- Hong Kong

- /

- Construction

- /

- SEHK:1783

Is Golden Ponder Holdings (HKG:1783) In A Good Position To Invest In Growth?

We can readily understand why investors are attracted to unprofitable companies. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So should Golden Ponder Holdings (HKG:1783) shareholders be worried about its cash burn? In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. Let's start with an examination of the business' cash, relative to its cash burn.

View our latest analysis for Golden Ponder Holdings

When Might Golden Ponder Holdings Run Out Of Money?

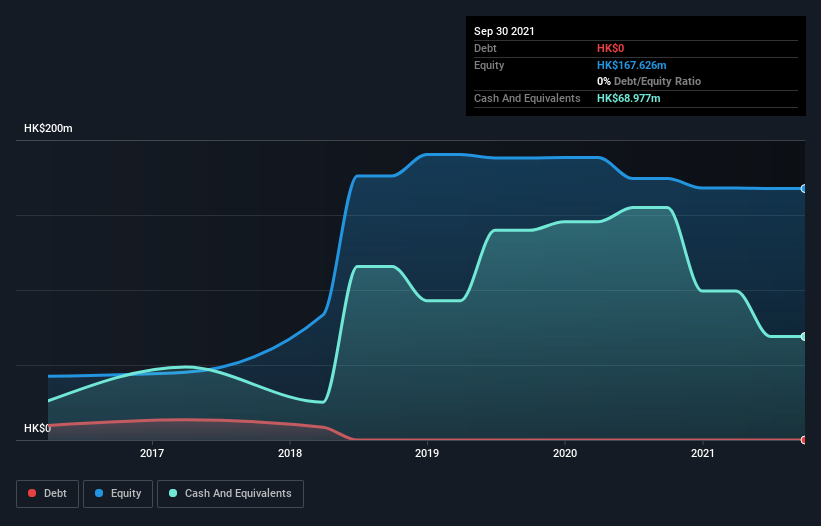

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. As at September 2021, Golden Ponder Holdings had cash of HK$69m and no debt. Looking at the last year, the company burnt through HK$72m. Therefore, from September 2021 it had roughly 12 months of cash runway. That's quite a short cash runway, indicating the company must either reduce its annual cash burn or replenish its cash. Depicted below, you can see how its cash holdings have changed over time.

Is Golden Ponder Holdings' Revenue Growing?

Given that Golden Ponder Holdings actually had positive free cash flow last year, before burning cash this year, we'll focus on its operating revenue to get a measure of the business trajectory. Notably, its strong revenue growth of 50% over the last year is genuinely cause for optimism. Of course, we've only taken a quick look at the stock's growth metrics, here. This graph of historic revenue growth shows how Golden Ponder Holdings is building its business over time.

How Easily Can Golden Ponder Holdings Raise Cash?

There's no doubt Golden Ponder Holdings' revenue growth is impressive but even if it's only hypothetical, it's always worth asking how easily it could raise more money to fund further growth. Companies can raise capital through either debt or equity. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Golden Ponder Holdings has a market capitalisation of HK$306m and burnt through HK$72m last year, which is 23% of the company's market value. That's fairly notable cash burn, so if the company had to sell shares to cover the cost of another year's operations, shareholders would suffer some costly dilution.

So, Should We Worry About Golden Ponder Holdings' Cash Burn?

On this analysis of Golden Ponder Holdings' cash burn, we think its revenue growth was reassuring, while its cash burn relative to its market cap has us a bit worried. We don't think its cash burn is particularly problematic, but after considering the range of factors in this article, we do think shareholders should be monitoring how it changes over time. On another note, Golden Ponder Holdings has 4 warning signs (and 1 which is significant) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

Valuation is complex, but we're here to simplify it.

Discover if Envision Greenwise Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1783

Envision Greenwise Holdings

An investment holding company, operates in the construction business in Hong Kong and the People’s Republic of China.

Adequate balance sheet with minimal risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success