- Hong Kong

- /

- Construction

- /

- SEHK:1903

JBB Builders International (HKG:1903) investors are up 11% in the past week, but earnings have declined over the last three years

Generally speaking, investors are inspired to be stock pickers by the potential to find the big winners. You won't get it right every time, but when you do, the returns can be truly splendid. For example, the JBB Builders International Limited (HKG:1903) share price is up a whopping 360% in the last three years, a handsome return for long term holders. On top of that, the share price is up 38% in about a quarter. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

We don't think that JBB Builders International's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

JBB Builders International's revenue trended up 0.7% each year over three years. That's not a very high growth rate considering it doesn't make profits. Therefore, we're a little surprised to see the share price gain has been so strong, at 66% per year, compound, over three years. We'll tip our hats to that, any day, but the top-line growth isn't particularly impressive when you compare it to other pre-profit companies. Shareholders would want to be sure that the share price rise is sustainable.

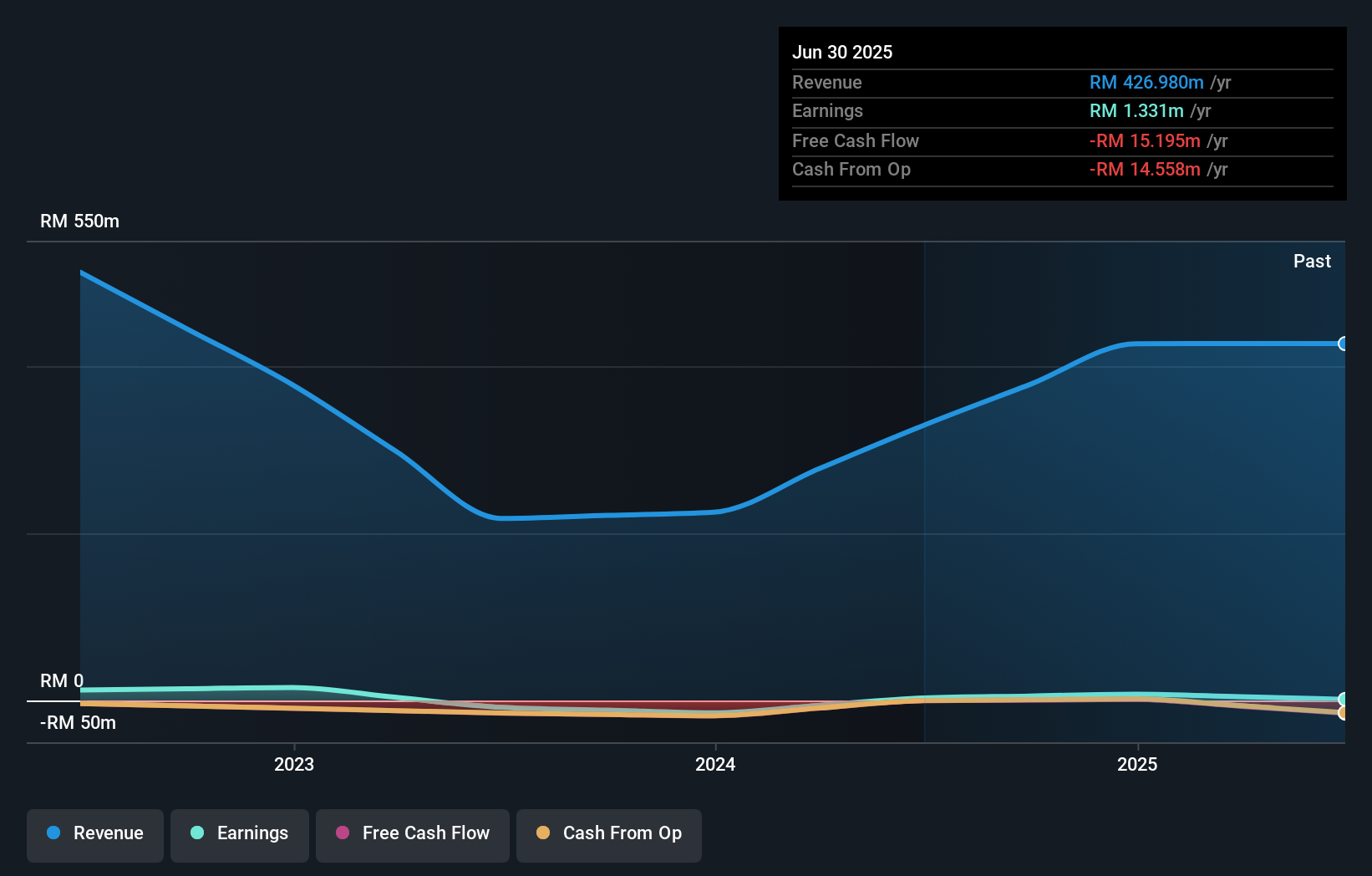

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on JBB Builders International's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that JBB Builders International shareholders have received a total shareholder return of 360% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 20% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that JBB Builders International is showing 2 warning signs in our investment analysis , and 1 of those is a bit unpleasant...

We will like JBB Builders International better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1903

JBB Builders International

An investment holding company, provides marine construction, and building and infrastructure services in Malaysia and Singapore.

Mediocre balance sheet with very low risk.

Market Insights

Community Narratives