- Hong Kong

- /

- Electrical

- /

- SEHK:2727

Can Siemens Partnership Help Shanghai Electric (SEHK:2727) Strengthen Its Edge in Sustainable Power Technology?

Reviewed by Sasha Jovanovic

- At the 8th China International Import Expo, Siemens AG announced the signing of a framework agreement with Shanghai Electric to jointly develop intelligent grid equipment aimed at supporting China's dual-carbon goals.

- This partnership brings together decades of cooperation between the companies, focusing on digitalization and decarbonization within power system technology to create benchmarks for sustainable energy infrastructure.

- We will now examine how this deepened focus on digital and low-carbon solutions could influence Shanghai Electric’s overall investment story.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Shanghai Electric Group's Investment Narrative?

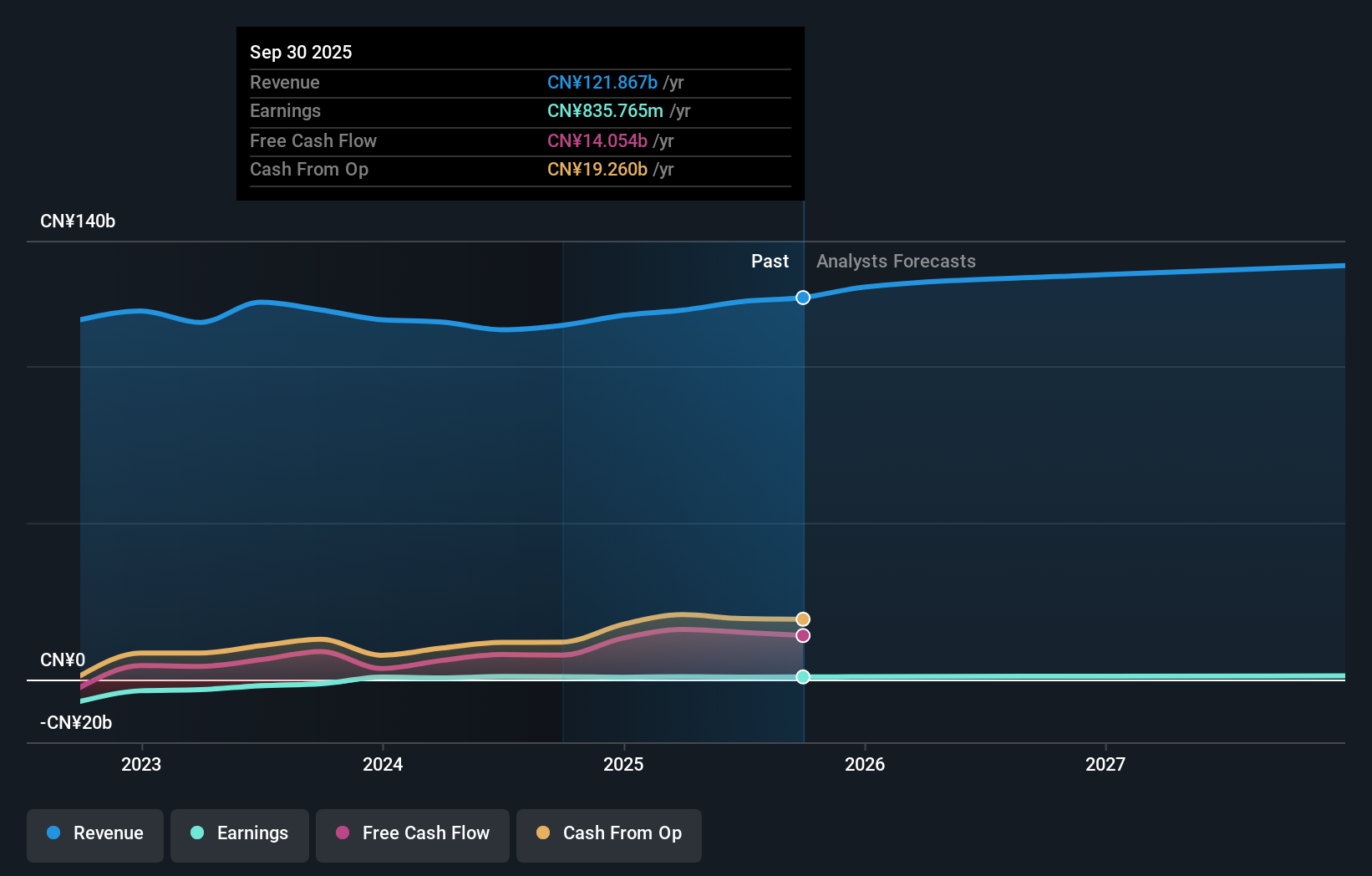

The recent, expanded partnership with Siemens AG reinforces Shanghai Electric's commitment to digitalization and decarbonization, directly supporting China's dual-carbon goals. For shareholders, the big picture centers on the company’s ability to grow as a leader in smart grid and clean energy equipment, areas drawing government and industry support. This move could be a meaningful near-term catalyst, potentially opening new market segments for Shanghai Electric and offering a showcase for its innovation. However, against a backdrop of earnings growth forecasts outpacing the local market, persistent board turnover and a share price that remains volatile, the fundamental risks, including current high valuation, a relatively inexperienced management team, and modest profit margins, remain top of mind. While this latest alliance adds momentum, investors will be watching for concrete progress that translates into material results. But with a new CEO and recent board changes, stability is still a concern investors should not overlook.

Despite retreating, Shanghai Electric Group's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore another fair value estimate on Shanghai Electric Group - why the stock might be worth just HK$22.19!

Build Your Own Shanghai Electric Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Shanghai Electric Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Shanghai Electric Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Shanghai Electric Group's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2727

Shanghai Electric Group

Manufactures and sells industrial and energy equipment in Mainland China and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives