- Hong Kong

- /

- Construction

- /

- SEHK:1618

Metallurgical Corporation of China Ltd. (HKG:1618) Soars 29% But It's A Story Of Risk Vs Reward

Metallurgical Corporation of China Ltd. (HKG:1618) shareholders would be excited to see that the share price has had a great month, posting a 29% gain and recovering from prior weakness. Looking further back, the 10% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

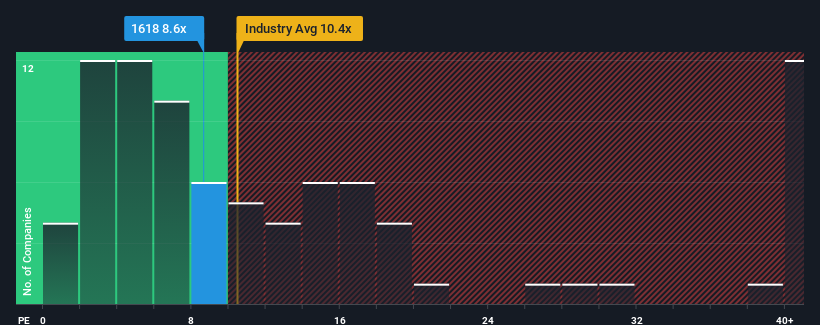

Even after such a large jump in price, there still wouldn't be many who think Metallurgical Corporation of China's price-to-earnings (or "P/E") ratio of 8.6x is worth a mention when the median P/E in Hong Kong is similar at about 10x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

While the market has experienced earnings growth lately, Metallurgical Corporation of China's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

See our latest analysis for Metallurgical Corporation of China

Does Growth Match The P/E?

In order to justify its P/E ratio, Metallurgical Corporation of China would need to produce growth that's similar to the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 62%. As a result, earnings from three years ago have also fallen 54% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 20% each year as estimated by the seven analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 12% per annum, which is noticeably less attractive.

With this information, we find it interesting that Metallurgical Corporation of China is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Metallurgical Corporation of China appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Metallurgical Corporation of China's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

You should always think about risks. Case in point, we've spotted 2 warning signs for Metallurgical Corporation of China you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1618

Metallurgical Corporation of China

Engages in the engineering contracting, resource development, specialty businesses, integrated real estate, and other businesses in China.

Good value with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives