Stock Analysis

Exploring Dream International And Two More Hidden Small Cap Treasures

Reviewed by Simply Wall St

As global markets exhibit mixed reactions to economic indicators, the Hong Kong market has shown resilience with small-cap stocks like Dream International gaining attention amid broader market fluctuations. In such a dynamic environment, identifying stocks that demonstrate strong fundamentals and potential for growth becomes particularly crucial for investors looking to capitalize on less visible opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| E-Commodities Holdings | 23.22% | 6.87% | 31.81% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -12.97% | 12.59% | ★★★★★★ |

| China Leon Inspection Holding | 17.06% | 24.06% | 27.08% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| JiaXing Gas Group | 17.72% | 26.04% | 22.07% | ★★★★★☆ |

| Hung Hing Printing Group | 3.97% | -2.51% | 33.57% | ★★★★★☆ |

| Changjiu Holdings | 14.09% | 12.87% | -4.74% | ★★★★★☆ |

| Mulsanne Group Holding | 186.88% | -12.02% | -43.54% | ★★★★☆☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

| Time Interconnect Technology | 212.50% | 27.21% | 15.01% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Dream International (SEHK:1126)

Simply Wall St Value Rating: ★★★★★★

Overview: Dream International Limited is an investment holding company engaged in the design, development, manufacturing, sale, and trade of plush stuffed toys, plastic figures, dolls, die-casting products, and tarpaulin items across various global markets including Hong Kong, North America, Japan, Europe, China, Vietnam and Korea; it has a market capitalization of HK$3.07 billion.

Operations: The company generates its primary revenue from the sale of plush stuffed toys, which brought in HK$2.74 billion, followed by plastic figures at HK$1.93 billion. Its gross profit margin has shown notable growth, reaching 25.12% by the end of the reporting period.

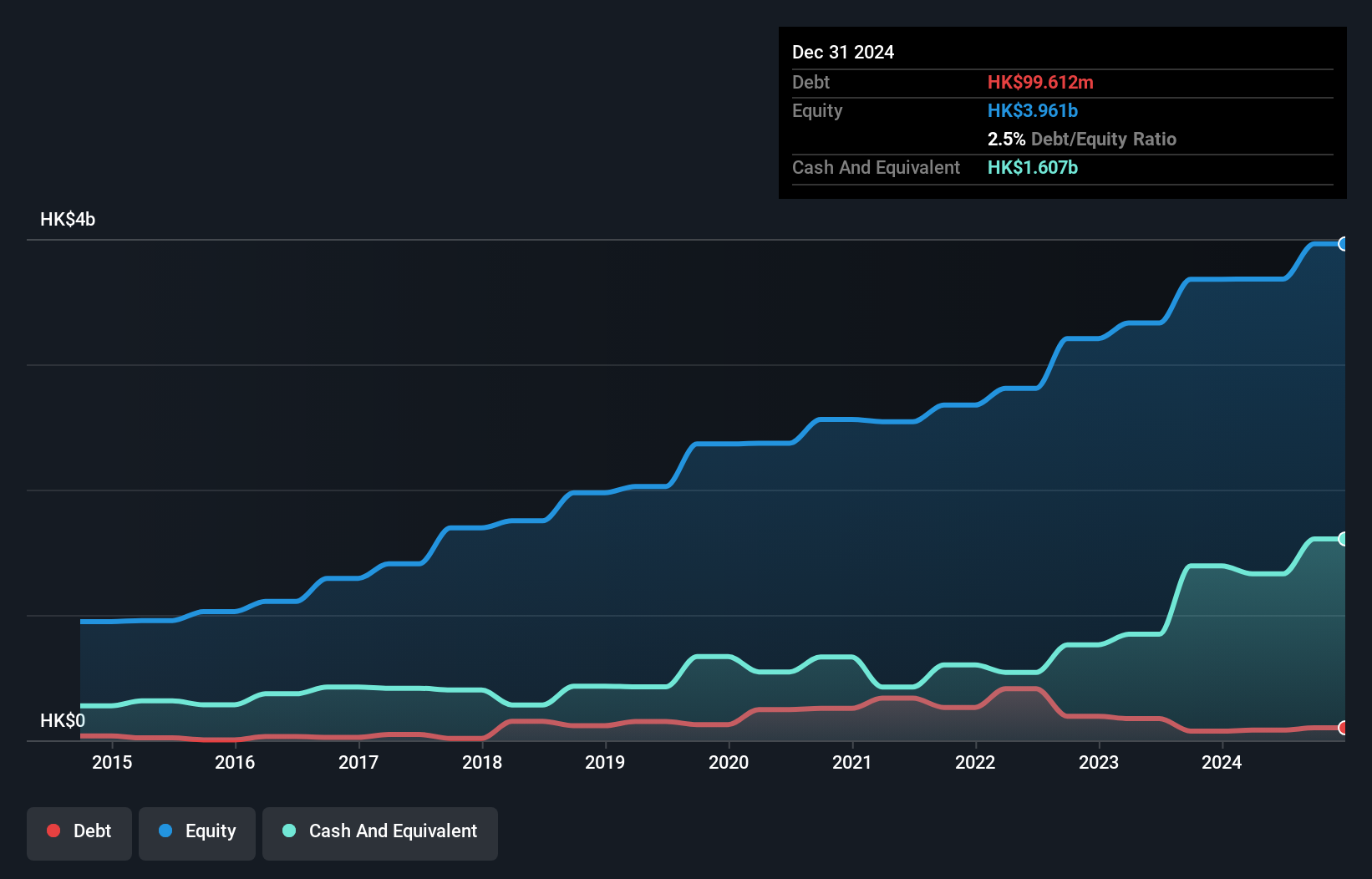

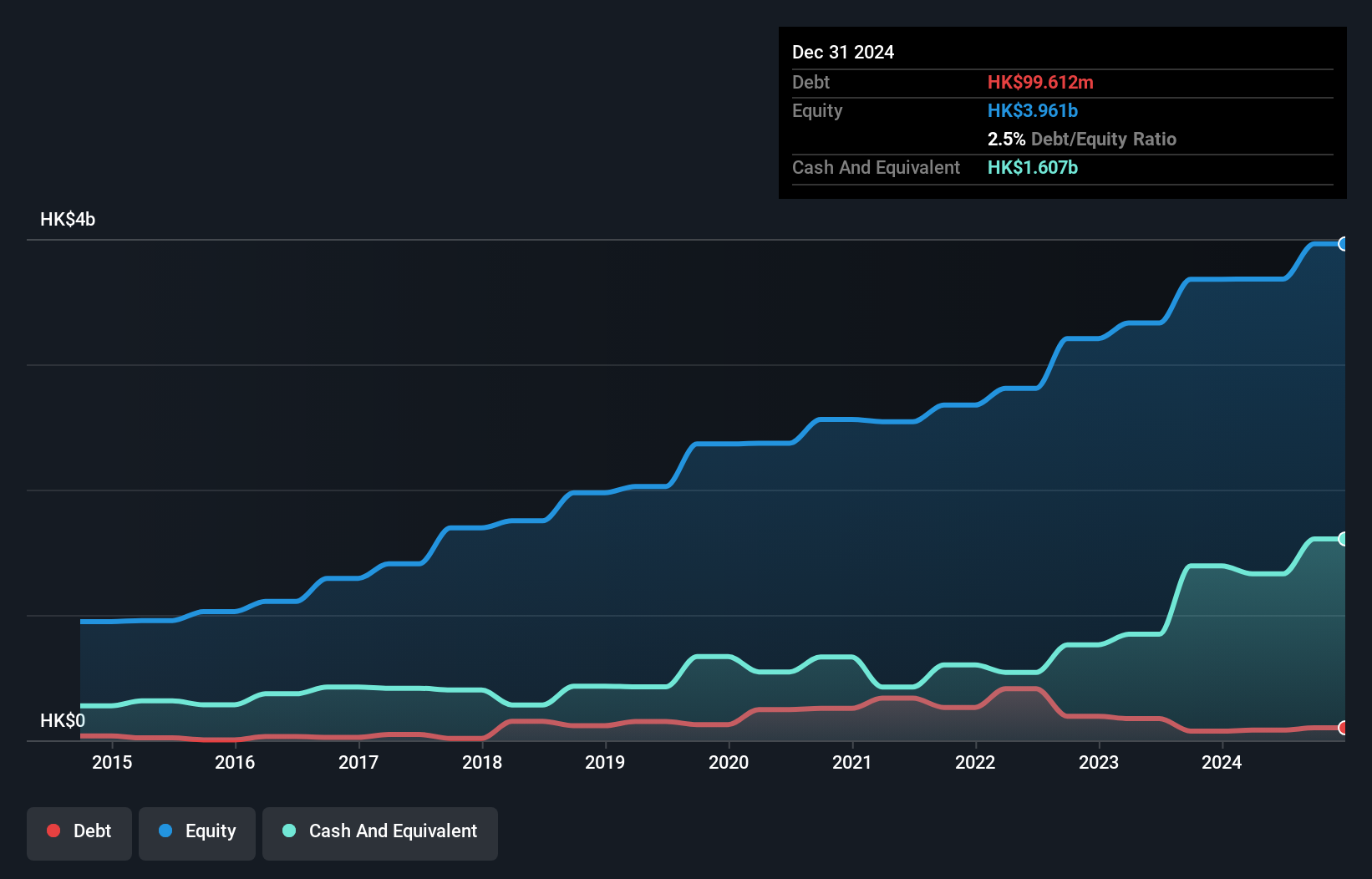

Dream International, a lesser-known Hong Kong entity, is trading at 40.4% below its estimated fair value, signaling potential undervaluation. Over the past five years, earnings have surged by 17.8% annually, although its year-over-year earnings growth of 20.8% lagged behind the leisure industry's 37.8%. The company has effectively managed its financial health by reducing its debt-to-equity ratio from 5.9% to a mere 2%, and it recently boosted shareholder returns by declaring a dividend of HK$0.35 per share in May 2024.

- Take a closer look at Dream International's potential here in our health report.

Assess Dream International's past performance with our detailed historical performance reports.

Dream International (SEHK:1126)

Simply Wall St Value Rating: ★★★★★★

Overview: Dream International Limited is an investment holding company engaged in the design, development, manufacturing, sale, and trade of plush stuffed toys, plastic figures, dolls, die-casting products, and tarpaulin items across various global markets including Hong Kong, North America, Japan, Europe, China, Vietnam and Korea; it has a market capitalization of HK$3.07 billion.

Operations: The company generates its primary revenue from the sale of plush stuffed toys, which brought in HK$2.74 billion, followed by plastic figures at HK$1.93 billion. Its gross profit margin has shown notable growth, reaching 25.12% by the end of the reporting period.

Dream International, a lesser-known Hong Kong entity, is trading at 40.4% below its estimated fair value, signaling potential undervaluation. Over the past five years, earnings have surged by 17.8% annually, although its year-over-year earnings growth of 20.8% lagged behind the leisure industry's 37.8%. The company has effectively managed its financial health by reducing its debt-to-equity ratio from 5.9% to a mere 2%, and it recently boosted shareholder returns by declaring a dividend of HK$0.35 per share in May 2024.

- Take a closer look at Dream International's potential here in our health report.

Assess Dream International's past performance with our detailed historical performance reports.

Tong Ren Tang Technologies (SEHK:1666)

Simply Wall St Value Rating: ★★★★★★

Overview: Tong Ren Tang Technologies Co. Ltd. specializes in the manufacturing and international sale of Chinese medicine products, with a market capitalization of HK$6.53 billion.

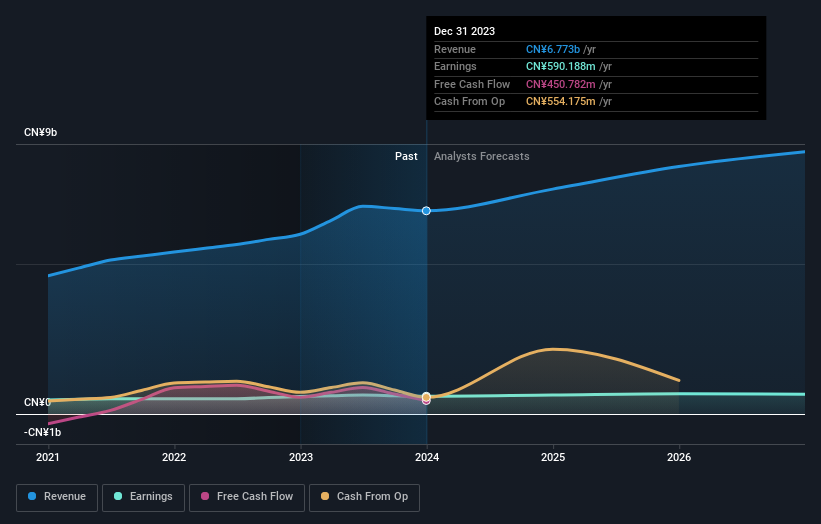

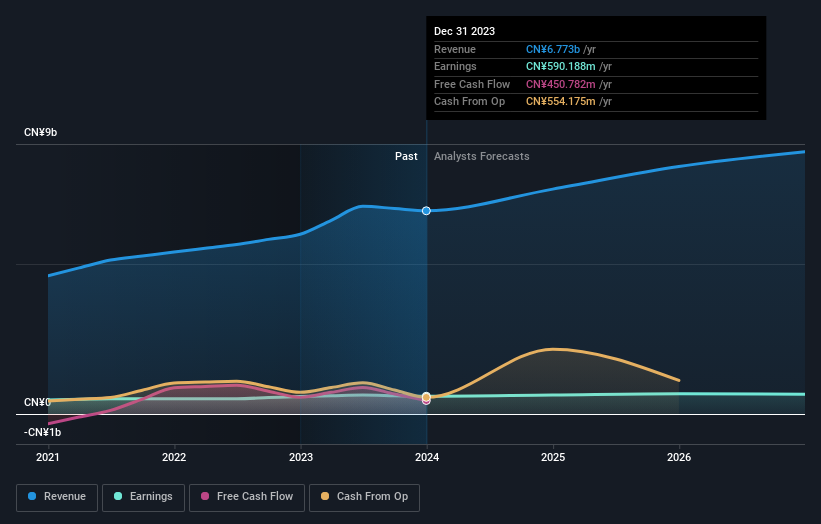

Operations: Tong Ren Tang Technologies primarily generates revenue through the production and sale of traditional Chinese medicine, boasting a gross profit margin of 42.04% as of the latest reporting period in 2024. The company incurs significant costs with a cost of goods sold (COGS) amounting to CN¥3.93 billion in the same period, reflecting its substantial operational scale in pharmaceutical manufacturing.

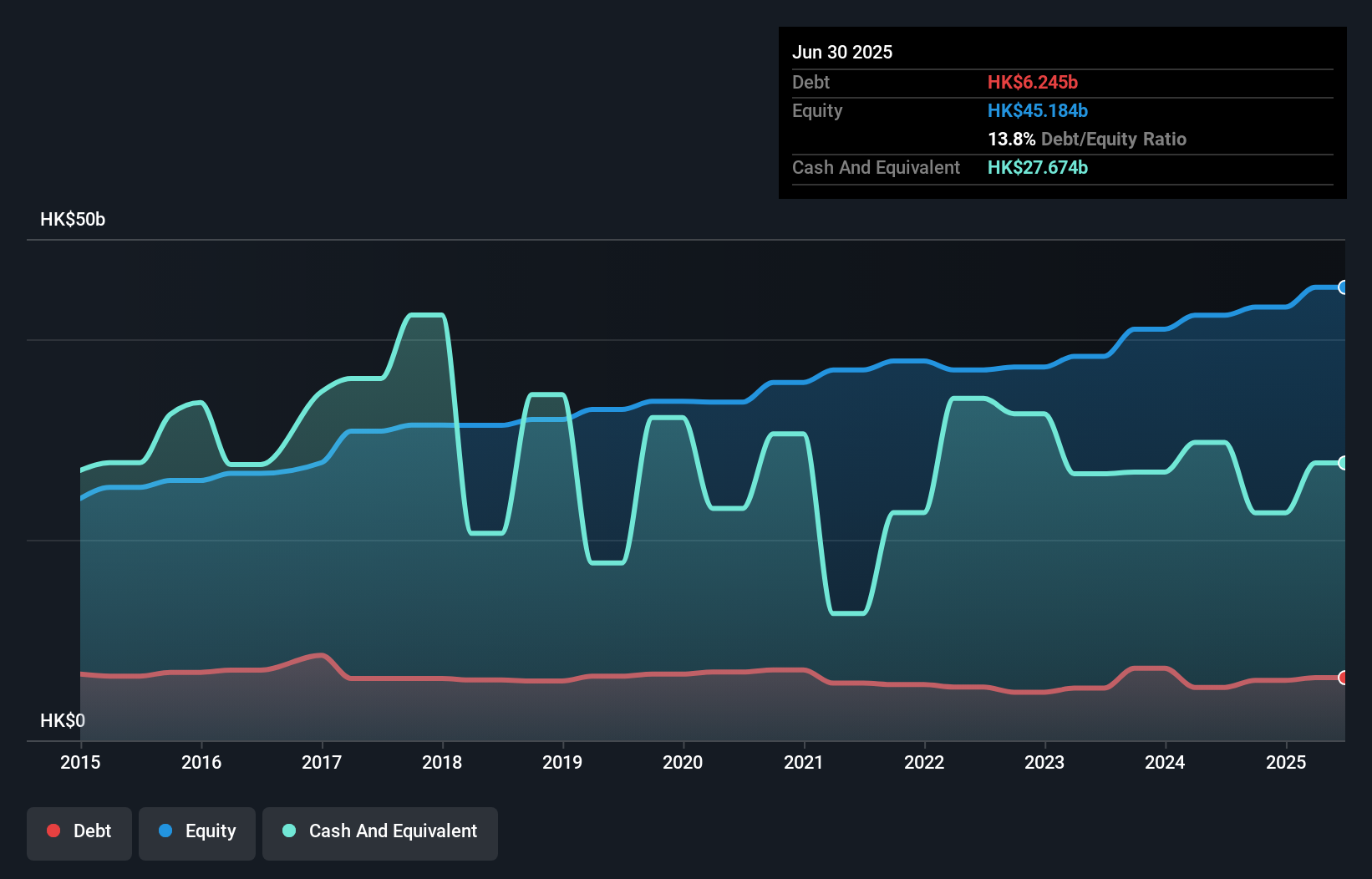

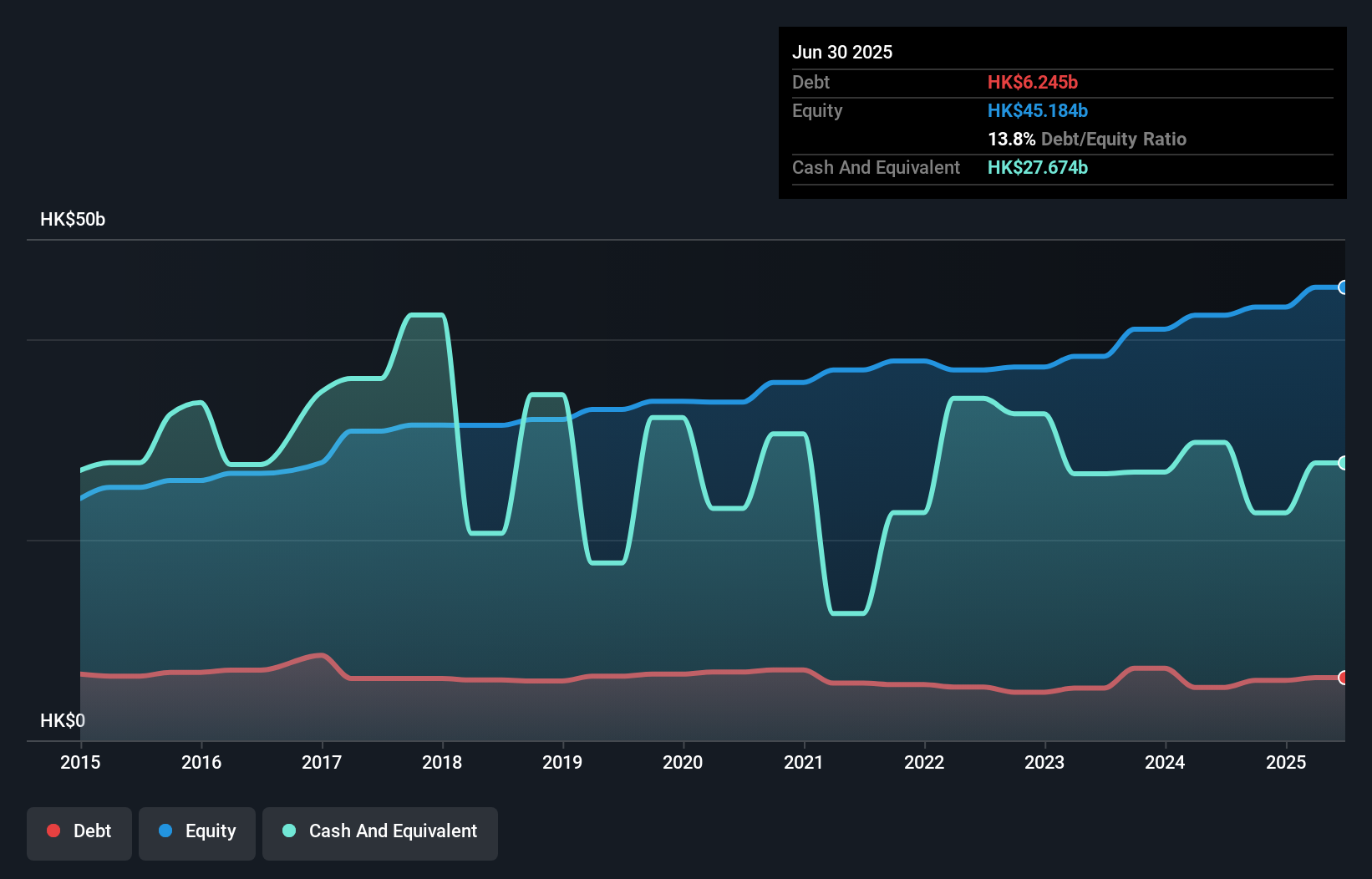

Tong Ren Tang Technologies, a noteworthy player in the pharmaceutical sector, has shown promising financial health with a 1.3% earnings growth surpassing the industry's 5% contraction. With more cash than debt and high-quality earnings, it's positioned for stable growth. Recently, it announced a dividend increase to RMB 0.18 per share and appointed new auditors and directors at its AGM, signaling robust governance and investor confidence as it moves forward.

Tong Ren Tang Technologies (SEHK:1666)

Simply Wall St Value Rating: ★★★★★★

Overview: Tong Ren Tang Technologies Co. Ltd. specializes in the manufacturing and international sale of Chinese medicine products, with a market capitalization of HK$6.53 billion.

Operations: Tong Ren Tang Technologies primarily generates revenue through the production and sale of traditional Chinese medicine, boasting a gross profit margin of 42.04% as of the latest reporting period in 2024. The company incurs significant costs with a cost of goods sold (COGS) amounting to CN¥3.93 billion in the same period, reflecting its substantial operational scale in pharmaceutical manufacturing.

Tong Ren Tang Technologies, a noteworthy player in the pharmaceutical sector, has shown promising financial health with a 1.3% earnings growth surpassing the industry's 5% contraction. With more cash than debt and high-quality earnings, it's positioned for stable growth. Recently, it announced a dividend increase to RMB 0.18 per share and appointed new auditors and directors at its AGM, signaling robust governance and investor confidence as it moves forward.

Dah Sing Financial Holdings (SEHK:440)

Simply Wall St Value Rating: ★★★★★☆

Overview: Dah Sing Financial Holdings Limited operates as an investment holding company, offering a range of banking, insurance, and financial services across Hong Kong, Macau, and the People’s Republic of China, with a market capitalization of approximately HK$6.74 billion.

Operations: Dah Sing Financial Holdings generates its revenue primarily through personal and corporate banking, contributing HK$2.45 billion and HK$1.04 billion respectively, supplemented by treasury and global markets operations at HK$1.13 billion. The company has consistently reported a gross profit margin of 100%, with net income margins showing variability over the observed periods, peaking at 32.08% as of the latest data point in December 2023.

Dah Sing Financial Holdings, with total assets of HK$269.8B and a robust equity base of HK$41.0B, stands out in Hong Kong's financial sector. The company's total deposits reached HK$211.4B while its loan portfolio stood at HK$144.8B, showcasing a well-balanced sheet. Notably, Dah Sing has maintained an appropriate bad loans ratio at 1.9% with a conservative 40% allowance for these loans, underscoring prudent risk management practices amid industry challenges where it outpaced peers with a 30% earnings growth last year compared to the industry’s 1.6%.

Dah Sing Financial Holdings (SEHK:440)

Simply Wall St Value Rating: ★★★★★☆

Overview: Dah Sing Financial Holdings Limited operates as an investment holding company, offering a range of banking, insurance, and financial services across Hong Kong, Macau, and the People’s Republic of China, with a market capitalization of approximately HK$6.74 billion.

Operations: Dah Sing Financial Holdings generates its revenue primarily through personal and corporate banking, contributing HK$2.45 billion and HK$1.04 billion respectively, supplemented by treasury and global markets operations at HK$1.13 billion. The company has consistently reported a gross profit margin of 100%, with net income margins showing variability over the observed periods, peaking at 32.08% as of the latest data point in December 2023.

Dah Sing Financial Holdings, with total assets of HK$269.8B and a robust equity base of HK$41.0B, stands out in Hong Kong's financial sector. The company's total deposits reached HK$211.4B while its loan portfolio stood at HK$144.8B, showcasing a well-balanced sheet. Notably, Dah Sing has maintained an appropriate bad loans ratio at 1.9% with a conservative 40% allowance for these loans, underscoring prudent risk management practices amid industry challenges where it outpaced peers with a 30% earnings growth last year compared to the industry’s 1.6%.

Summing It All Up

- Click this link to deep-dive into the 181 companies within our SEHK Undiscovered Gems With Strong Fundamentals screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Dream International is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1126

Dream International

An investment holding company, designs, develops, manufactures, sells, and trades in plush stuffed toys, plastic figures, dolls, die-casting, and tarpaulin products in Hong Kong, North America, Japan, Europe, the People’s Republic of China, Vietnam, Korea, and internationally.

Flawless balance sheet with solid track record and pays a dividend.