- Hong Kong

- /

- Trade Distributors

- /

- SEHK:1733

C.banner International Holdings And 2 Other Promising Penny Stocks To Consider

Reviewed by Simply Wall St

Amid a busy week of earnings reports and economic data, global markets have shown mixed results, with small-cap stocks holding up better than their larger counterparts. In this context, penny stocks—though a somewhat outdated term—remain an intriguing area for investors seeking growth opportunities in smaller or newer companies. These stocks can offer surprising value when backed by strong financial health and fundamentals, presenting potential upside without the typical risks associated with this segment of the market.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.22 | MYR343.4M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.85 | HK$539.57M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.785 | MYR135.97M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.89 | MYR295.43M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.455 | £356.81M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.53 | MYR761.86M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.60 | A$70.33M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.865 | £384.4M | ★★★★☆☆ |

Click here to see the full list of 5,774 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

C.banner International Holdings (SEHK:1028)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: C.banner International Holdings Limited is an investment holding company that produces, sells, and retails women's formal and casual footwear primarily in the People’s Republic of China and the United States, with a market cap of HK$654.26 million.

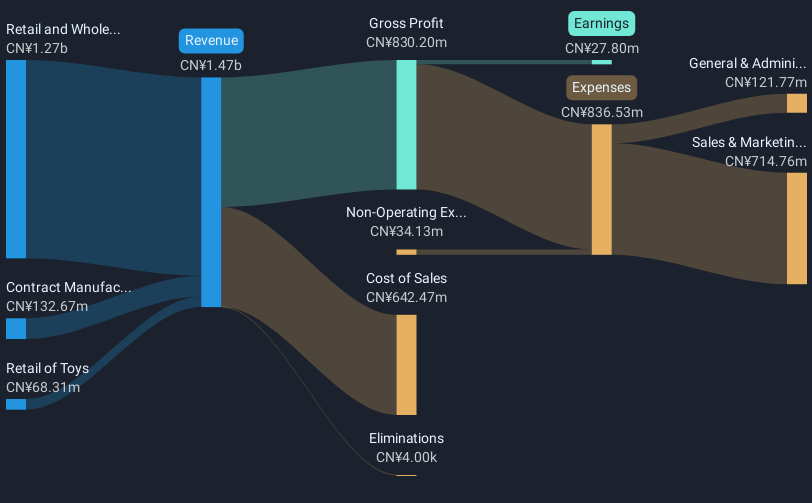

Operations: The company's revenue is primarily derived from the retail and wholesale of shoes (CN¥1.27 billion), followed by contract manufacturing of shoes (CN¥132.67 million) and the retail of toys (CN¥68.31 million).

Market Cap: HK$654.25M

C.banner International Holdings has shown a mixed financial performance recently. The company reported sales of CN¥720.64 million for the first half of 2024, down from CN¥787.91 million a year prior, but net income rose to CN¥52.41 million from CN¥45.44 million. Despite having no debt and strong short-term asset coverage (CN¥1.4 billion), its return on equity remains low at 2.4%. Profit growth has decelerated with negative earnings growth over the past year, though it achieved profitability over five years with significant earnings expansion annually (65.8%). The management team and board are experienced, providing stability amid moderate volatility (7%).

- Click here and access our complete financial health analysis report to understand the dynamics of C.banner International Holdings.

- Gain insights into C.banner International Holdings' past trends and performance with our report on the company's historical track record.

E-Commodities Holdings (SEHK:1733)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: E-Commodities Holdings Limited, along with its subsidiaries, is involved in the processing and trading of coal and other products, with a market capitalization of approximately HK$3.94 billion.

Operations: The company generates revenue from two main segments: HK$6.34 billion from rendering integrated supply chain services and HK$36.57 billion from the processing and trading of coal and other products.

Market Cap: HK$3.94B

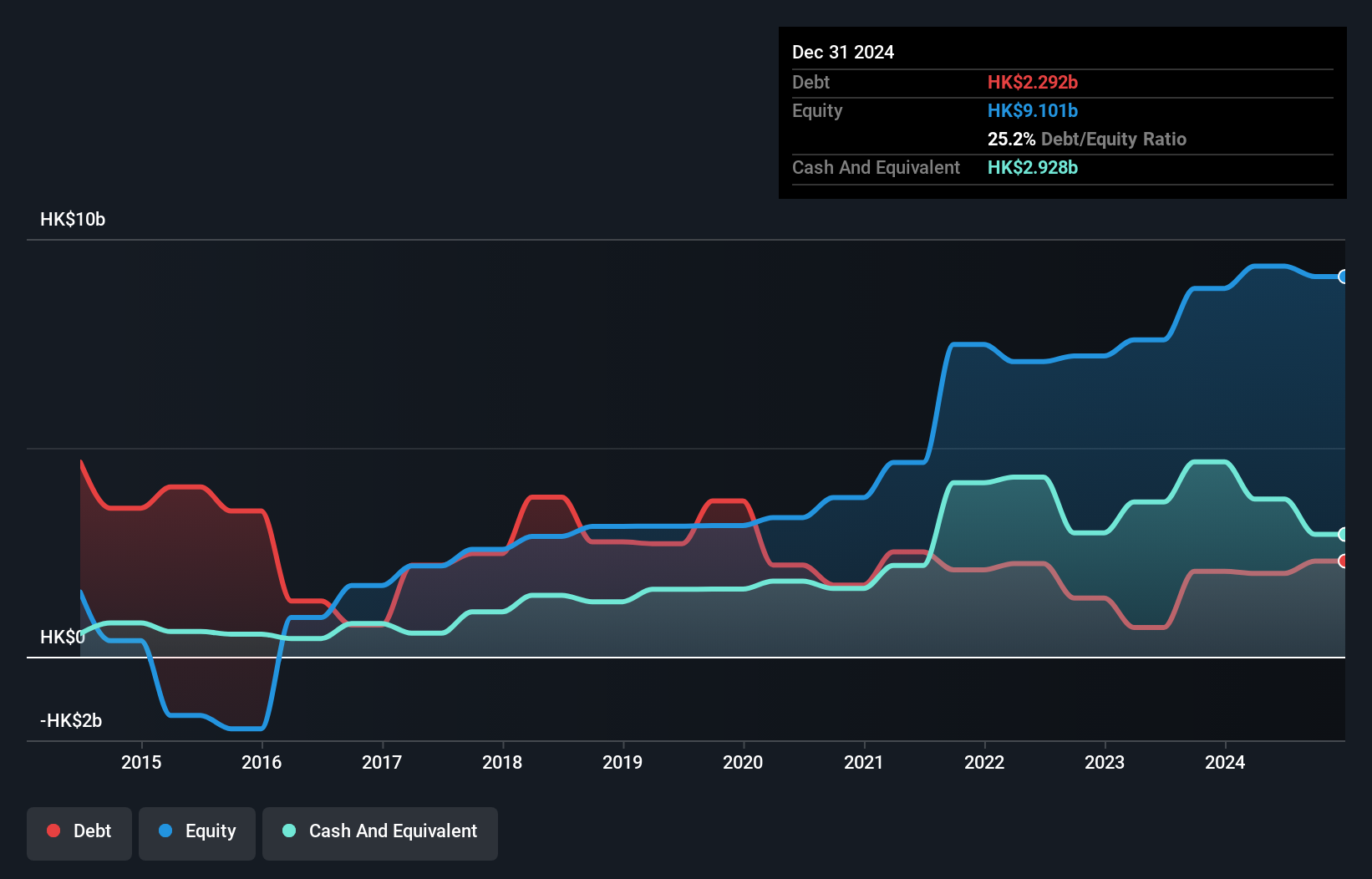

E-Commodities Holdings Limited's financial position indicates both strengths and challenges. The company reported HK$19.85 billion in sales for the first half of 2024, a slight increase from the previous year, though net income decreased to HK$782.86 million. While its short-term assets significantly exceed liabilities, providing solid liquidity, shareholder dilution occurred with shares outstanding growing by 4.8%. The company's dividend yield is high but not well-covered by free cash flows, and profit margins have slightly declined compared to last year. However, E-Commodities benefits from a high return on equity at 22.8% and reduced debt levels over five years.

- Navigate through the intricacies of E-Commodities Holdings with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into E-Commodities Holdings' track record.

Lepu Biopharma (SEHK:2157)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lepu Biopharma Co., Ltd. is a biopharmaceutical company that specializes in the discovery, development, and commercialization of cancer targeted therapy and immunotherapy drugs in China and internationally, with a market cap of HK$5.22 billion.

Operations: Lepu Biopharma generates CN¥205.08 million from its pharmaceutical product sales and new drug research and development activities.

Market Cap: HK$5.22B

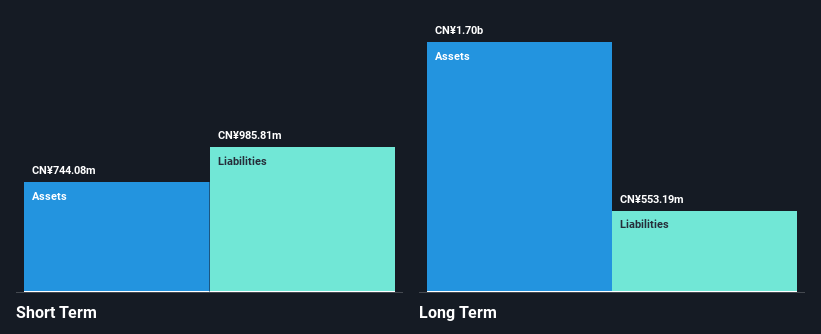

Lepu Biopharma's recent developments highlight its focus on advancing cancer therapies, notably receiving priority review for its drug candidate MRG003 from China's regulatory body. Despite a market cap of HK$5.22 billion, the company faces financial hurdles with increasing net losses and shareholder dilution over the past year. Its short-term assets (CN¥744.1M) fall short of covering liabilities (CN¥985.8M), yet it maintains a satisfactory net debt to equity ratio of 15.9%. While unprofitable, Lepu has reduced losses by 27.6% annually over five years and forecasts significant revenue growth at 65.6% per year, indicating potential for future improvement.

- Click here to discover the nuances of Lepu Biopharma with our detailed analytical financial health report.

- Gain insights into Lepu Biopharma's outlook and expected performance with our report on the company's earnings estimates.

Make It Happen

- Discover the full array of 5,774 Penny Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if E-Commodities Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1733

E-Commodities Holdings

Engages in the processing and trading of coal and other products.

Flawless balance sheet and good value.