As global markets react to rising U.S. Treasury yields and economic uncertainties, the Hong Kong market has seen its benchmark Hang Seng Index decline slightly, reflecting cautious investor sentiment amid broader macroeconomic fluctuations. In this environment, dividend stocks can offer a measure of stability and income potential for investors seeking to navigate these volatile conditions.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| Luk Fook Holdings (International) (SEHK:590) | 9.04% | ★★★★★☆ |

| China Hongqiao Group (SEHK:1378) | 8.67% | ★★★★★☆ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 7.17% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 6.98% | ★★★★★☆ |

| Playmates Toys (SEHK:869) | 8.57% | ★★★★★☆ |

| China Construction Bank (SEHK:939) | 7.06% | ★★★★★☆ |

| PC Partner Group (SEHK:1263) | 8.44% | ★★★★★☆ |

| Tianjin Development Holdings (SEHK:882) | 6.89% | ★★★★★☆ |

| China Mobile (SEHK:941) | 6.59% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 4.71% | ★★★★★☆ |

Click here to see the full list of 91 stocks from our Top SEHK Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

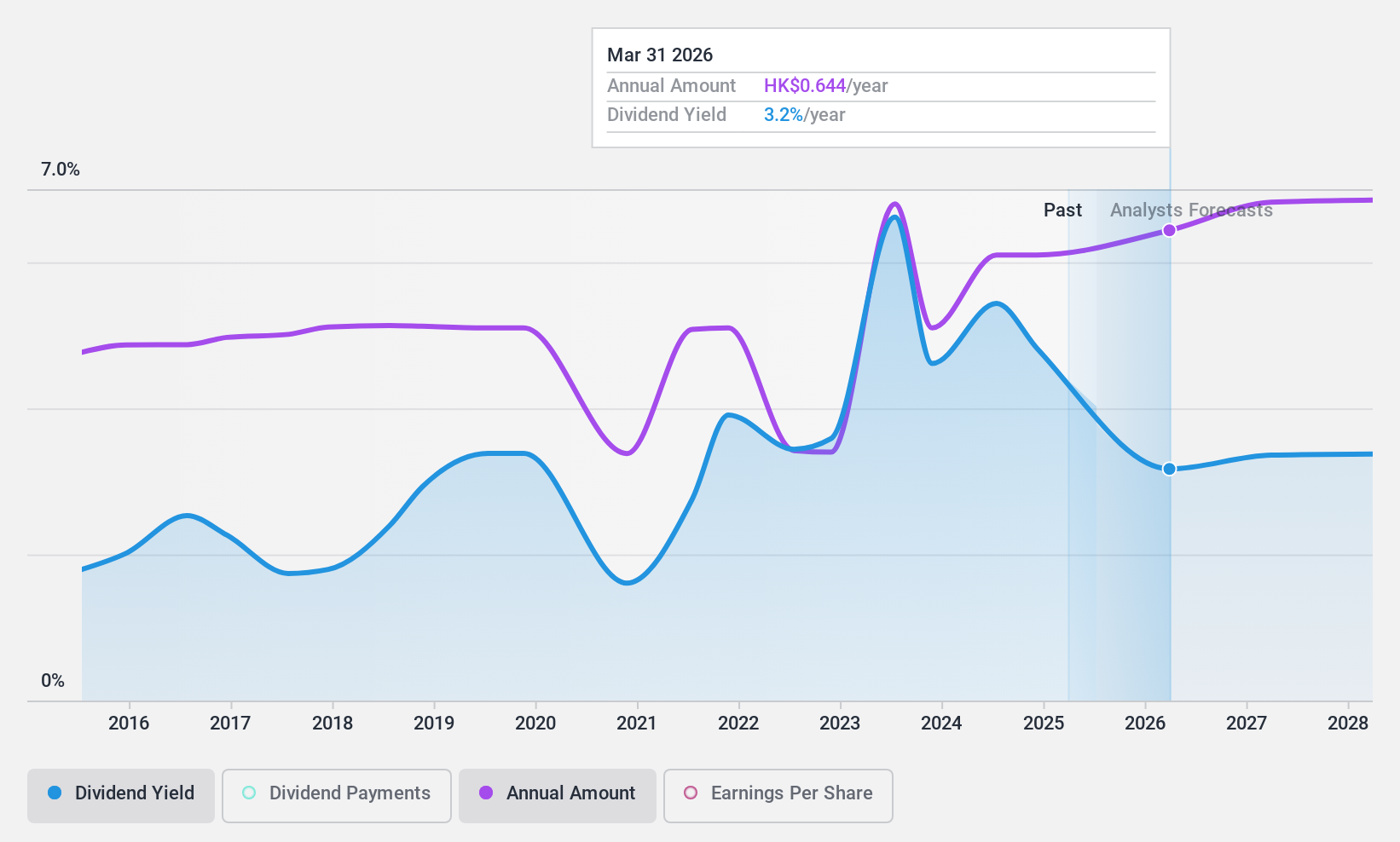

Johnson Electric Holdings (SEHK:179)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Johnson Electric Holdings Limited is an investment holding company involved in the manufacture and sale of motion systems globally, with a market capitalization of approximately HK$10.33 billion.

Operations: Johnson Electric Holdings Limited generates revenue primarily from its Auto Parts & Accessories segment, amounting to $3.81 billion.

Dividend Yield: 5.4%

Johnson Electric Holdings offers a mixed dividend profile, with a payout ratio of 31.5% and cash payout ratio of 18.3%, indicating sustainability from earnings and cash flows. However, its dividends have been volatile and unreliable over the past decade, despite recent growth in payments. The current yield is relatively low compared to top-tier Hong Kong dividend stocks, but the stock trades at a significant discount to its estimated fair value.

- Click here to discover the nuances of Johnson Electric Holdings with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Johnson Electric Holdings' share price might be too pessimistic.

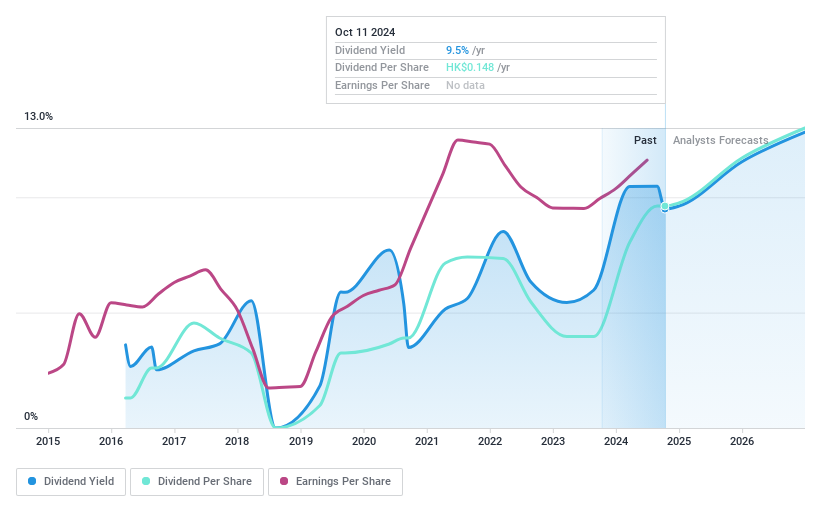

Ten Pao Group Holdings (SEHK:1979)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ten Pao Group Holdings Limited is an investment holding company that develops, manufactures, and sells electric charging products globally, with a market capitalization of approximately HK$1.54 billion.

Operations: Ten Pao Group Holdings Limited generates its revenue from several segments, including Telecommunication (HK$1.46 billion), Smart Chargers and Controllers (HK$1.81 billion), New Energy Business (HK$820.12 million), Media and Entertainment (HK$370.37 million), and Lighting (HK$298.56 million).

Dividend Yield: 9.9%

Ten Pao Group Holdings' dividend yield is among the top 25% in Hong Kong, supported by a payout ratio of 41.4% and cash payout ratio of 37.1%, indicating strong earnings and cash flow coverage. Despite recent increases, dividends have been volatile over nine years. The company reported improved half-year earnings with net income rising to HK$175.83 million from HK$136.71 million, enhancing its capacity for future payouts while trading significantly below estimated fair value.

- Click to explore a detailed breakdown of our findings in Ten Pao Group Holdings' dividend report.

- Our comprehensive valuation report raises the possibility that Ten Pao Group Holdings is priced lower than what may be justified by its financials.

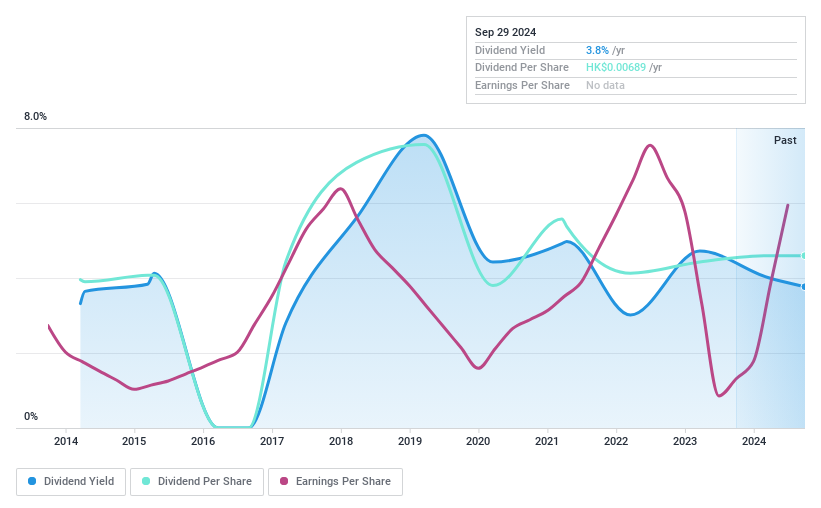

China Starch Holdings (SEHK:3838)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Starch Holdings Limited is an investment holding company that produces and sells cornstarch, lysine, starch-based sweeteners, modified starch, and other corn-derived products in China with a market cap of HK$1.10 billion.

Operations: China Starch Holdings Limited generates its revenue from two main segments: Upstream Products, which contribute CN¥9.80 billion, and Fermented and Downstream Products, accounting for CN¥3.86 billion.

Dividend Yield: 3.7%

China Starch Holdings' dividend yield is lower than the top 25% in Hong Kong, with a low payout ratio of 10.4% and cash payout ratio of 25.8%, suggesting dividends are well-covered by earnings and cash flow. Despite a significant earnings increase to CNY 214.66 million, past dividend payments have been volatile and unreliable over the last decade. Recent board changes, including new appointments, may impact future governance and financial strategies related to dividends.

- Take a closer look at China Starch Holdings' potential here in our dividend report.

- Our valuation report unveils the possibility China Starch Holdings' shares may be trading at a premium.

Seize The Opportunity

- Unlock our comprehensive list of 91 Top SEHK Dividend Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3838

China Starch Holdings

An investment holding company, manufactures and sells cornstarch, lysine, starch-based sweeteners, modified starch, and ancillary corn-based and corn-refined products in the People’s Republic of China.

Solid track record with excellent balance sheet and pays a dividend.