Introducing China Machinery Engineering, The Stock That Dropped 26% In The Last Three Years

Want to participate in a short research study? Help shape the future of investing tools and receive a $20 prize!

As an investor its worth striving to ensure your overall portfolio beats the market average. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. We regret to report that long term China Machinery Engineering Corporation (HKG:1829) shareholders have had that experience, with the share price dropping 26% in three years, versus a market return of about 52%. The good news is that the stock is up 4.7% in the last week.

View our latest analysis for China Machinery Engineering

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

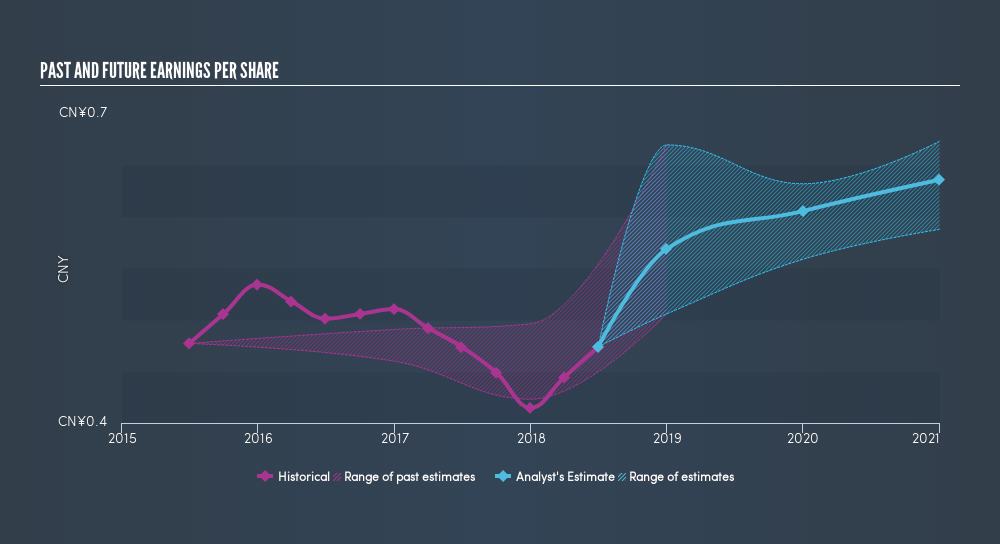

During the three years that the share price fell, China Machinery Engineering's earnings per share (EPS) dropped by 2.7% each year. The share price decline of 9.6% is actually steeper than the EPS slippage. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy. The less favorable sentiment is reflected in its current P/E ratio of 7.62.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, China Machinery Engineering's TSR for the last 3 years was -14%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While it's certainly disappointing to see that China Machinery Engineering shares lost 4.9% throughout the year, that wasn't as bad as the market loss of 7.7%. Unfortunately, last year's performance may indicate unresolved challenges, given that it's worse than the annualised loss of 1.2% over the last half decade. Whilst Warren Buffett does say to 'buy when there is blood on the streets', buyers would need to examine the data carefully to be comfortable that the business itself is sound. Keeping this in mind, a solid next step might be to take a look at China Machinery Engineering's dividend track record. This freeinteractive graph is a great place to start.

But note: China Machinery Engineering may not be the best stock to buy. So take a peek at this freelist of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Market Insights

Community Narratives