Should Strong Earnings and Leadership Change Prompt Action From Precision Tsugami (China) (SEHK:1651) Investors?

Reviewed by Sasha Jovanovic

- Precision Tsugami (China) recently announced strong half-year results, with sales rising to CNY 2,496.9 million and net income climbing to CNY 502.25 million, alongside declaring an interim dividend of HKD 0.6 per share for the six months ended September 30, 2025.

- The company also underwent major leadership changes, appointing Dr. Wang Xiaokun as Chairman and CEO and introducing a new CFO, marking a significant management transition.

- We’ll examine how the combination of robust earnings and sweeping executive appointments shapes Precision Tsugami (China)'s investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Precision Tsugami (China)'s Investment Narrative?

For those considering Precision Tsugami (China), the investment story combines rapid earnings growth, competitive valuations, and a history of outperformance in the Hong Kong machinery sector. The jump in half-year sales and profit offers evidence of operational momentum, while a higher interim dividend may appeal to those focused on income. However, the major leadership overhaul, with a new CEO and CFO, introduces an element of short-term uncertainty even as outgoing leaders remain close in advisory roles. This shift could impact the company's near-term catalysts, especially around execution of growth strategies, though the mix of fresh leadership and board experience may help shore up stability. Given recent share price moves and sector trends, these management changes are significant enough to warrant attention, possibly altering risk exposures and the path to realizing forecasted growth. On the other hand, board independence remains a concern investors should keep in mind.

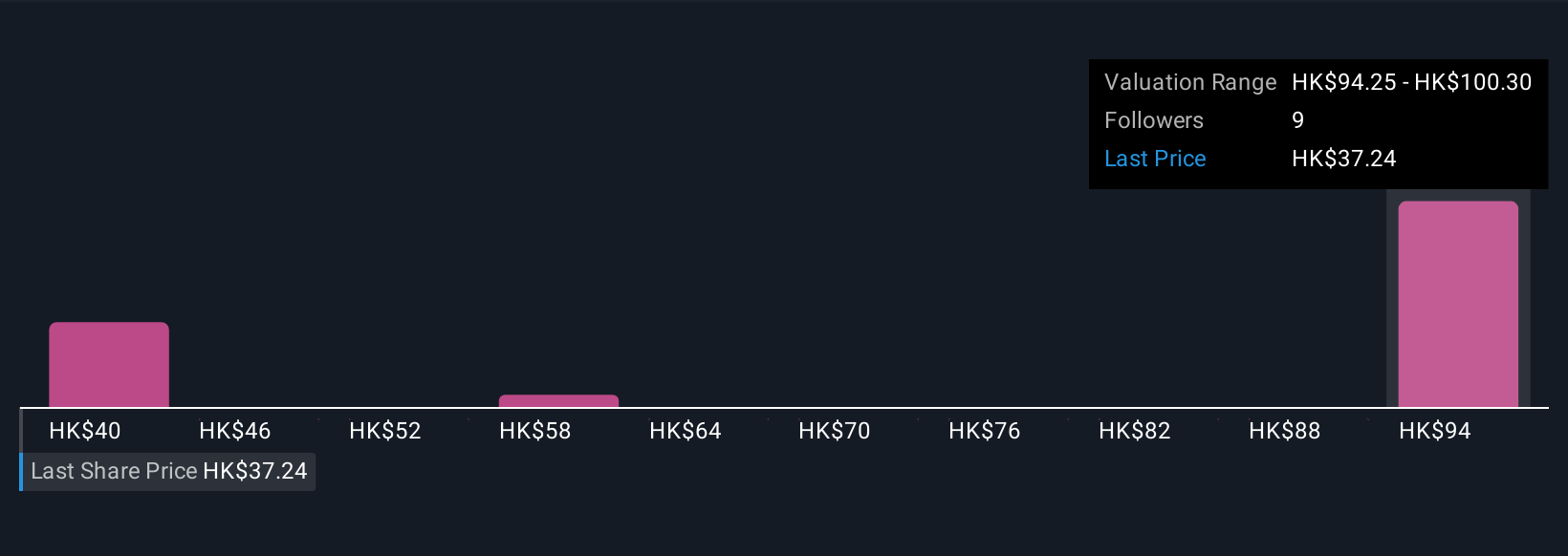

Despite retreating, Precision Tsugami (China)'s shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 3 other fair value estimates on Precision Tsugami (China) - why the stock might be worth over 3x more than the current price!

Build Your Own Precision Tsugami (China) Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Precision Tsugami (China) research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Precision Tsugami (China) research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Precision Tsugami (China)'s overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1651

Precision Tsugami (China)

An investment holding company, manufactures and sells computer numerical control machine tools primarily in Mainland China.

Outstanding track record and undervalued.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success