- Hong Kong

- /

- Industrials

- /

- SEHK:1

These 4 Measures Indicate That CK Hutchison Holdings (HKG:1) Is Using Debt Extensively

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that CK Hutchison Holdings Limited (HKG:1) does use debt in its business. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for CK Hutchison Holdings

What Is CK Hutchison Holdings's Net Debt?

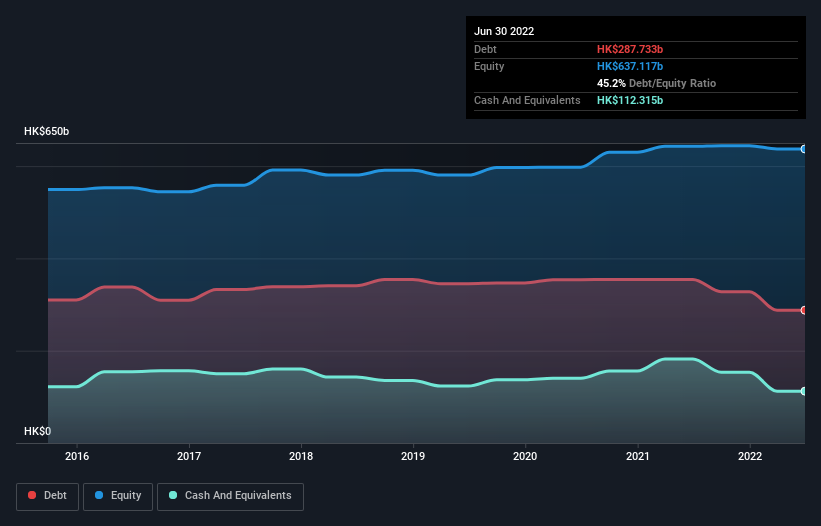

The image below, which you can click on for greater detail, shows that CK Hutchison Holdings had debt of HK$287.7b at the end of June 2022, a reduction from HK$354.4b over a year. However, because it has a cash reserve of HK$112.3b, its net debt is less, at about HK$175.4b.

A Look At CK Hutchison Holdings' Liabilities

We can see from the most recent balance sheet that CK Hutchison Holdings had liabilities of HK$151.5b falling due within a year, and liabilities of HK$349.2b due beyond that. Offsetting this, it had HK$112.3b in cash and HK$54.9b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by HK$333.5b.

The deficiency here weighs heavily on the HK$200.2b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. After all, CK Hutchison Holdings would likely require a major re-capitalisation if it had to pay its creditors today.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

CK Hutchison Holdings has a debt to EBITDA ratio of 2.5 and its EBIT covered its interest expense 5.0 times. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. Importantly, CK Hutchison Holdings grew its EBIT by 35% over the last twelve months, and that growth will make it easier to handle its debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if CK Hutchison Holdings can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the most recent three years, CK Hutchison Holdings recorded free cash flow worth 74% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

We feel some trepidation about CK Hutchison Holdings's difficulty level of total liabilities, but we've got positives to focus on, too. To wit both its EBIT growth rate and conversion of EBIT to free cash flow were encouraging signs. Looking at all the angles mentioned above, it does seem to us that CK Hutchison Holdings is a somewhat risky investment as a result of its debt. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 2 warning signs with CK Hutchison Holdings , and understanding them should be part of your investment process.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1

CK Hutchison Holdings

An investment holding company, primarily operates in ports and related services, retail, infrastructure, and telecommunications businesses in Hong Kong and internationally.

Very undervalued with mediocre balance sheet.