- Hong Kong

- /

- Construction

- /

- SEHK:1783

A Look at Envision Greenwise Holdings (SEHK:1783) Valuation After Positive Profit Alert Signals Turnaround

Reviewed by Simply Wall St

Envision Greenwise Holdings (SEHK:1783) has caught attention after issuing a positive profit alert. The company is projecting a return to net profit for the six months ended 30 September 2025, following recent improvements in its core business segments.

See our latest analysis for Envision Greenwise Holdings.

Envision Greenwise Holdings has seen notable momentum in its total shareholder return, recording a 1-year TSR of 18.15% and a striking 1228% over three years, even though the current share price sits at HK$3.32 after some short-term choppiness. The positive profit alert appears to be shifting sentiment as investors weigh growth prospects against lingering risks.

If Envision Greenwise’s turnaround has sparked your curiosity, now is a good time to broaden your search and discover fast growing stocks with high insider ownership

With shares already surging over the past three years, investors now face a key question: Is Envision Greenwise Holdings fundamentally undervalued at today's price, or has the prospect of renewed profitability been fully factored into the current valuation?

Price-to-Sales of 10.7x: Is it justified?

With Envision Greenwise Holdings trading at a price-to-sales ratio of 10.7x versus the industry average of just 0.4x, the stock stands out as notably more expensive than its sector peers based on sales alone. At the last close of HK$3.32, investors are paying a premium for every dollar of revenue compared to other Hong Kong construction companies.

The price-to-sales (P/S) ratio measures how much investors are willing to pay for each dollar of a company's revenue. For Envision Greenwise Holdings, a P/S of 10.7x suggests the market has high expectations for significant profitability improvement or revenue growth, usually reserved for companies with differentiated growth prospects.

However, with Envision Greenwise still unprofitable and its recent annual earnings declining at 43.6% per year, such a lofty premium has yet to be validated by financial results. The current multiple is well above both the peer group average of 6.1x and the broader industry, potentially limiting upside unless the company can deliver rapid growth or improved margins in the near term.

Without a fair P/S ratio benchmark available for Envision Greenwise, these high expectations stand in contrast to muted profitability trends, highlighting how much is riding on a turnaround. See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Sales of 10.7x (OVERVALUED)

However, continued net losses and a lack of clear revenue growth leave Envision Greenwise Holdings exposed if its turnaround does not deliver sustained improvement.

Find out about the key risks to this Envision Greenwise Holdings narrative.

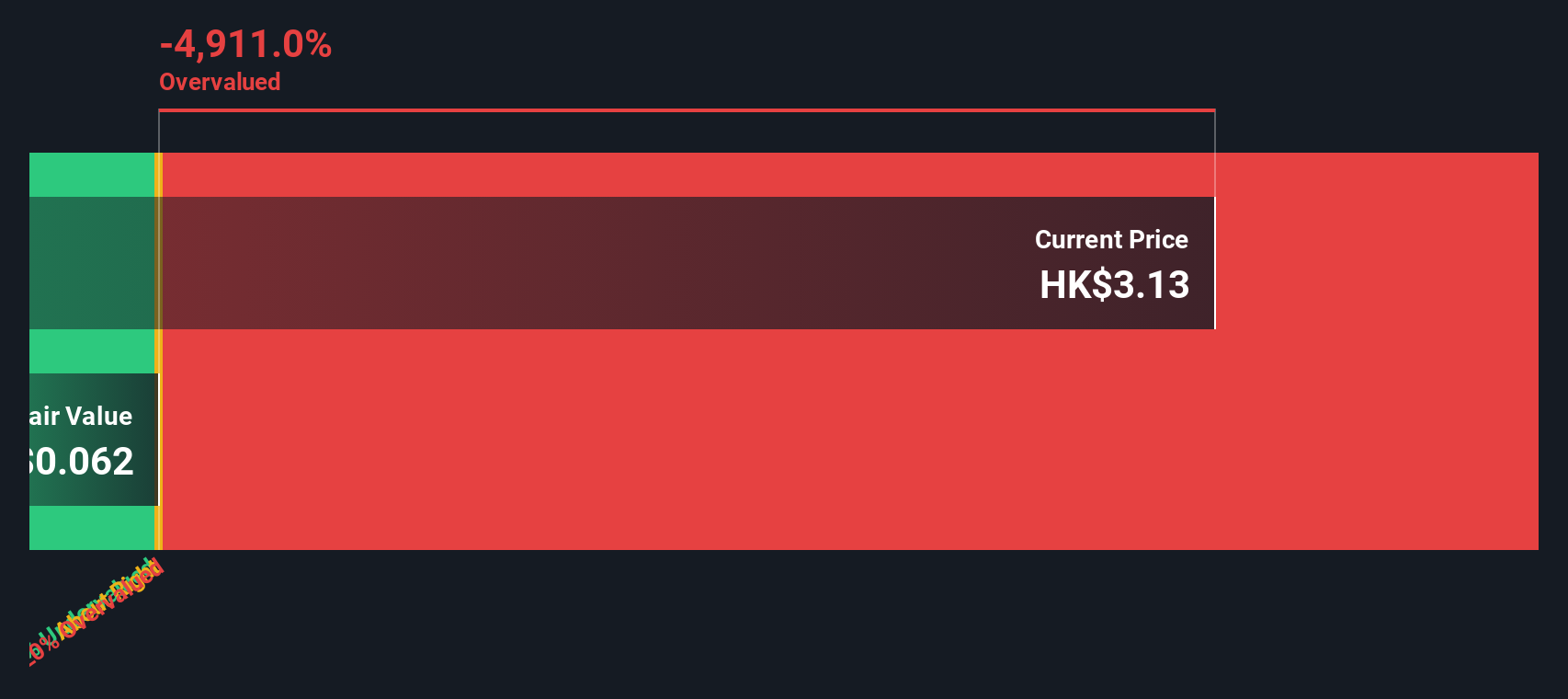

Another View: Discounted Cash Flow Says Shares Are Overvalued

Taking a different angle, the SWS DCF model places Envision Greenwise Holdings’ fair value at just HK$0.06 per share. This is far below its current price of HK$3.32. This method suggests the market may be pricing in much more optimism than the company’s fundamentals currently support. Does this disconnect point to a hidden risk, or is the market seeing value that models cannot?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Envision Greenwise Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 895 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Envision Greenwise Holdings Narrative

If you have a different perspective or want to analyze the numbers firsthand, you can interpret the data yourself and develop your own narrative in just a few minutes. Do it your way

A great starting point for your Envision Greenwise Holdings research is our analysis highlighting 1 important warning sign that could impact your investment decision.

Ready for Your Next Big Opportunity?

Don’t let your momentum stop here, as the next standout stock may be just a click away. Streamline your search and gain an investing edge by using these powerful tools:

- Target value-packed opportunities and pinpoint excellent prospects with these 895 undervalued stocks based on cash flows to see which stocks offer strong upside potential based on their cash flow fundamentals.

- Benefit from reliable income and stability, and spot top picks via these 15 dividend stocks with yields > 3% for companies consistently delivering yields above 3%.

- Get ahead of market shifts by checking out these 27 AI penny stocks for breakthrough innovators capitalizing on artificial intelligence trends in today's most dynamic sectors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Envision Greenwise Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1783

Envision Greenwise Holdings

An investment holding company, operates in the construction business in Hong Kong and the People’s Republic of China.

Adequate balance sheet with minimal risk.

Market Insights

Community Narratives