Stock Analysis

- Hong Kong

- /

- Hospitality

- /

- SEHK:3690

SEHK Growth Companies With High Insider Ownership In July 2024

Reviewed by Simply Wall St

As global markets experience fluctuations, the Hong Kong stock market remains a focal point for investors looking for growth opportunities. In this context, companies with high insider ownership can be particularly intriguing, as they often signal strong confidence from those closest to the business in its future prospects.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

| Name | Insider Ownership | Earnings Growth |

| iDreamSky Technology Holdings (SEHK:1119) | 20.2% | 104.1% |

| Fenbi (SEHK:2469) | 32.8% | 43% |

| Tian Tu Capital (SEHK:1973) | 34% | 70.5% |

| Adicon Holdings (SEHK:9860) | 22.4% | 28.3% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 73.4% |

| DPC Dash (SEHK:1405) | 38.2% | 90.2% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.7% | 79.3% |

| Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 100.1% |

| Beijing Airdoc Technology (SEHK:2251) | 28.7% | 83.9% |

| Ocumension Therapeutics (SEHK:1477) | 23.1% | 93.7% |

Here's a peek at a few of the choices from the screener.

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315)

Simply Wall St Growth Rating: ★★★★★☆

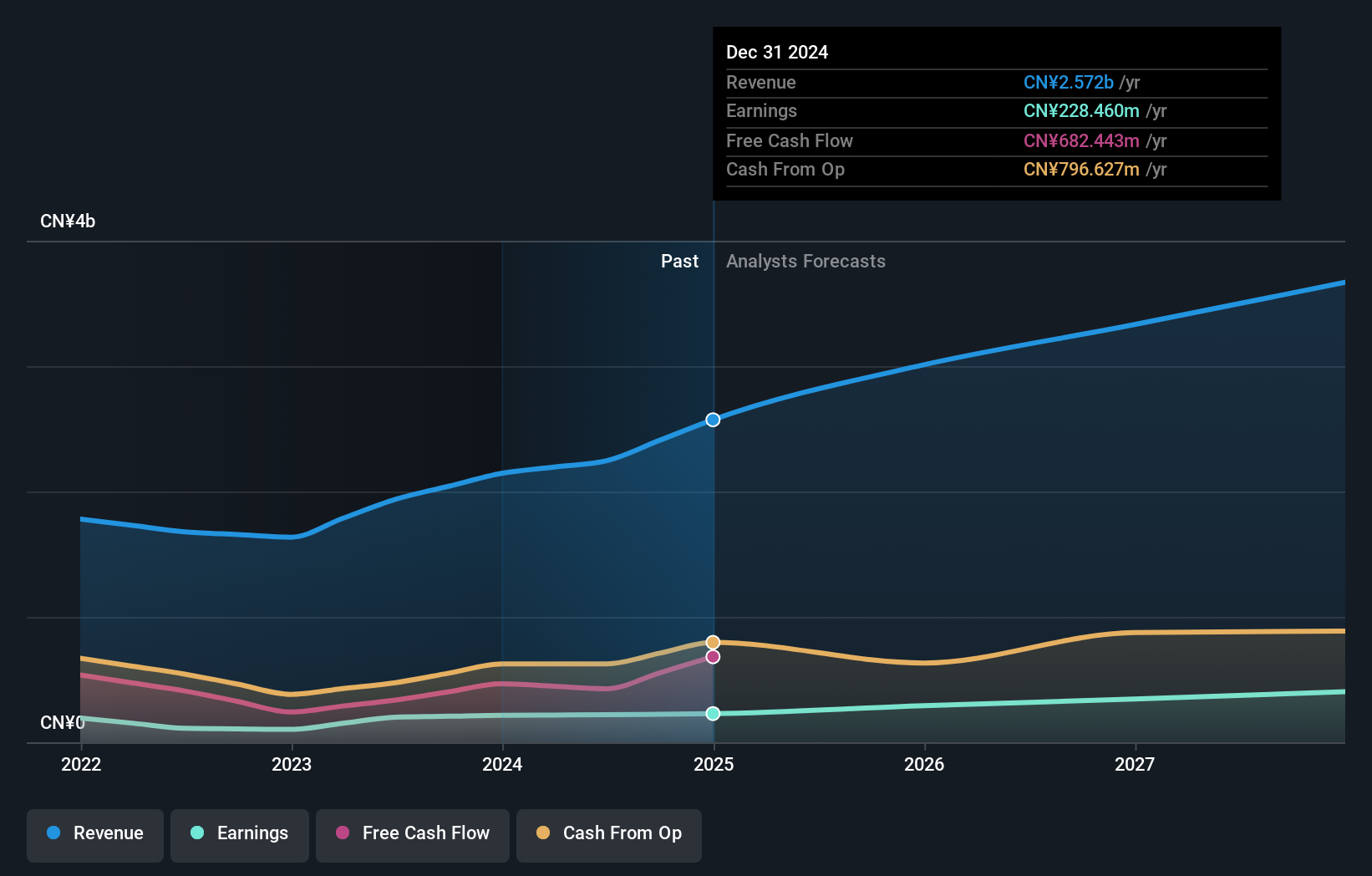

Overview: Biocytogen Pharmaceuticals (Beijing) Co., Ltd. is a biotechnology firm focused on the research and development of antibody-based drugs, operating in the People’s Republic of China, the United States, and internationally, with a market capitalization of approximately HK$3.01 billion.

Operations: Biocytogen Pharmaceuticals generates revenue primarily through the sale of animal models (CN¥293.68 million), pre-clinical pharmacology and efficacy evaluation services (CN¥193.40 million), antibody development (CN¥175.87 million), and gene editing services (CN¥74.33 million).

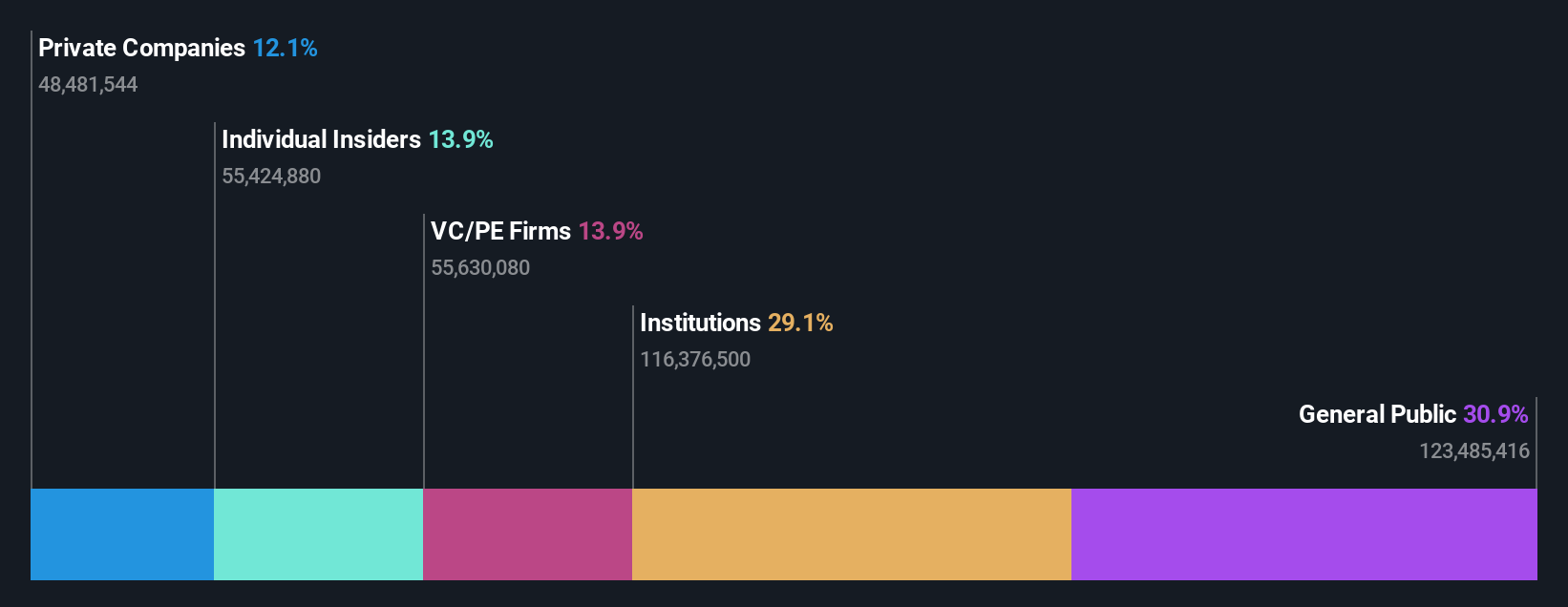

Insider Ownership: 13.9%

Biocytogen Pharmaceuticals (Beijing) is poised for significant growth with a revenue increase of 21.3% per year, outpacing the Hong Kong market's 7.7%. The company's earnings are expected to surge by 100.1% annually. Recently, Biocytogen entered into a lucrative collaboration with SOTIO Biotech, potentially earning up to US$325.5 million plus royalties from bispecific antibodies and ADC platforms targeting solid tumors. This partnership underscores its strategic initiatives in expanding its innovative drug development capabilities despite a forecast of low Return on Equity at 18.6%.

- Delve into the full analysis future growth report here for a deeper understanding of Biocytogen Pharmaceuticals (Beijing).

- Our comprehensive valuation report raises the possibility that Biocytogen Pharmaceuticals (Beijing) is priced lower than what may be justified by its financials.

Beauty Farm Medical and Health Industry (SEHK:2373)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beauty Farm Medical and Health Industry Inc. operates in the healthcare sector with a market capitalization of approximately HK$3.84 billion.

Operations: The company generates revenue primarily through three segments: Aesthetic Medical Services (CN¥850.36 million), Subhealth Medical Services (CN¥101.04 million), and Beauty and Wellness Services, split between Direct Stores (CN¥1.08 billion) and Franchisee and Others (CN¥113.81 million).

Insider Ownership: 33.9%

Beauty Farm Medical and Health Industry Inc. recently declared a dividend of HK$0.47 per share, reflecting confidence in its financial stability. The company's earnings are forecasted to grow by 20.55% annually, outpacing the Hong Kong market's average of 11.4%. Additionally, it is trading at a significant discount—50.8% below its estimated fair value—highlighting potential undervaluation despite robust revenue growth projections (18.5% per year) compared to the market (7.7%).

- Unlock comprehensive insights into our analysis of Beauty Farm Medical and Health Industry stock in this growth report.

- Upon reviewing our latest valuation report, Beauty Farm Medical and Health Industry's share price might be too optimistic.

Meituan (SEHK:3690)

Simply Wall St Growth Rating: ★★★★★☆

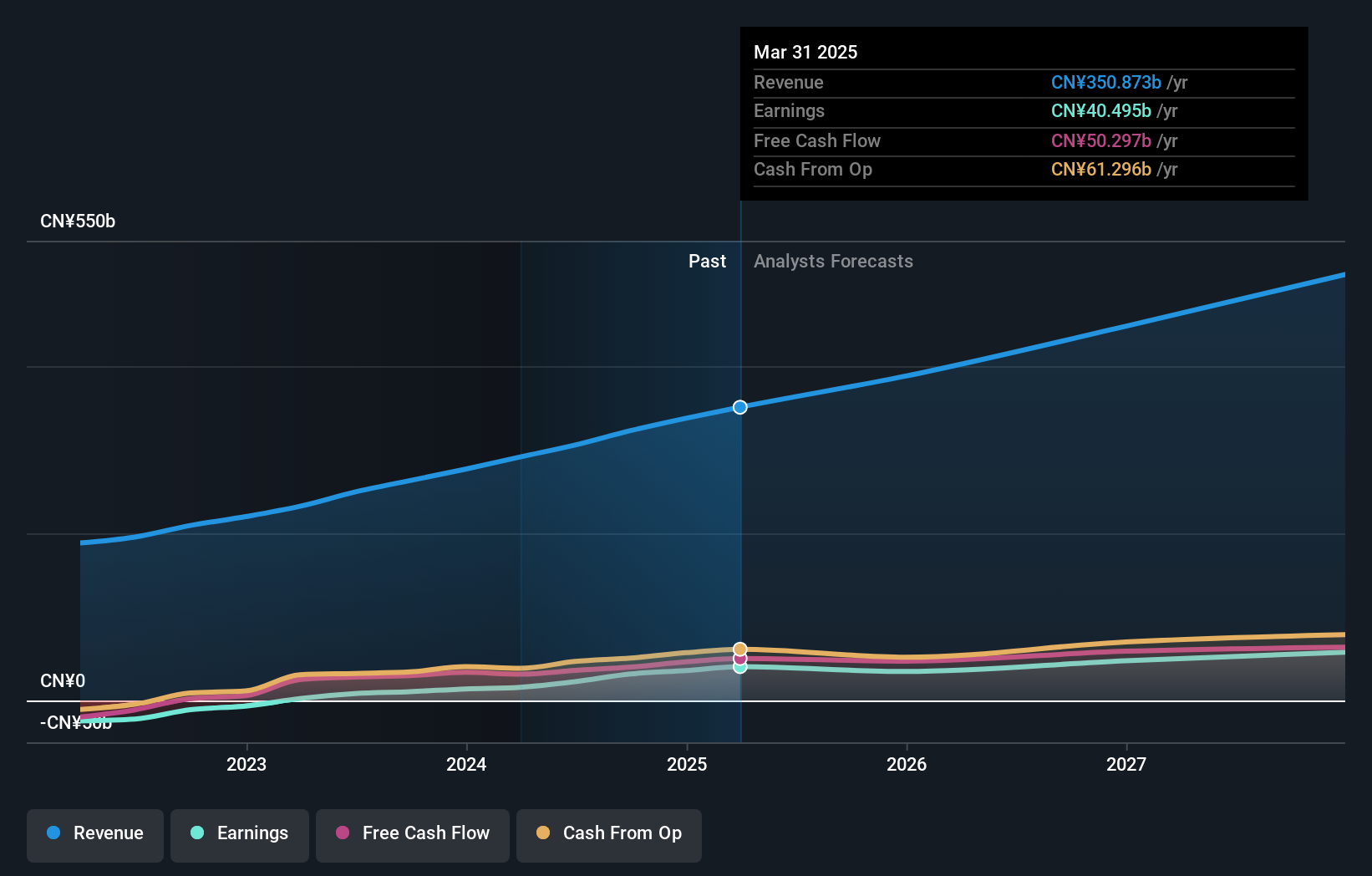

Overview: Meituan is a technology retail company based in the People's Republic of China, with a market capitalization of approximately HK$722.17 billion.

Operations: The company generates revenue through technology retail operations in China.

Insider Ownership: 11.5%

Meituan has recently seen substantial management changes and confirmed a significant share repurchase of US$2 billion, signaling confidence in its value. The company reported robust first-quarter earnings with sales up to CNY 73.28 billion and net income increasing to CNY 5.37 billion year-over-year. Despite trading at 66% below its estimated fair value, Meituan's revenue is expected to grow faster than the Hong Kong market average, with projected significant earnings growth over the next three years.

- Click to explore a detailed breakdown of our findings in Meituan's earnings growth report.

- The valuation report we've compiled suggests that Meituan's current price could be inflated.

Key Takeaways

- Explore the 54 names from our Fast Growing SEHK Companies With High Insider Ownership screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Meituan is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3690

Meituan

Operates as a technology retail company in the People’s Republic of China.

High growth potential with excellent balance sheet.