- Hong Kong

- /

- Trade Distributors

- /

- SEHK:2588

Will BOC Aviation’s Board Change Shift Its Strategic Focus or Reinforce Stability? (SEHK:2588)

Reviewed by Sasha Jovanovic

- BOC Aviation announced that Ms. Zhang Xiaolu resigned as Chairman and Non-executive Director, and Mr. Zhuo Chengwen was appointed as the new Chairman, Executive Director, and committee leader as of 30 October 2025, following a change in work arrangements.

- Mr. Zhuo brings extensive experience from various senior roles at Bank of China and its affiliates, including expertise in risk, audit, and financial management, which could influence BOC Aviation’s board oversight and strategic direction.

- We'll examine how the leadership transition, led by Mr. Zhuo's appointment, may influence BOC Aviation's investment narrative and outlook.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

BOC Aviation Investment Narrative Recap

To be a shareholder in BOC Aviation, you need to believe in long-term growth in global air travel and the continued preference of airlines for leasing over owning aircraft, especially in Asia-Pacific. The recent leadership change, with Mr. Zhuo Chengwen's appointment as Chairman, is unlikely to materially impact the company’s largest near-term catalyst, its orderbook and fleet expansion, or shift the immediate risk profile, which remains tied to demand and interest rate conditions.

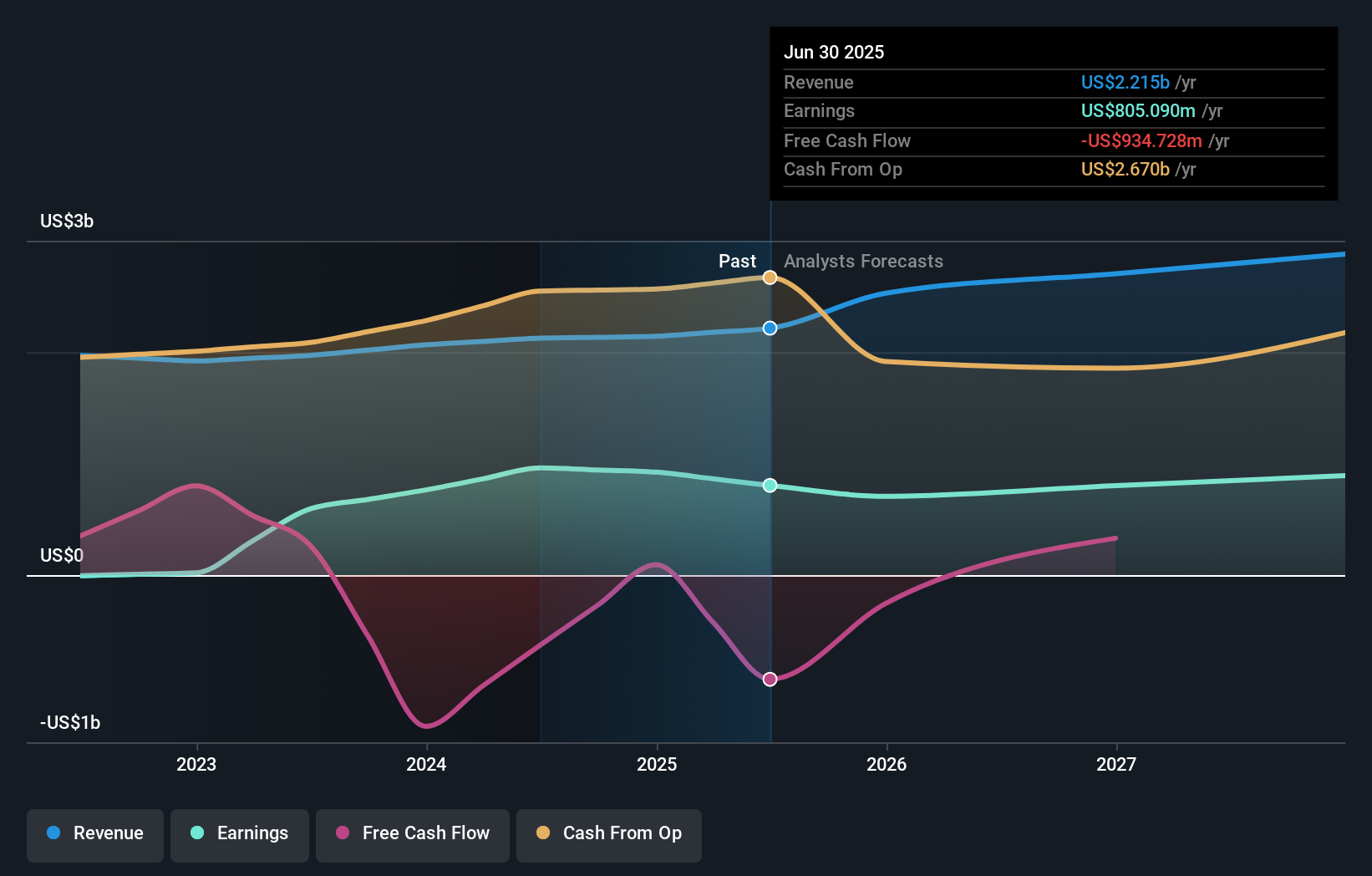

Of the recent company announcements, the earnings report for the first half of 2025 stands out as most relevant. Despite revenue growth, net income declined during the period, reflecting pressure from elevated refinancing costs and lower lease yields, key short-term variables that investors are watching closely as management transitions and capital commitments rise.

However, it is crucial to also consider that the company’s sizeable capital expenditure program, while supportive of growth, heightens exposure to the risk that airline demand may soften, especially if...

Read the full narrative on BOC Aviation (it's free!)

BOC Aviation's narrative projects $3.0 billion revenue and $866.5 million earnings by 2028. This requires 10.7% yearly revenue growth and a $61.4 million earnings increase from the current $805.1 million.

Uncover how BOC Aviation's forecasts yield a HK$83.40 fair value, a 19% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community shared two individual fair value estimates for BOC Aviation between HK$83.40 and HK$103.62. As many participants express, significant committed capital spending brings both upside potential and risk if market demand shifts, so it’s smart to weigh differing opinions.

Explore 2 other fair value estimates on BOC Aviation - why the stock might be worth just HK$83.40!

Build Your Own BOC Aviation Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BOC Aviation research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free BOC Aviation research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BOC Aviation's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BOC Aviation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2588

BOC Aviation

Operates as an aircraft operating leasing company in Mainland China, Hong Kong, Macau, Taiwan, rest of the Asia Pacific, the Americas, Europe, the Middle East, and Africa.

Undervalued with low risk.

Similar Companies

Market Insights

Community Narratives