Unveiling 3 Hong Kong Dividend Stocks With Yields Up To 8.4%

Reviewed by Simply Wall St

Amidst a backdrop of mixed economic signals from global markets, including a modest uptick in Hong Kong's Hang Seng Index, investors are keenly observing opportunities for stable returns. Dividend stocks in Hong Kong offer an appealing avenue for those looking to capitalize on yields up to 8.4%, particularly as broader market conditions present both challenges and opportunities for income-focused portfolios.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.45% | ★★★★★★ |

| CITIC Telecom International Holdings (SEHK:1883) | 9.84% | ★★★★★★ |

| China Construction Bank (SEHK:939) | 7.53% | ★★★★★☆ |

| S.A.S. Dragon Holdings (SEHK:1184) | 8.84% | ★★★★★☆ |

| Playmates Toys (SEHK:869) | 8.96% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 6.69% | ★★★★★☆ |

| China Mobile (SEHK:941) | 6.43% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 4.02% | ★★★★★☆ |

| International Housewares Retail (SEHK:1373) | 8.68% | ★★★★★☆ |

| Tian An China Investments (SEHK:28) | 5.13% | ★★★★★☆ |

Click here to see the full list of 90 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

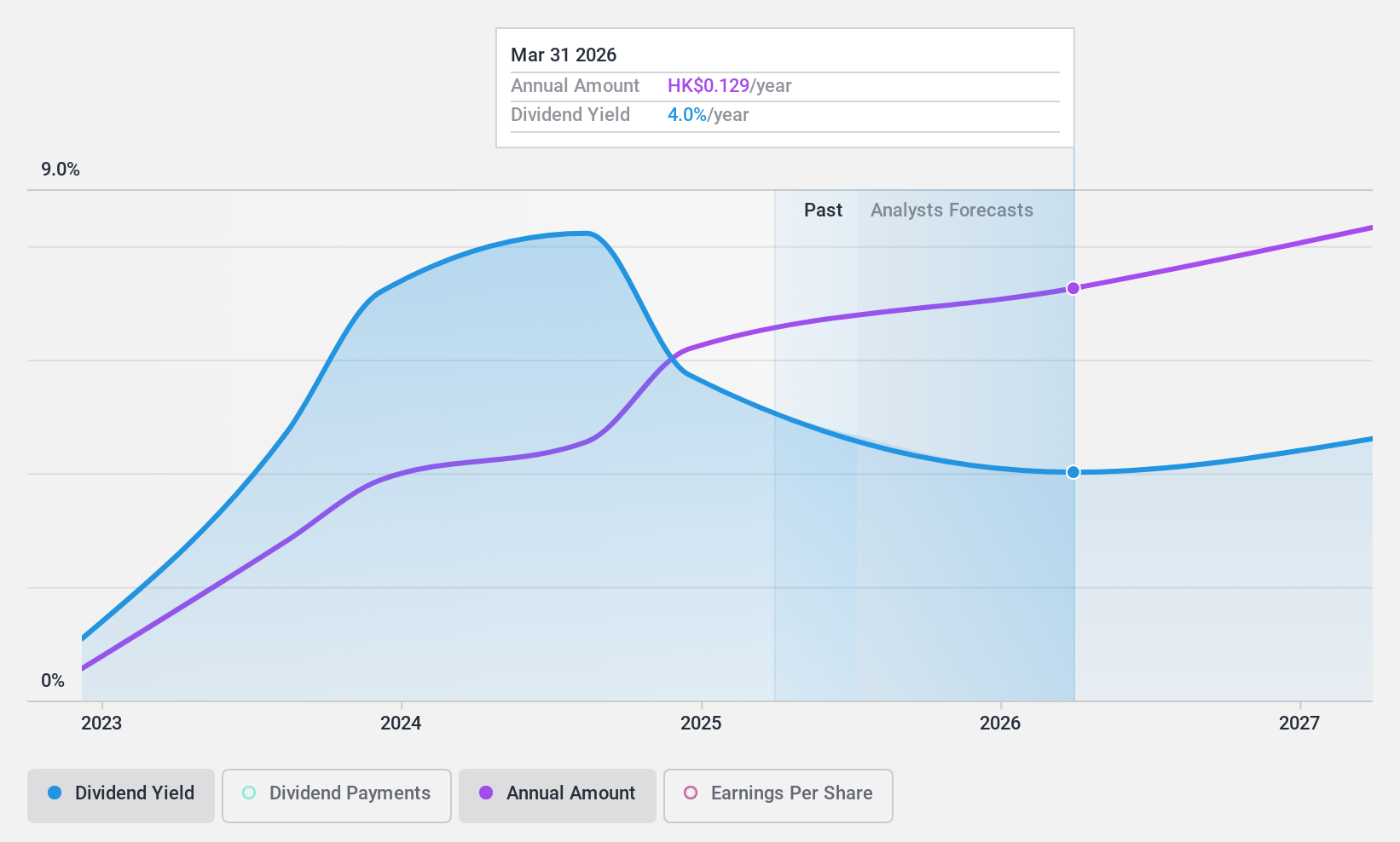

JBM (Healthcare) (SEHK:2161)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JBM (Healthcare) Limited operates as an investment holding company that manufactures, markets, distributes, and sells branded healthcare and wellness products in Hong Kong, Macau, Mainland China, and internationally; it has a market cap of approximately HK$0.81 billion.

Operations: JBM (Healthcare) Limited generates revenue through three primary segments: branded medicines (HK$190.11 million), health and wellness products (HK$72.19 million), and proprietary Chinese medicines (HK$386.12 million).

Dividend Yield: 8.3%

JBM (Healthcare) Limited, a dividend-paying entity in Hong Kong, recently proposed a final dividend of HK$0.0405 per share for FY 2024, underscoring its commitment to returning value to shareholders. The company's financial performance has shown significant improvement with sales rising from HK$520.32 million to HK$648.42 million and net income more than doubling from HK$57.09 million to HK$130.46 million year-over-year. This robust earnings growth supports the sustainability of its dividends, evidenced by a payout ratio of 50.8% and a cash payout ratio of 51.5%, aligning with industry norms for dividend coverage by earnings and cash flows respectively.

- Unlock comprehensive insights into our analysis of JBM (Healthcare) stock in this dividend report.

- Upon reviewing our latest valuation report, JBM (Healthcare)'s share price might be too pessimistic.

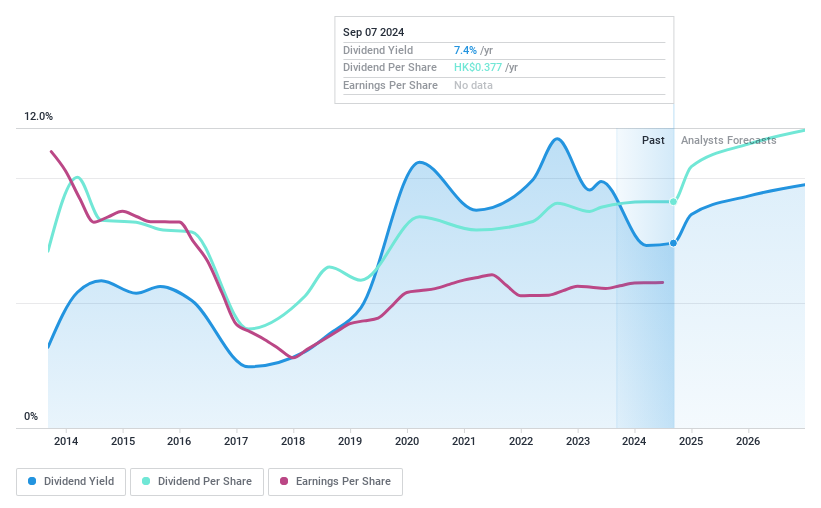

SINOPEC Engineering (Group) (SEHK:2386)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SINOPEC Engineering (Group) Co., Ltd. offers engineering, procurement, and construction (EPC) contracting services across China and internationally, with a market capitalization of approximately HK$23.30 billion.

Operations: SINOPEC Engineering (Group) Co., Ltd. generates revenue through several segments, including Construction at CN¥25.28 billion, EPC Contracting at CN¥31.99 billion, Equipment Manufacturing at CN¥0.73 billion, and Engineering, Consulting and Licensing at CN¥3.82 billion.

Dividend Yield: 7.0%

SINOPEC Engineering (Group) Co., Ltd. has shown a modest earnings growth of 3.9% annually over the past five years, yet its dividend payments demonstrate volatility and unreliability in the same period. Despite this, both earnings (65% payout ratio) and cash flows (71.2% cash payout ratio) adequately cover the dividends, indicating a level of sustainability in its current distribution policy. However, with a dividend yield of 6.97%, it falls short compared to Hong Kong's top dividend payers at 7.84%. Recent corporate changes include executive shifts and adjustments to company bylaws which could impact future governance and operational strategies.

- Click to explore a detailed breakdown of our findings in SINOPEC Engineering (Group)'s dividend report.

- Upon reviewing our latest valuation report, SINOPEC Engineering (Group)'s share price might be too optimistic.

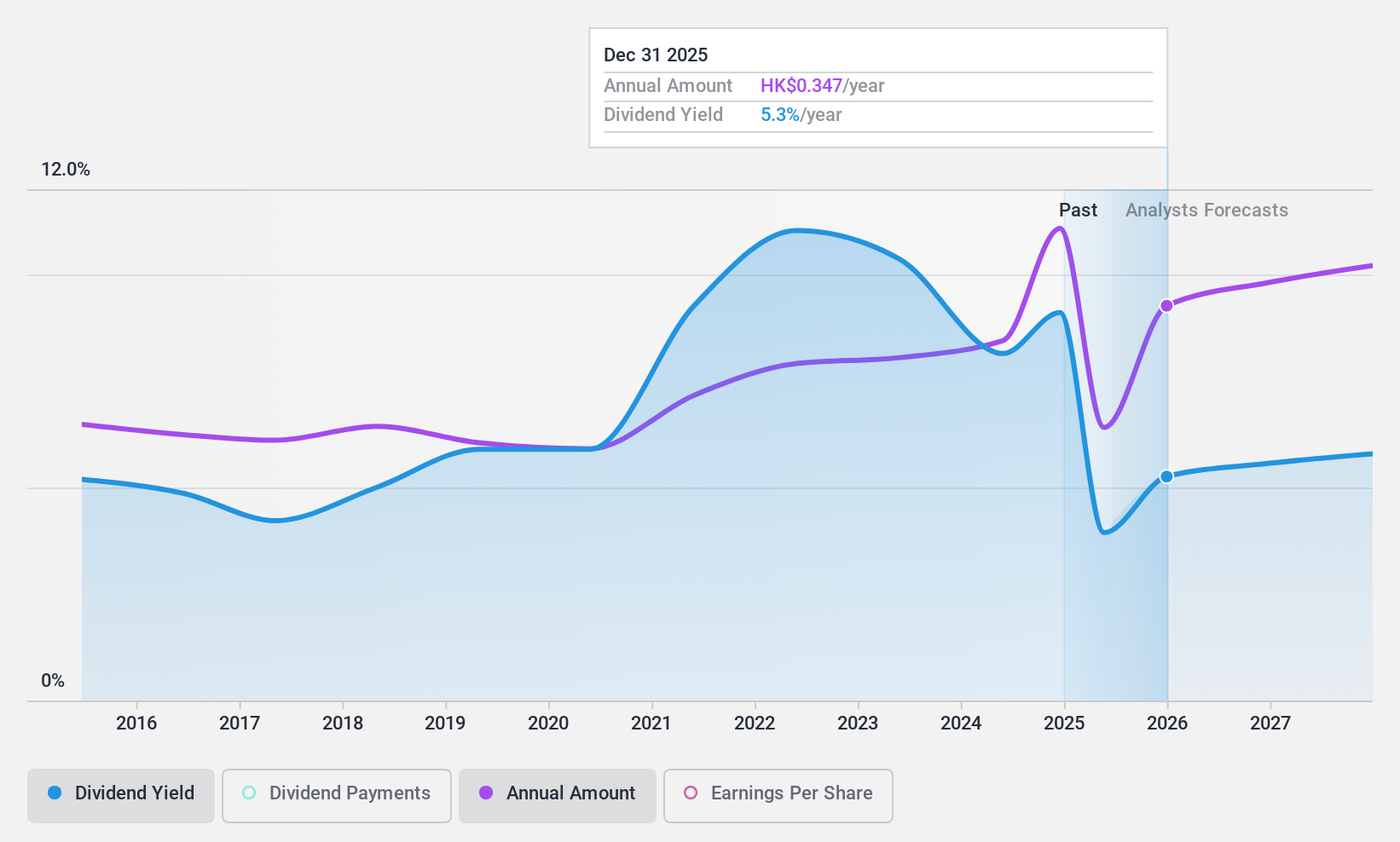

Chongqing Rural Commercial Bank (SEHK:3618)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Chongqing Rural Commercial Bank Co., Ltd. provides banking services across the People’s Republic of China, with a market capitalization of approximately HK$56.47 billion.

Operations: Chongqing Rural Commercial Bank Co., Ltd. generates its revenue primarily from banking services across the People’s Republic of China.

Dividend Yield: 8.5%

Chongqing Rural Commercial Bank maintains a stable dividend history with a 10-year record of consistent payments and recent growth. The bank's dividends are well-covered by earnings, with a current payout ratio of 32.1% and projected coverage at 28.9% in three years, ensuring sustainability. Trading significantly below estimated fair value offers potential value to investors. Recent approval for a substantial dividend payout totaling RMB 3.276 billion highlights ongoing commitment to shareholder returns, despite slight declines in quarterly earnings and net income as reported in the first quarter of 2024 results.

- Take a closer look at Chongqing Rural Commercial Bank's potential here in our dividend report.

- The analysis detailed in our Chongqing Rural Commercial Bank valuation report hints at an deflated share price compared to its estimated value.

Seize The Opportunity

- Navigate through the entire inventory of 90 Top Dividend Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2161

JBM (Healthcare)

An investment holding company, engages in the manufacture, marketing, distribution, and sale of branded healthcare and wellness products in Hong Kong, Macau, Mainland China, and internationally.

Flawless balance sheet with solid track record and pays a dividend.