- Hong Kong

- /

- Construction

- /

- SEHK:2355

There's No Escaping Baoye Group Company Limited's (HKG:2355) Muted Earnings Despite A 34% Share Price Rise

Baoye Group Company Limited (HKG:2355) shareholders would be excited to see that the share price has had a great month, posting a 34% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 27% in the last year.

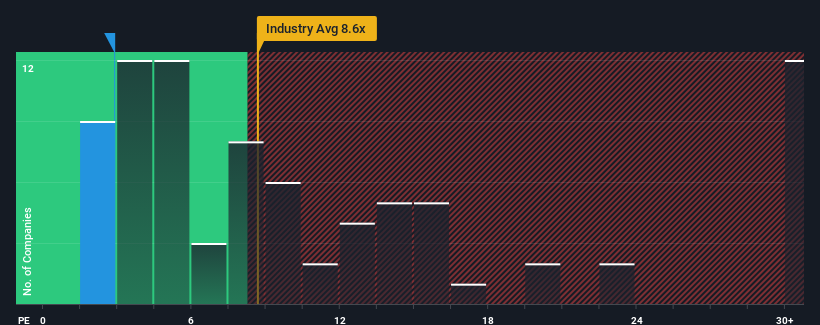

In spite of the firm bounce in price, given about half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") above 10x, you may still consider Baoye Group as a highly attractive investment with its 2.9x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

With earnings growth that's exceedingly strong of late, Baoye Group has been doing very well. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Baoye Group

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Baoye Group would need to produce anemic growth that's substantially trailing the market.

Retrospectively, the last year delivered an exceptional 30% gain to the company's bottom line. As a result, it also grew EPS by 21% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 19% shows it's noticeably less attractive on an annualised basis.

With this information, we can see why Baoye Group is trading at a P/E lower than the market. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Bottom Line On Baoye Group's P/E

Shares in Baoye Group are going to need a lot more upward momentum to get the company's P/E out of its slump. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Baoye Group revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Baoye Group with six simple checks on some of these key factors.

If you're unsure about the strength of Baoye Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Baoye Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2355

Baoye Group

Provides construction services in the People’s Republic of China.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth