Bank of China (SEHK:3988): Exploring Valuation After a 6% Monthly Share Price Gain

Reviewed by Simply Wall St

Bank of China (SEHK:3988) has seen its share price shift over the past month, gaining 6% amid evolving investor sentiment. Activity around the stock suggests market participants are reassessing its current valuation and future growth prospects.

See our latest analysis for Bank of China.

Looking at the bigger picture, Bank of China’s shares have picked up nearly 6% over the month, building on solid momentum that has seen its 2024 share price return reach 19%. What is even more striking is the 37% total shareholder return over the past year and an impressive 146% gain over five years. This trend highlights steadily improving investor confidence and a shift in how the market values the bank’s long-term potential.

If you want to see what else is out there and broaden your investment perspective, now is a great moment to discover fast growing stocks with high insider ownership

With strong recent gains and robust long-term returns, the question for investors now is whether Bank of China shares remain undervalued at current levels or if the market has already priced in future growth potential.

Most Popular Narrative: 10.3% Undervalued

Compared to the last close at HK$4.66, the most popular narrative sees Bank of China's fair value at HK$5.19. Analysts appear optimistic, giving the stock breathing room for further gains if their forecasts play out in reality.

The rapid adoption of digital payments, fintech, and artificial intelligence, areas in which Bank of China is making significant investments, is expected to enhance customer engagement, lower operational costs, and increase product innovation. This may lead to greater operating efficiency and potential margin expansion.

Curious about the bold moves driving this valuation? The forecast banks on ambitious digital growth, new revenue pillars, and stronger margins than many expect. Tempted to find out which projections are making analysts raise their price targets? Read on to uncover the numbers and assumptions shaping this bullish outlook.

Result: Fair Value of $5.19 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained low interest rates or rising non-performing loans from property exposure could quickly challenge the optimistic outlook that currently surrounds Bank of China.

Find out about the key risks to this Bank of China narrative.

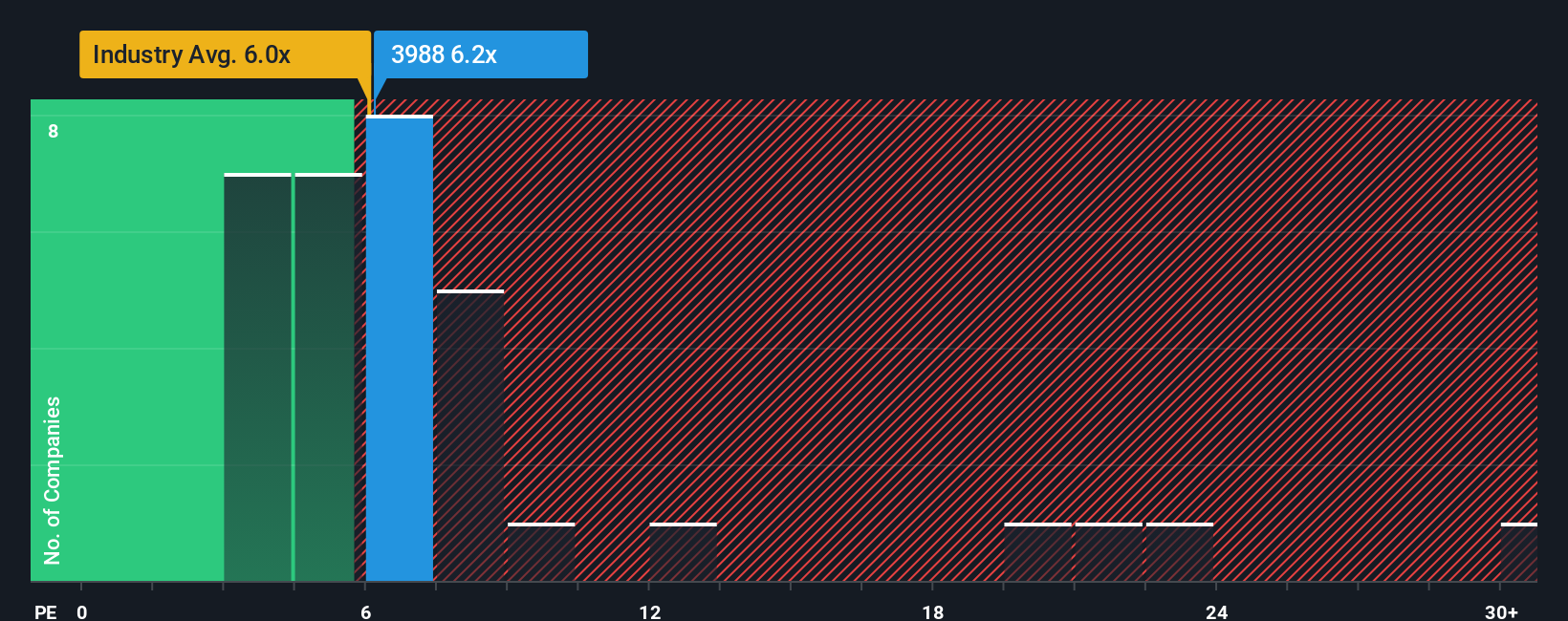

Another View: the Market Multiple

While many investors point to Bank of China’s low share price compared to its future earnings, examining its price-to-earnings ratio offers a more cautionary perspective. At 6.1x, it is only modestly below the peer average of 6.5x and close to the industry average of 5.8x, but above the "fair ratio" of 7.1x that the market could eventually approach. This narrower discount suggests there may be less room for upside and increased potential risks if sentiment changes direction. If the market is not yet convinced, is there more to consider beyond headline valuation?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bank of China Narrative

If you want to challenge the consensus or follow your own insights, you can shape your own Bank of China narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Bank of China.

Looking for More Investment Opportunities?

Don’t let today’s gains be the end of your investing story. Amplify your portfolio with select ideas that help you spot the next breakout winner before the crowd.

- Tap into momentum by targeting potential high-flyers among these 3598 penny stocks with strong financials. These selections may outpace the broader market with their resilience and upside.

- Maximize your income with these 16 dividend stocks with yields > 3% that offer stable yields above 3%. This approach can help you build a stronger, more reliable foundation for your wealth.

- Get ahead of transformative trends by researching these 30 healthcare AI stocks, where innovation in medical technology combines with robust growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of China might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3988

Bank of China

Provides various banking and financial services in Chinese Mainland, Hong Kong, Macao, Taiwan, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives