Stock Analysis

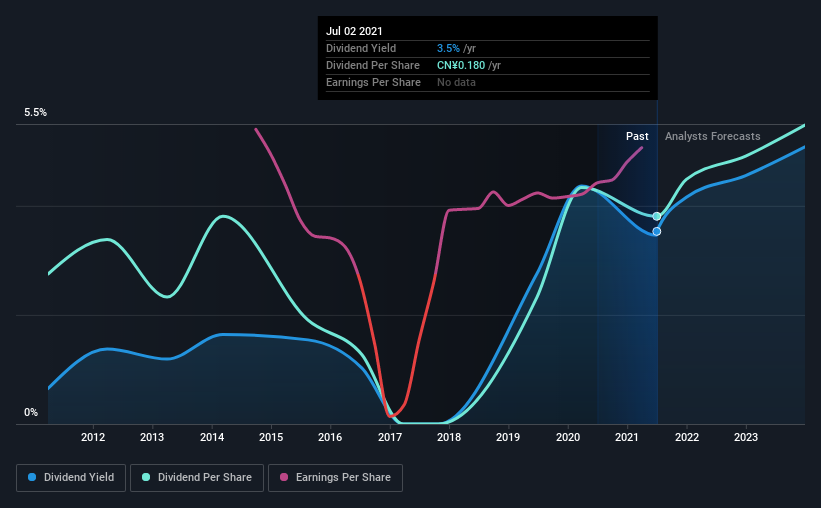

Dongfang Electric Corporation Limited (HKG:1072) is reducing its dividend to HK$0.22 on the 25th of August. However, the dividend yield of 3.5% still remains in a typical range for the industry.

Check out our latest analysis for Dongfang Electric

Dongfang Electric's Earnings Easily Cover the Distributions

We aren't too impressed by dividend yields unless they can be sustained over time. Based on the last payment, Dongfang Electric was earning enough to cover the dividend, but free cash flows weren't positive. With the company not bringing in any cash, paying out to shareholders is bound to become difficult at some point.

Looking forward, earnings per share is forecast to rise by 5.7% over the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 34%, which is in the range that makes us comfortable with the sustainability of the dividend.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The first annual payment during the last 10 years was CN¥0.13 in 2011, and the most recent fiscal year payment was CN¥0.18. This means that it has been growing its distributions at 3.3% per annum over that time. We're glad to see the dividend has risen, but with a limited rate of growth and fluctuations in the payments the total shareholder return may be limited.

The Dividend Looks Likely To Grow

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Dongfang Electric has impressed us by growing EPS at 36% per year over the past five years. Rapid earnings growth and a low payout ratio suggest this company has been effectively reinvesting in its business. Should that continue, this company could have a bright future.

Our Thoughts On Dongfang Electric's Dividend

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. While the low payout ratio is redeeming feature, this is offset by the minimal cash to cover the payments. This company is not in the top tier of income providing stocks.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Case in point: We've spotted 2 warning signs for Dongfang Electric (of which 1 is concerning!) you should know about. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Dongfang Electric is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1072

Dongfang Electric

Engages in the design, develop, manufacture, and sale of power generation equipment in China and internationally.

Proven track record with adequate balance sheet.