Should You Be Adding China CITIC Bank (HKG:998) To Your Watchlist Today?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like China CITIC Bank (HKG:998). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for China CITIC Bank

How Quickly Is China CITIC Bank Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. Over the last three years, China CITIC Bank has grown EPS by 13% per year. That's a good rate of growth, if it can be sustained.

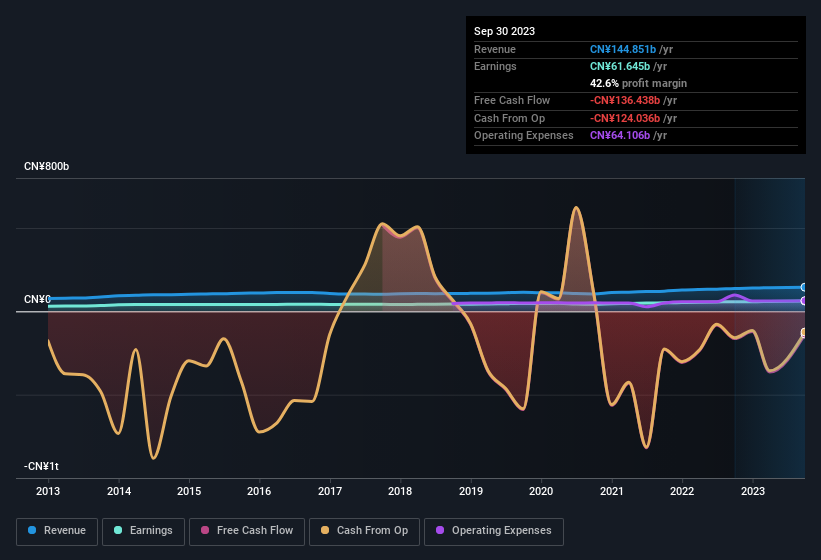

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Not all of China CITIC Bank's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. EBIT margins for China CITIC Bank remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 5.4% to CN¥145b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for China CITIC Bank's future profits.

Are China CITIC Bank Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's good to see China CITIC Bank insiders walking the walk, by spending CN¥2.0m on shares in just twelve months. And when you consider that there was no insider selling, you can understand why shareholders might believe that there are brighter days ahead. It is also worth noting that it was company insider Danghuai Guo who made the biggest single purchase, worth HK$2.0m, paying HK$3.72 per share.

It's reassuring that China CITIC Bank insiders are buying the stock, but that's not the only reason to think management are fair to shareholders. Namely, China CITIC Bank has a very reasonable level of CEO pay. Our analysis has discovered that the median total compensation for the CEOs of companies like China CITIC Bank, with market caps over CN¥58b, is about CN¥7.2m.

The China CITIC Bank CEO received total compensation of just CN¥2.0m in the year to December 2022. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Should You Add China CITIC Bank To Your Watchlist?

As previously touched on, China CITIC Bank is a growing business, which is encouraging. And there's more to China CITIC Bank, with the insider buying and modest CEO pay being a great look for those with an eye on the company. The sum of all that, points to a quality business, and a genuine prospect for further research. You still need to take note of risks, for example - China CITIC Bank has 1 warning sign we think you should be aware of.

Keen growth investors love to see insider buying. Thankfully, China CITIC Bank isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:998

China CITIC Bank

Provides various banking products and services in the People’s Republic of China and internationally.

Flawless balance sheet, undervalued and pays a dividend.