- Hong Kong

- /

- Industrials

- /

- SEHK:138

Investors bid CCT Fortis Holdings (HKG:138) up HK$45m despite increasing losses YoY, taking one-year return to 93%

It hasn't been the best quarter for CCT Fortis Holdings Limited (HKG:138) shareholders, since the share price has fallen 21% in that time. But that doesn't change the reality that over twelve months the stock has done really well. To wit, it had solidly beat the market, up 93%.

Since it's been a strong week for CCT Fortis Holdings shareholders, let's have a look at trend of the longer term fundamentals.

Check out our latest analysis for CCT Fortis Holdings

CCT Fortis Holdings wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over the last twelve months, CCT Fortis Holdings' revenue grew by 2.0%. That's not a very high growth rate considering it doesn't make profits. The modest growth is probably largely reflected in the share price, which is up 93%. While not a huge gain tht seems pretty reasonable. It could be worth keeping an eye on this one, especially if growth accelerates.

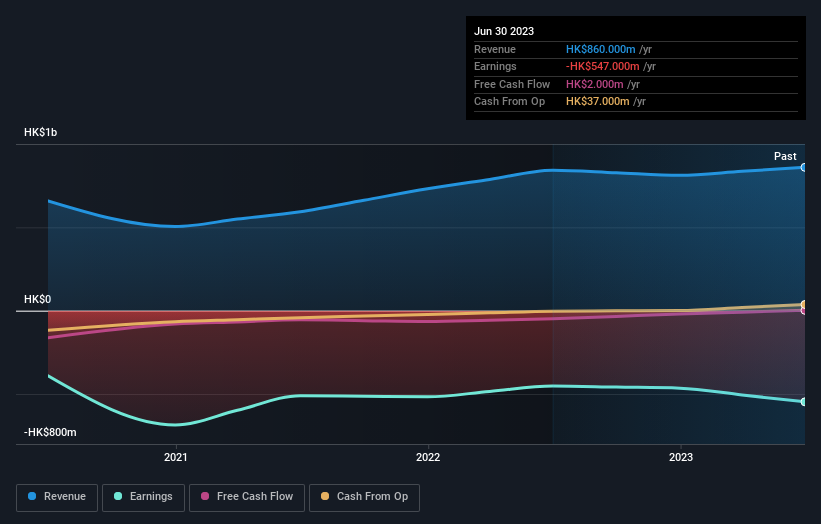

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

We're pleased to report that CCT Fortis Holdings shareholders have received a total shareholder return of 93% over one year. Notably the five-year annualised TSR loss of 10% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 3 warning signs for CCT Fortis Holdings you should be aware of, and 2 of them shouldn't be ignored.

Of course CCT Fortis Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:138

CCT Fortis Holdings

An investment holding company, engages in the property, automotive, securities, cultural entertainment, and other businesses in Mainland China, Hong Kong, Macau, and internationally.

Mediocre balance sheet low.