- Hong Kong

- /

- Medical Equipment

- /

- SEHK:2276

3 Asian Stocks Estimated To Be Up To 40.5% Undervalued Offering Intriguing Opportunities

Reviewed by Simply Wall St

As Asian markets experience a surge in technology-focused shares and navigate economic uncertainties, investors are increasingly on the lookout for stocks that may be undervalued amidst these shifting conditions. In this context, identifying stocks with strong fundamentals and growth potential can offer intriguing opportunities for those seeking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an International Medical Investment (SZSE:000516) | CN¥4.76 | CN¥9.37 | 49.2% |

| Teikoku Sen-i (TSE:3302) | ¥3410.00 | ¥6673.15 | 48.9% |

| Takara Bio (TSE:4974) | ¥923.00 | ¥1802.98 | 48.8% |

| TaewoongLtd (KOSDAQ:A044490) | ₩31350.00 | ₩61413.35 | 49% |

| Ningxia Building Materials GroupLtd (SHSE:600449) | CN¥13.32 | CN¥26.43 | 49.6% |

| IbidenLtd (TSE:4062) | ¥13595.00 | ¥26769.99 | 49.2% |

| HD Hyundai Construction Equipment (KOSE:A267270) | ₩103300.00 | ₩199784.82 | 48.3% |

| DuChemBIOLtd (KOSDAQ:A176750) | ₩9160.00 | ₩17685.75 | 48.2% |

| CICT Mobile Communication Technology (SHSE:688387) | CN¥6.75 | CN¥13.37 | 49.5% |

| Alibaba Health Information Technology (SEHK:241) | HK$5.79 | HK$11.30 | 48.8% |

Let's dive into some prime choices out of the screener.

Morimatsu International Holdings (SEHK:2155)

Overview: Morimatsu International Holdings Company Limited specializes in designing, manufacturing, installing, operating, and maintaining core equipment and process systems for chemical reactions, biological reactions, and polymerization with a market cap of HK$12.47 billion.

Operations: The company generates revenue primarily through the sale of comprehensive pressure equipment, totaling CN¥6.16 billion.

Estimated Discount To Fair Value: 38.2%

Morimatsu International Holdings is trading at HK$10.01, significantly undervalued compared to its estimated fair value of HK$16.2, with a 38.2% discount on this estimate. Despite recent declines in sales and net income for the first half of 2025, its earnings are forecast to grow at 23% annually over the next three years, outpacing the Hong Kong market's growth rate of 12.3%. Analysts expect a price rise by 26.2%.

- Our growth report here indicates Morimatsu International Holdings may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Morimatsu International Holdings.

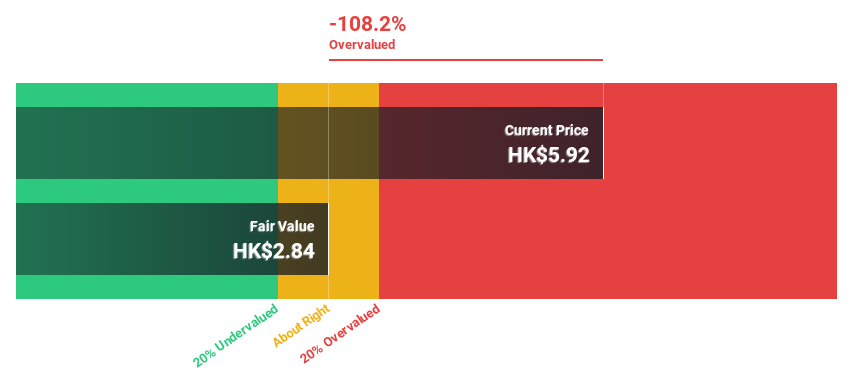

Shanghai Conant Optical (SEHK:2276)

Overview: Shanghai Conant Optical Co., Ltd. manufactures and sells resin spectacle lenses across Mainland China, the Americas, Asia, Europe, Oceania, and Africa with a market cap of HK$21.31 billion.

Operations: The company's revenue primarily comes from the manufacturing and sales of resin spectacle lenses, amounting to CN¥2.17 billion.

Estimated Discount To Fair Value: 40.5%

Shanghai Conant Optical is trading at HK$44.4, which is 40.5% below its estimated fair value of HK$74.63, presenting a potential undervaluation based on cash flows. The company's earnings grew by 30.6% over the past year and are forecast to grow at 18.1% per year, surpassing the Hong Kong market's growth rate of 12.3%. Recent events include an interim dividend payment and amendments to company bylaws reflecting changes in capital structure.

- Our comprehensive growth report raises the possibility that Shanghai Conant Optical is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Shanghai Conant Optical's balance sheet health report.

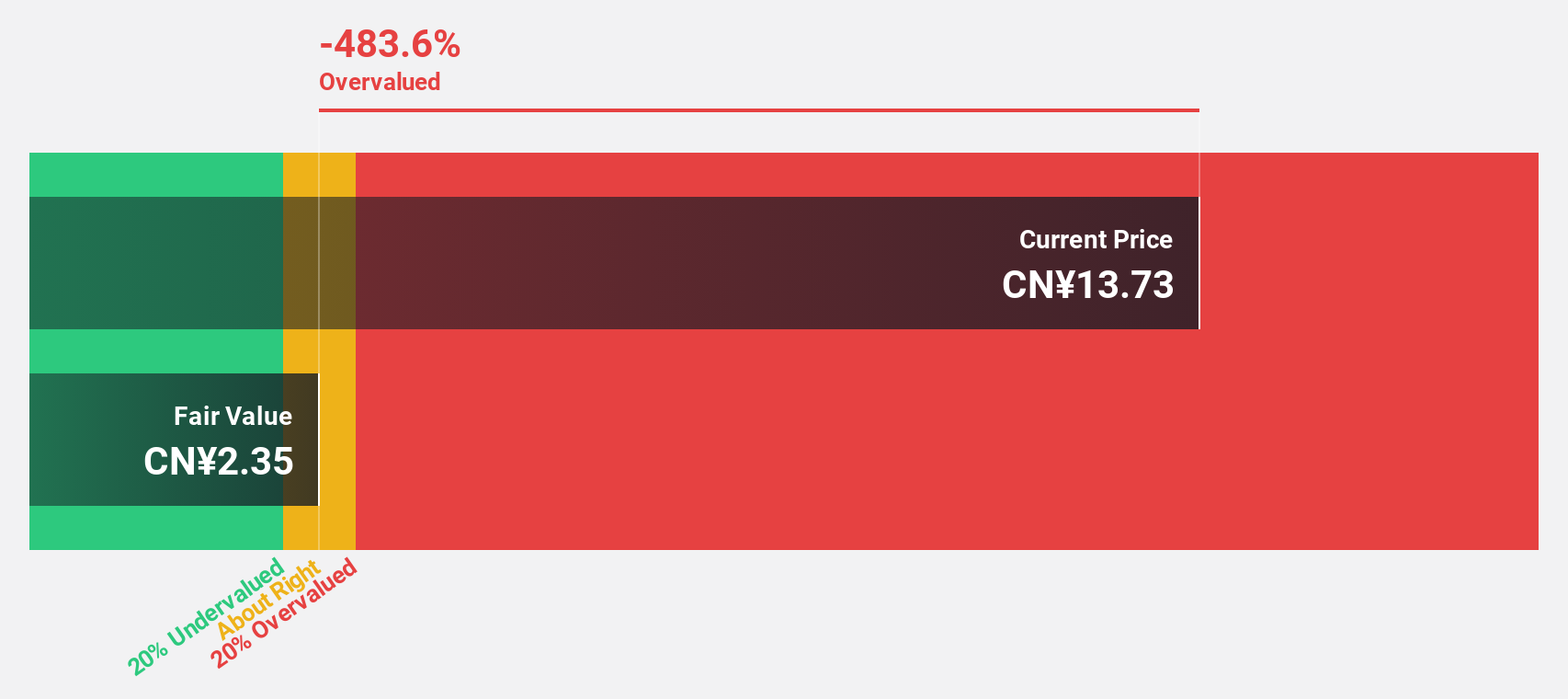

Ningbo Yunsheng (SHSE:600366)

Overview: Ningbo Yunsheng Co., Ltd. focuses on the research, development, manufacture, and sale of rare earth permanent magnet materials in China with a market cap of CN¥15.66 billion.

Operations: The company generates revenue primarily from the research, development, manufacturing, and sale of rare earth permanent magnet materials in China.

Estimated Discount To Fair Value: 11%

Ningbo Yunsheng is trading at CN¥14.55, 11% below its estimated fair value of CN¥16.34, suggesting a modest undervaluation based on cash flows. The company's earnings are forecast to grow significantly at 31.4% annually over the next three years, outpacing the broader Chinese market's growth rate of 26.5%. Recent earnings reports show a strong performance with net income rising to CN¥275.89 million for the first nine months of 2025 from CN¥69.14 million a year earlier.

- In light of our recent growth report, it seems possible that Ningbo Yunsheng's financial performance will exceed current levels.

- Navigate through the intricacies of Ningbo Yunsheng with our comprehensive financial health report here.

Turning Ideas Into Actions

- Reveal the 266 hidden gems among our Undervalued Asian Stocks Based On Cash Flows screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

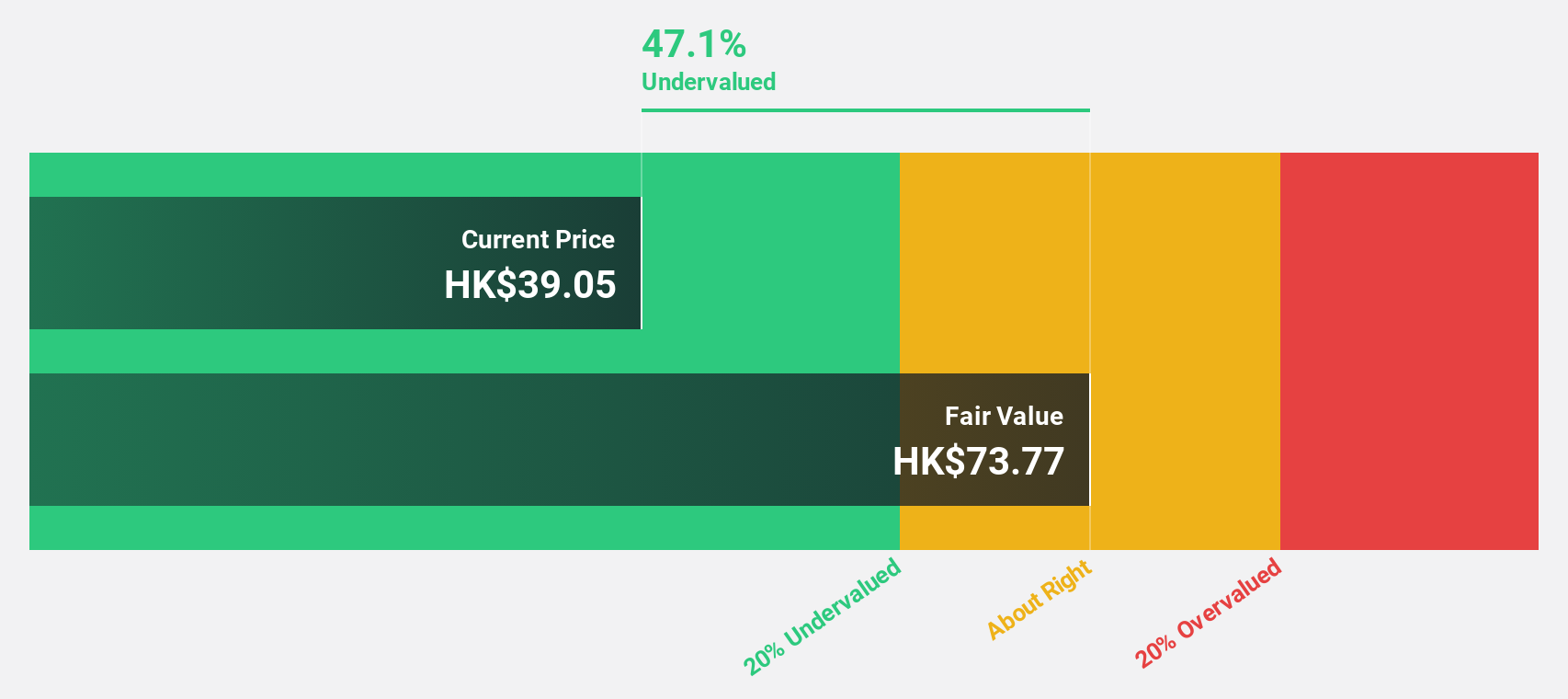

About SEHK:2276

Shanghai Conant Optical

Manufactures and sells resin spectacle lenses in Mainland China, the Americas, Asia, Europe, Oceania, and Africa.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives