- Hong Kong

- /

- Trade Distributors

- /

- SEHK:2866

COSCO SHIPPING Dev. (SEHK:2866) Margin Gain Reinforces Value Narrative Despite Five-Year Earnings Decline

Reviewed by Simply Wall St

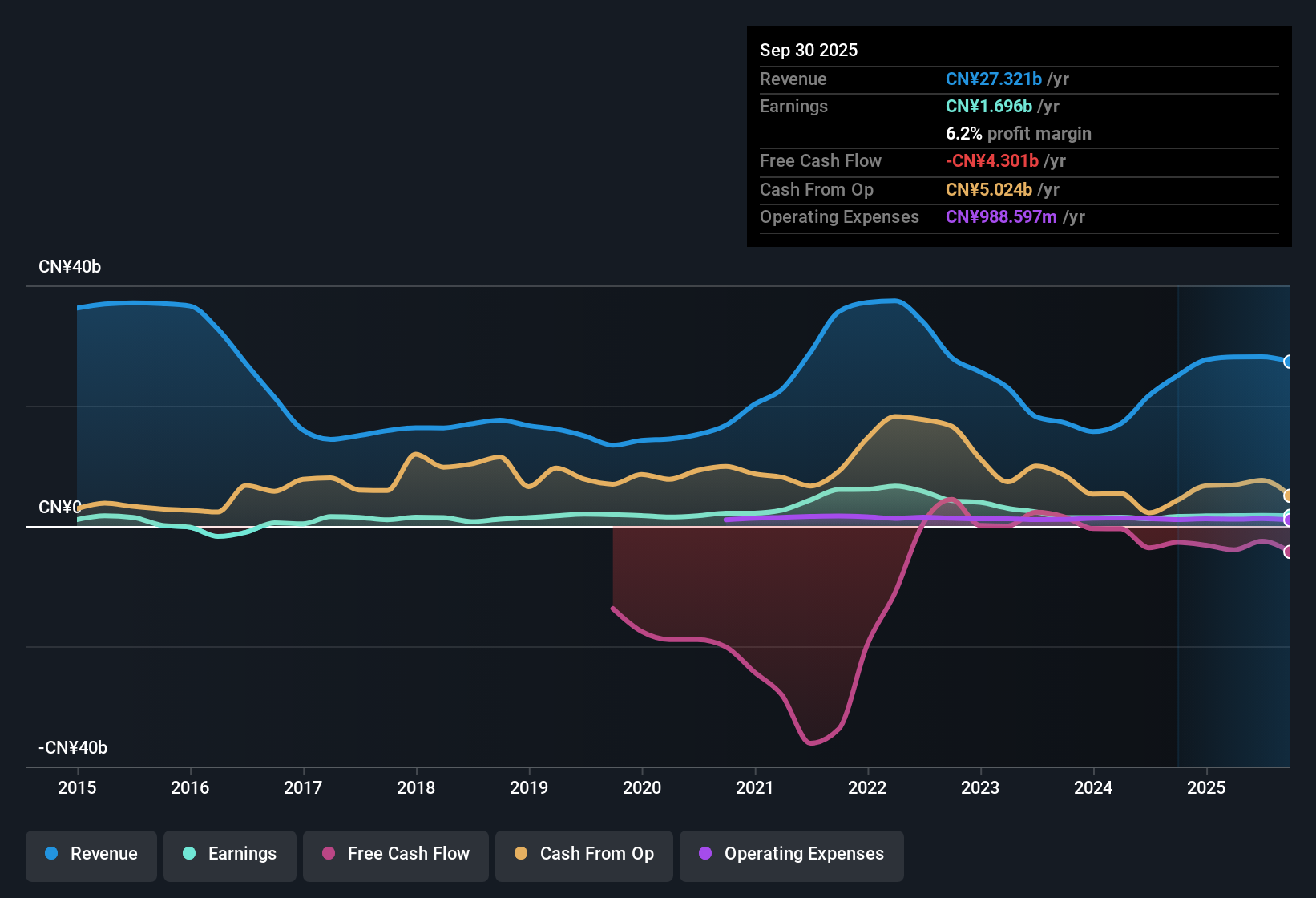

COSCO SHIPPING Development (SEHK:2866) posted net profit margins of 6.3%, rising from 5.5% a year earlier, with EPS surging 46.3% over the past year. Despite these headline gains, earnings have contracted by an average of 21.9% per year over the last five years. The stock trades at an 8x price-to-earnings ratio, well below peers and the broader Hong Kong Trade Distributors industry. This signals a value tilt as investors weigh recent margin expansion against the company’s longer-term earnings slide.

See our full analysis for COSCO SHIPPING Development.Next up, let’s see how these numbers stack up against the major narratives that shape investor sentiment. Some may align with expectations, while others could shift the debate.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Expansion Signals Operational Discipline

- Net profit margin rose to 6.3% this year versus 5.5% last year, alongside a 46.3% jump in annual earnings. This shows that COSCO SHIPPING Development is translating more of its revenue into bottom-line profits despite sector headwinds.

- The prevailing market view highlights that this margin improvement suggests the company’s asset-light strategy and logistics expansion are having a tangible impact. This helps appeal to investors looking for resilient, income-generating stocks.

- At the same time, stability in operations and no negative shocks per recent news coverage reinforce the company’s image as a defensive play during a period of normalization in global shipping.

- However, muted market enthusiasm suggests that income-oriented investors may appreciate the improved efficiency more than traders seeking rapid gains.

Five-Year Earnings Slide Raises Financial Risks

- COSCO SHIPPING Development’s average annual earnings have declined by 21.9% over the last five years. This puts pressure on the company’s ability to deliver consistent growth and underlines risks flagged around its financial position, expected earnings growth, and dividend sustainability.

- The current market perspective underscores that, although recent margin gains are meaningful, the longer-term trend of earnings contraction creates concern that positive news may not signal a durable turnaround.

- Risks related to sustainability of payouts and overall financial health remain upfront for cautious investors, especially as sector-wide uncertainty lingers.

- This tension between operational progress and multi-year contraction means investors are alert for new catalysts or evidence the trend can reverse.

Valuation Discount Draws Value Hunters’ Attention

- The company trades at an 8x price-to-earnings ratio, materially below its peer average of 17.5x and the Hong Kong Trade Distributors industry average of 11x. This marks it out as a value candidate in the sector.

- The dominant narrative is that this valuation gap strengthens the appeal for value and income-focused investors who prioritize stable profitability over fast growth. However, ongoing sector volatility and the company’s own financial risk profile could limit rerating potential.

- Analysts point out that shares may continue to trade at a discount until the business delivers more consistent growth. Value-oriented buyers may start moving in at these levels.

- If sector conditions or company performance improve, there is room for a modest premium, according to recent industry commentary. Expectations for outsized gains are being tempered by the history of earnings declines.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on COSCO SHIPPING Development's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite recent margin improvement, COSCO SHIPPING Development is still hampered by a five-year earnings decline and ongoing concerns about financial health and dividend stability.

If you want to avoid persistent earnings contractions and financial risks, seek out steadier performers using stable growth stocks screener (2108 results) with records of consistent growth and stability across changing market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2866

COSCO SHIPPING Development

Researches, develops, manufactures, and sells containers in the United States, Asia, Hong Kong, Mainland China, Europe, and internationally.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives