V.S. International Group (HKG:1002) Has Some Difficulty Using Its Capital Effectively

If we're looking to avoid a business that is in decline, what are the trends that can warn us ahead of time? More often than not, we'll see a declining return on capital employed (ROCE) and a declining amount of capital employed. This indicates to us that the business is not only shrinking the size of its net assets, but its returns are falling as well. Having said that, after a brief look, V.S. International Group (HKG:1002) we aren't filled with optimism, but let's investigate further.

Return On Capital Employed (ROCE): What is it?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on V.S. International Group is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.021 = CN¥8.3m ÷ (CN¥520m - CN¥132m) (Based on the trailing twelve months to January 2021).

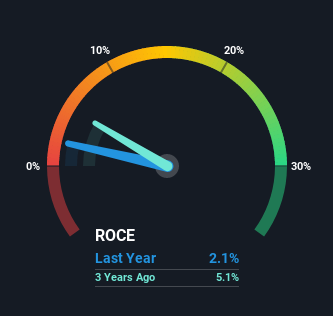

Therefore, V.S. International Group has an ROCE of 2.1%. Ultimately, that's a low return and it under-performs the Machinery industry average of 9.1%.

See our latest analysis for V.S. International Group

Historical performance is a great place to start when researching a stock so above you can see the gauge for V.S. International Group's ROCE against it's prior returns. If you want to delve into the historical earnings, revenue and cash flow of V.S. International Group, check out these free graphs here.

How Are Returns Trending?

The trend of ROCE at V.S. International Group is showing some signs of weakness. To be more specific, today's ROCE was 2.9% five years ago but has since fallen to 2.1%. On top of that, the business is utilizing 27% less capital within its operations. When you see both ROCE and capital employed diminishing, it can often be a sign of a mature and shrinking business that might be in structural decline. If these underlying trends continue, we wouldn't be too optimistic going forward.

On a side note, V.S. International Group has done well to pay down its current liabilities to 25% of total assets. So we could link some of this to the decrease in ROCE. Effectively this means their suppliers or short-term creditors are funding less of the business, which reduces some elements of risk. Some would claim this reduces the business' efficiency at generating ROCE since it is now funding more of the operations with its own money.

What We Can Learn From V.S. International Group's ROCE

To see V.S. International Group reducing the capital employed in the business in tandem with diminishing returns, is concerning. Long term shareholders who've owned the stock over the last five years have experienced a 63% depreciation in their investment, so it appears the market might not like these trends either. Unless there is a shift to a more positive trajectory in these metrics, we would look elsewhere.

On a final note, we found 2 warning signs for V.S. International Group (1 is potentially serious) you should be aware of.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1002

V.S. International Group

An investment holding company, manufactures, assembles, and sells plastic molded products and parts in the People’s Republic of China, Hong Kong, Southeast Asia, Europe, and the United States.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives