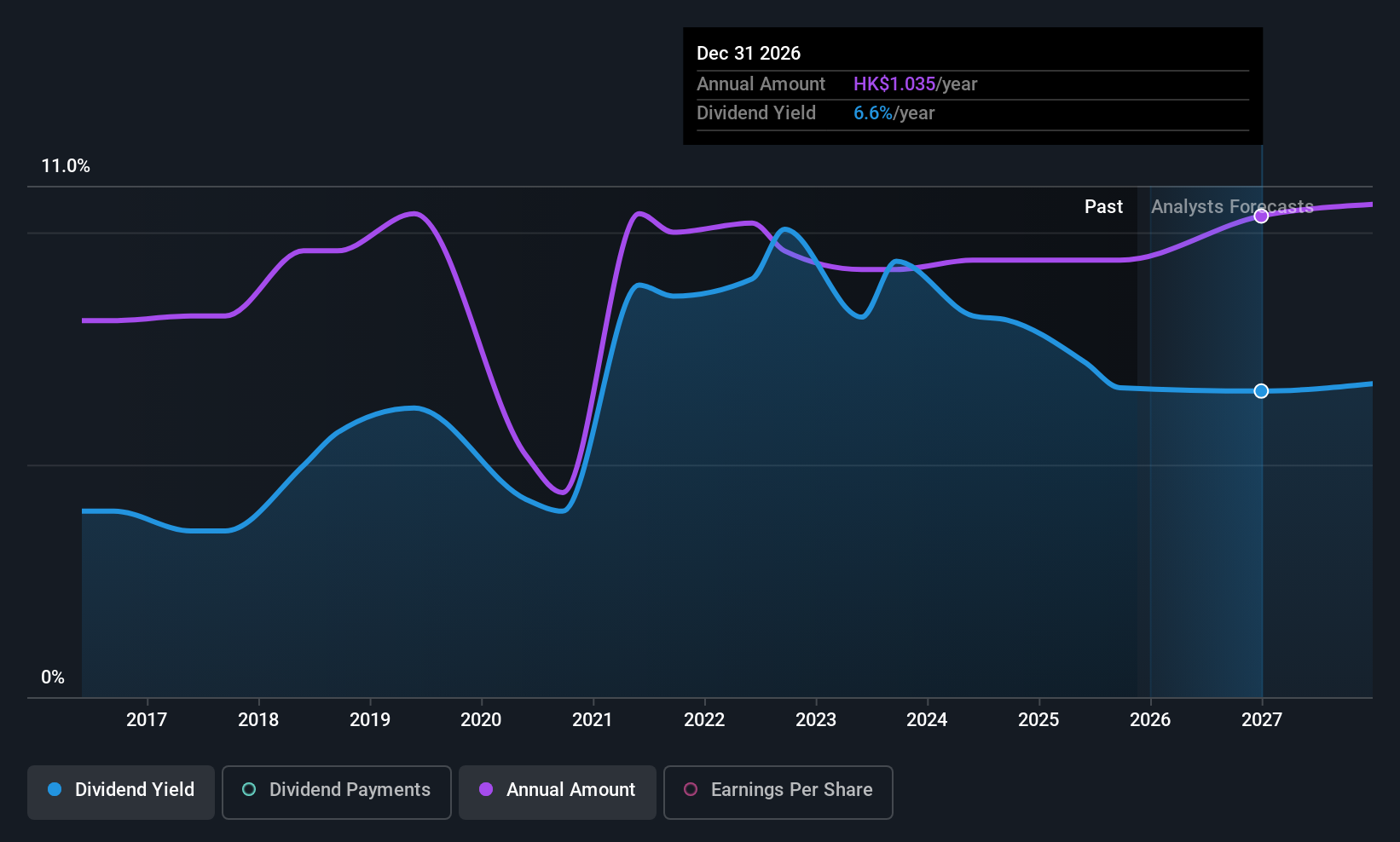

Dividend Yield: 6%

Shanghai Industrial Holdings has a mixed dividend profile. While its dividends have grown over the past decade, they have been volatile, with annual drops exceeding 20%. The company's payout ratios are reasonable, with earnings coverage at 38.6% and cash flow coverage at 72.3%, suggesting sustainability despite past volatility. Recent changes in executive and board positions could impact future strategies. An interim dividend of HK$0.42 per share was declared for H1 2025 amidst declining sales and net income compared to the previous year.

- Unlock comprehensive insights into our analysis of Shanghai Industrial Holdings stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Shanghai Industrial Holdings is priced lower than what may be justified by its financials.

Persol HoldingsLtd (TSE:2181)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Persol Holdings Co., Ltd. is a global provider of human resource services under the PERSOL brand, with a market capitalization of ¥625.09 billion.

Operations: Persol Holdings Co., Ltd. operates in various revenue segments, including temporary staffing, recruiting, and outsourcing services under the PERSOL brand globally.

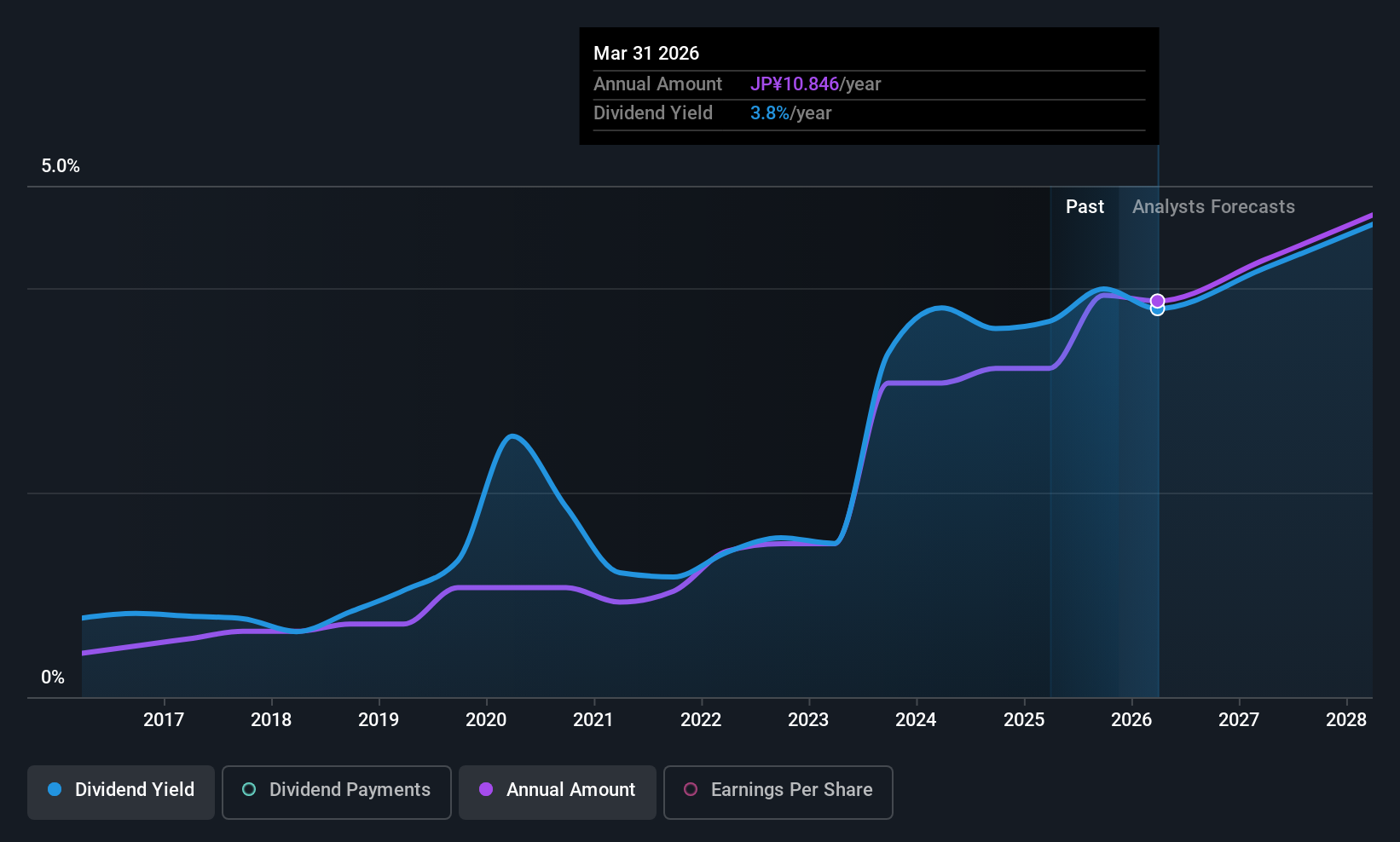

Dividend Yield: 3.9%

Persol Holdings' dividend profile is marked by volatility over the past decade, with annual drops exceeding 20%. However, its current payout ratios are sustainable, with earnings coverage at 28.6% and cash flow coverage at 38.2%. The recent dividend increase to ¥5.50 from ¥4.50 indicates a positive outlook for shareholders despite past instability. Additionally, strategic moves like acquiring Gojob SAS could influence future growth and dividend stability amidst an attractive valuation below estimated fair value.

- Get an in-depth perspective on Persol HoldingsLtd's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Persol HoldingsLtd is trading behind its estimated value.

Noritsu Koki (TSE:7744)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Noritsu Koki Co., Ltd. is a company that manufactures and sells audio equipment and peripheral products across various international markets, with a market cap of approximately ¥187.76 billion.

Operations: Noritsu Koki Co., Ltd. generates revenue through the manufacturing and sale of audio equipment and peripheral products across diverse regions including Japan, China, the United States, Europe, Central and South America, the Middle East, Africa, and other international markets.

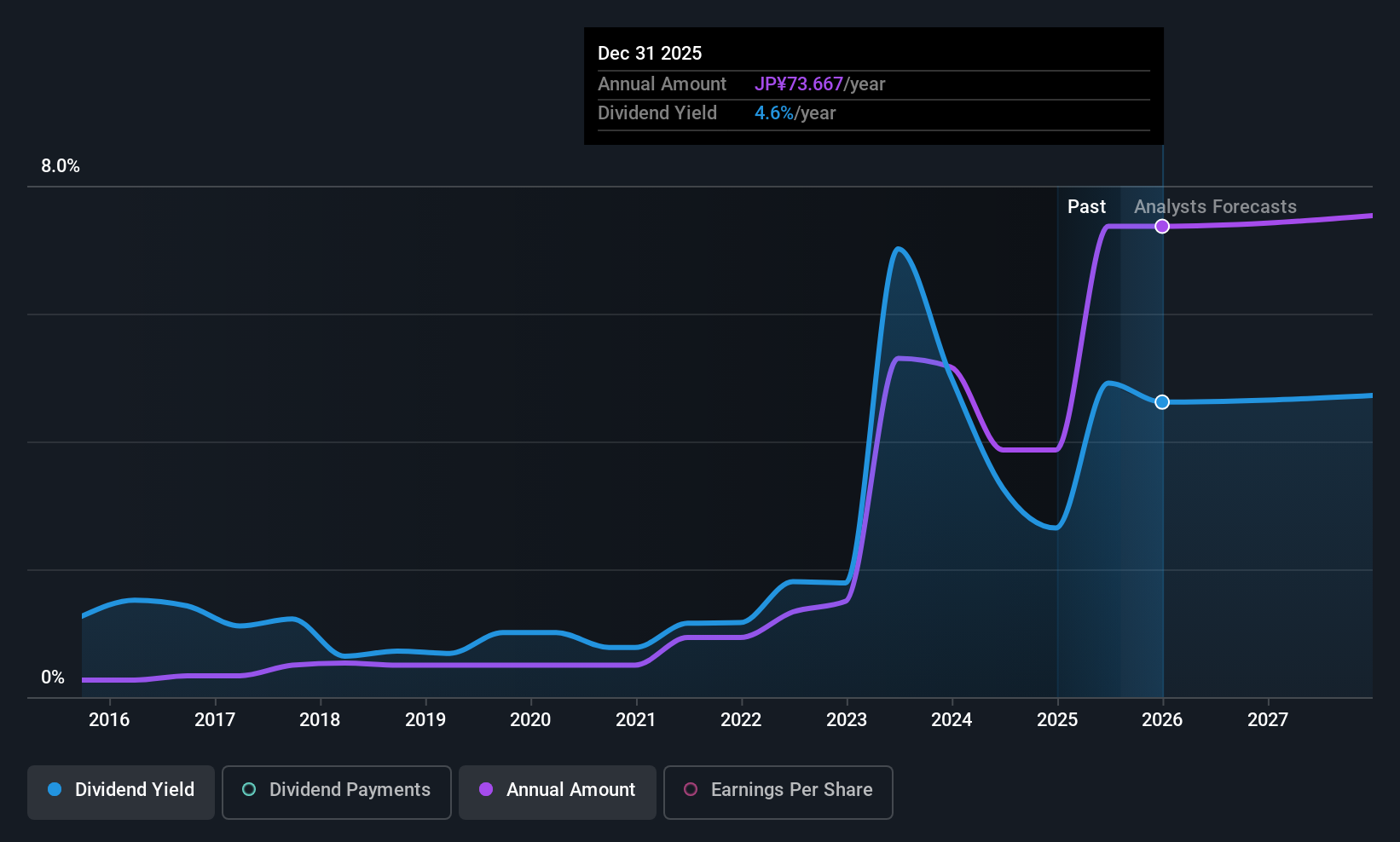

Dividend Yield: 4.2%

Noritsu Koki's dividend profile shows volatility over the past decade, with payments increasing but remaining unstable. Despite this, dividends are well-covered by earnings and cash flows, with payout ratios of 26.4% and 54.2%, respectively. Trading significantly below estimated fair value, it offers a compelling valuation compared to peers. The dividend yield is in the top quartile of Japan's market at 4.16%, suggesting potential appeal for income-focused investors despite historical inconsistencies.

- Click here to discover the nuances of Noritsu Koki with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Noritsu Koki's share price might be too pessimistic.

Next Steps

- Click here to access our complete index of 1079 Top Asian Dividend Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:363

Shanghai Industrial Holdings

An investment holding company, engages in the infrastructure and environmental protection, real estate, consumer products, and comprehensive healthcare operations businesses.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives