These 4 Measures Indicate That Zhejiang Tengy Environmental Technology (HKG:1527) Is Using Debt Safely

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Zhejiang Tengy Environmental Technology Co., Ltd (HKG:1527) does carry debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Zhejiang Tengy Environmental Technology

How Much Debt Does Zhejiang Tengy Environmental Technology Carry?

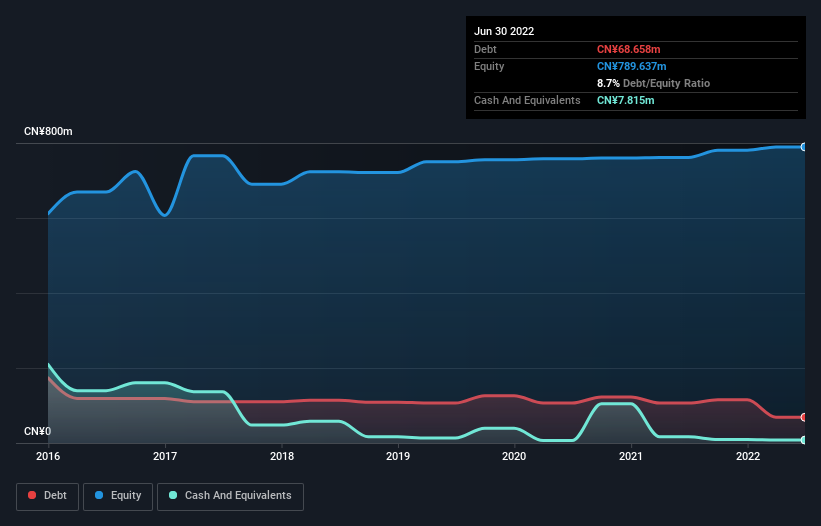

As you can see below, Zhejiang Tengy Environmental Technology had CN¥68.7m of debt at June 2022, down from CN¥106.7m a year prior. However, it also had CN¥7.82m in cash, and so its net debt is CN¥60.8m.

A Look At Zhejiang Tengy Environmental Technology's Liabilities

According to the balance sheet data, Zhejiang Tengy Environmental Technology had liabilities of CN¥702.6m due within 12 months, but no longer term liabilities. On the other hand, it had cash of CN¥7.82m and CN¥813.7m worth of receivables due within a year. So it actually has CN¥118.9m more liquid assets than total liabilities.

This surplus strongly suggests that Zhejiang Tengy Environmental Technology has a rock-solid balance sheet (and the debt is of no concern whatsoever). Having regard to this fact, we think its balance sheet is as strong as an ox.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Zhejiang Tengy Environmental Technology has net debt of just 1.1 times EBITDA, indicating that it is certainly not a reckless borrower. And this view is supported by the solid interest coverage, with EBIT coming in at 8.9 times the interest expense over the last year. Although Zhejiang Tengy Environmental Technology made a loss at the EBIT level, last year, it was also good to see that it generated CN¥53m in EBIT over the last twelve months. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Zhejiang Tengy Environmental Technology will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. Happily for any shareholders, Zhejiang Tengy Environmental Technology actually produced more free cash flow than EBIT over the last year. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

The good news is that Zhejiang Tengy Environmental Technology's demonstrated ability to convert EBIT to free cash flow delights us like a fluffy puppy does a toddler. And that's just the beginning of the good news since its level of total liabilities is also very heartening. We think Zhejiang Tengy Environmental Technology is no more beholden to its lenders, than the birds are to birdwatchers. For investing nerds like us its balance sheet is almost charming. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 3 warning signs for Zhejiang Tengy Environmental Technology you should be aware of, and 1 of them shouldn't be ignored.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Tengy Environmental Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1527

Zhejiang Tengy Environmental Technology

Designs, develops, manufactures, installs, and sells environmental pollution prevention equipment and electronic products in Mainland China and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives