- Hong Kong

- /

- Trade Distributors

- /

- SEHK:1231

Newton Resources Ltd's (HKG:1231) Shares Climb 31% But Its Business Is Yet to Catch Up

Newton Resources Ltd (HKG:1231) shareholders are no doubt pleased to see that the share price has bounced 31% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 25% in the last twelve months.

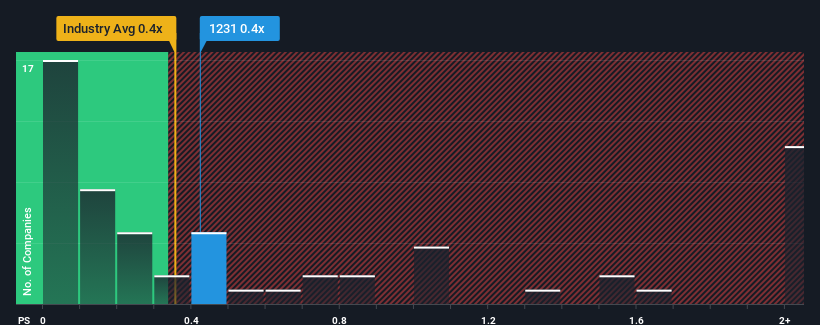

In spite of the firm bounce in price, there still wouldn't be many who think Newton Resources' price-to-sales (or "P/S") ratio of 0.4x is worth a mention when it essentially matches the median P/S in Hong Kong's Trade Distributors industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Newton Resources

What Does Newton Resources' P/S Mean For Shareholders?

With revenue growth that's exceedingly strong of late, Newton Resources has been doing very well. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. Those who are bullish on Newton Resources will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Newton Resources, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Newton Resources' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 57%. However, this wasn't enough as the latest three year period has seen the company endure a nasty 12% drop in revenue in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 25% shows it's an unpleasant look.

With this information, we find it concerning that Newton Resources is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

The Final Word

Newton Resources' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We find it unexpected that Newton Resources trades at a P/S ratio that is comparable to the rest of the industry, despite experiencing declining revenues during the medium-term, while the industry as a whole is expected to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Newton Resources with six simple checks on some of these key factors.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Newton Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1231

Newton Resources

An investment holding company, engages in identification and exploration of sourcing and supply of iron ores and other commodities in Mainland China and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives