Stock Analysis

- Hong Kong

- /

- Construction

- /

- SEHK:2132

Landrich Holding Limited's (HKG:2132) Fundamentals Look Pretty Strong: Could The Market Be Wrong About The Stock?

It is hard to get excited after looking at Landrich Holding's (HKG:2132) recent performance, when its stock has declined 36% over the past three months. However, stock prices are usually driven by a company’s financials over the long term, which in this case look pretty respectable. Particularly, we will be paying attention to Landrich Holding's ROE today.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

View our latest analysis for Landrich Holding

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Landrich Holding is:

9.5% = HK$29m ÷ HK$306m (Based on the trailing twelve months to September 2023).

The 'return' is the yearly profit. That means that for every HK$1 worth of shareholders' equity, the company generated HK$0.09 in profit.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

A Side By Side comparison of Landrich Holding's Earnings Growth And 9.5% ROE

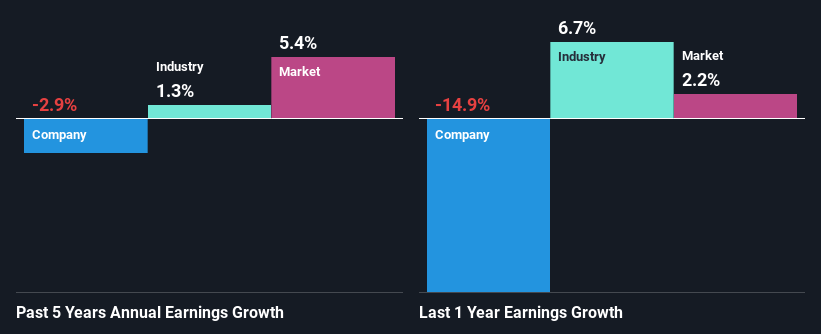

On the face of it, Landrich Holding's ROE is not much to talk about. Although a closer study shows that the company's ROE is higher than the industry average of 6.6% which we definitely can't overlook. But seeing Landrich Holding's five year net income decline of 2.9% over the past five years, we might rethink that. Remember, the company's ROE is a bit low to begin with, just that it is higher than the industry average. So that could be one of the factors that are causing earnings growth to shrink.

However, when we compared Landrich Holding's growth with the industry we found that while the company's earnings have been shrinking, the industry has seen an earnings growth of 1.3% in the same period. This is quite worrisome.

Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Is Landrich Holding fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Landrich Holding Using Its Retained Earnings Effectively?

While the company did payout a portion of its dividend in the past, it currently doesn't pay a regular dividend. This implies that potentially all of its profits are being reinvested in the business.

Summary

On the whole, we do feel that Landrich Holding has some positive attributes. Although, we are disappointed to see a lack of growth in earnings even in spite of a moderate ROE and and a high reinvestment rate. We believe that there might be some outside factors that could be having a negative impact on the business. While we won't completely dismiss the company, what we would do, is try to ascertain how risky the business is to make a more informed decision around the company. Our risks dashboard would have the 3 risks we have identified for Landrich Holding.

Valuation is complex, but we're helping make it simple.

Find out whether Landrich Holding is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2132

Landrich Holding

An investment holding company, undertakes construction engineering works in Hong Kong.

Flawless balance sheet and slightly overvalued.