- Hong Kong

- /

- Marine and Shipping

- /

- SEHK:1748

Three Undiscovered Gems In Hong Kong To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets experience mixed performance and economic indicators present a cautiously optimistic outlook, the Hong Kong market has shown resilience with the Hang Seng Index gaining 2.14%. In this dynamic environment, identifying undervalued stocks can offer significant opportunities for portfolio enhancement. A good stock in these conditions typically exhibits strong fundamentals, growth potential, and stability amidst market volatility. Here are three undiscovered gems in Hong Kong that could enhance your investment portfolio.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★★ |

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| China Leon Inspection Holding | 8.55% | 21.36% | 22.77% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| HBM Holdings | 52.89% | 66.59% | 31.70% | ★★★★★☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Xin Yuan Enterprises Group (SEHK:1748)

Simply Wall St Value Rating: ★★★★★★

Overview: Xin Yuan Enterprises Group Limited, an investment holding company, provides asphalt tanker and bulk carrier chartering services in the People’s Republic of China, Hong Kong, and Singapore with a market cap of HK$6.60 billion.

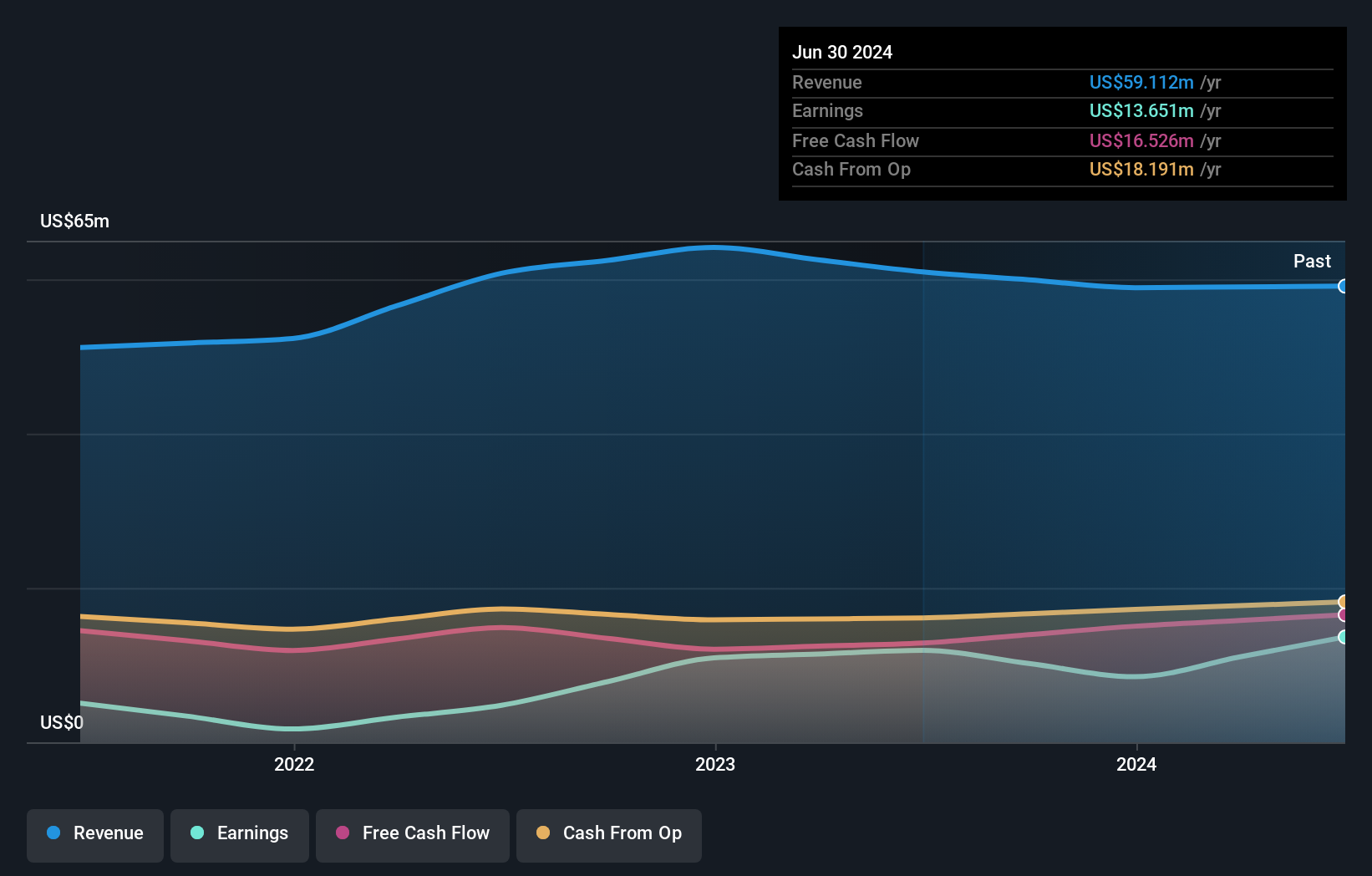

Operations: Xin Yuan Enterprises Group generates revenue primarily from asphalt tanker chartering services, contributing $55.49 million, and bulk carrier chartering services, contributing $3.63 million. The company has a market cap of HK$6.60 billion.

Xin Yuan Enterprises Group has shown promising performance with earnings growth of 14.6% over the past year, outpacing the shipping industry's -29.9%. Its net debt to equity ratio stands at a satisfactory 6.1%, and interest payments are well covered by EBIT at 3.3x coverage. A notable one-off gain of US$4.5M impacted its recent financials, contributing to a net income of US$10.69M for H1 2024, up from US$5.53M last year, reflecting strong operational efficiency and strategic gains from asset disposals.

Dah Sing Banking Group (SEHK:2356)

Simply Wall St Value Rating: ★★★★★☆

Overview: Dah Sing Banking Group Limited is an investment holding company offering banking, financial, and related services in Hong Kong, Macau, and the People’s Republic of China with a market cap of HK$9.78 billion.

Operations: The company's revenue streams include Personal Banking (HK$2.68 billion), Corporate Banking (HK$853.60 million), Treasury and Global Markets (HK$1.34 billion), and Mainland China and Macau Banking (HK$176.27 million).

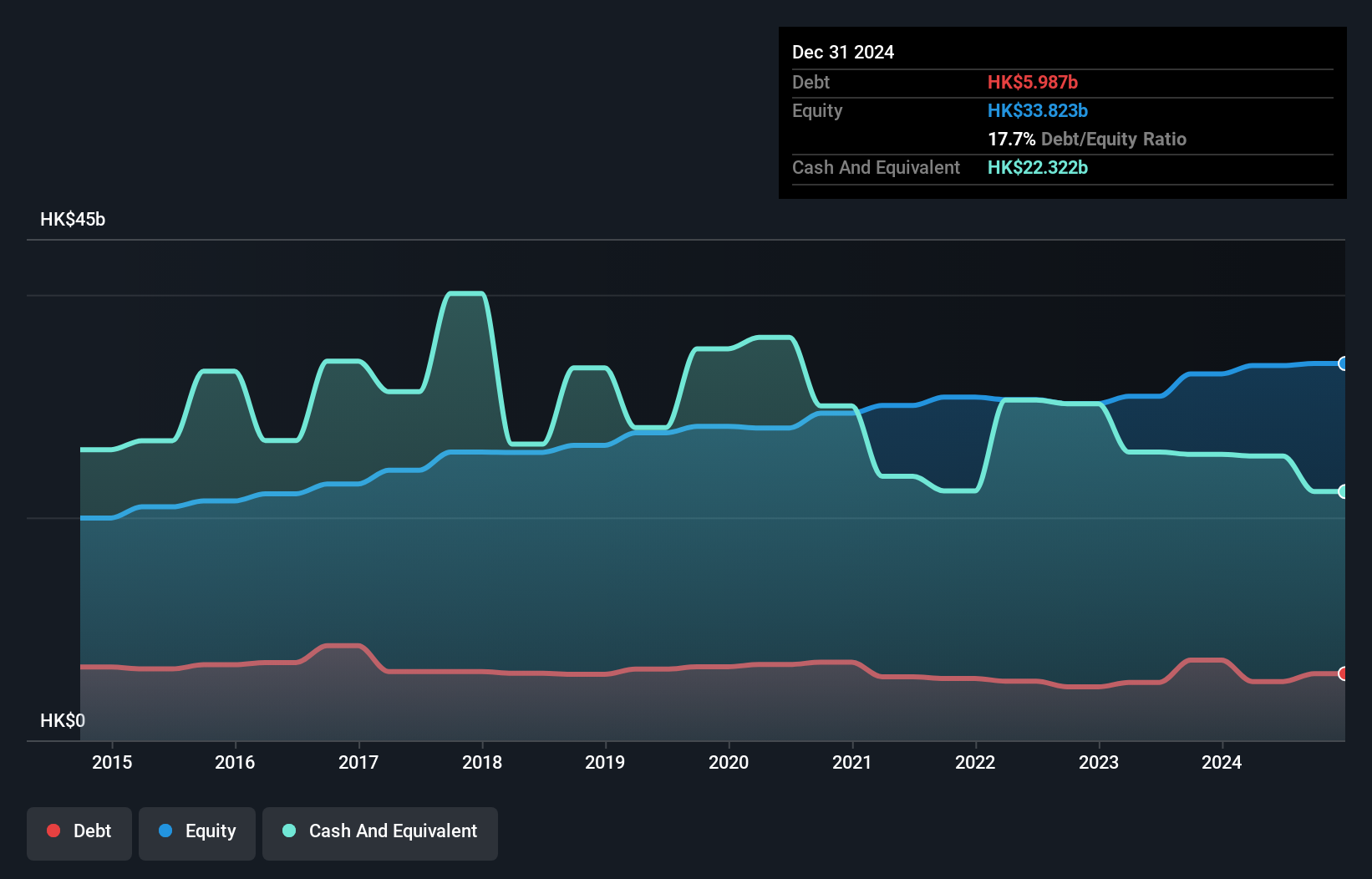

Dah Sing Banking Group, with total assets of HK$262.4B and equity of HK$33.6B, reported net income for the first half of 2024 at HK$1.40B, up from HK$1.11B a year ago. Total deposits stand at HK$214.6B while loans are at HK$141.9B with a net interest margin of 2%. The bank's allowance for bad loans is insufficient at 1.9%, though it has primarily low-risk funding sources comprising 94% customer deposits and trades below its estimated fair value by 46%.

- Click to explore a detailed breakdown of our findings in Dah Sing Banking Group's health report.

Assess Dah Sing Banking Group's past performance with our detailed historical performance reports.

Dah Sing Financial Holdings (SEHK:440)

Simply Wall St Value Rating: ★★★★★☆

Overview: Dah Sing Financial Holdings Limited is an investment holding company that offers banking, insurance, financial, and related services across Hong Kong, Macau, and the People’s Republic of China with a market cap of HK$7.61 billion.

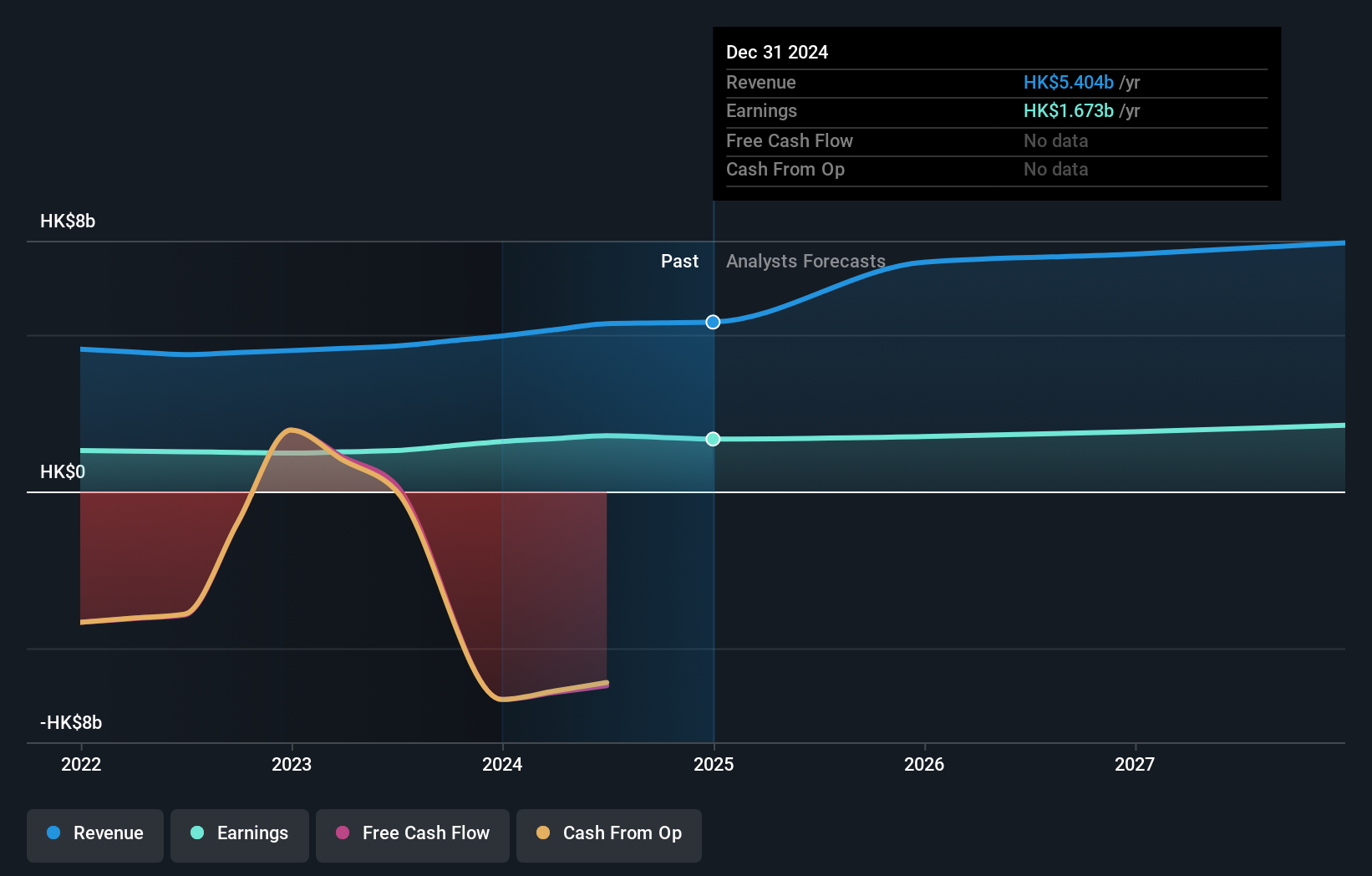

Operations: The company generates revenue from personal banking (HK$2.68 billion), corporate banking (HK$853.60 million), insurance business (HK$246.25 million), treasury and global markets (HK$1.34 billion), and mainland China and Macau banking (HK$176.27 million).

Dah Sing Financial Holdings, with assets of HK$272.4B and equity of HK$42.4B, has seen earnings grow by 42.5% over the past year, outpacing the banks industry average of 2.8%. Total deposits stand at HK$214.2B against loans of HK$141.9B, while bad loans are at a manageable 1.9%. The company trades at 42% below its estimated fair value and recently announced an interim dividend of HKD0.92 per share for H1 2024.

- Unlock comprehensive insights into our analysis of Dah Sing Financial Holdings stock in this health report.

Gain insights into Dah Sing Financial Holdings' past trends and performance with our Past report.

Next Steps

- Take a closer look at our SEHK Undiscovered Gems With Strong Fundamentals list of 174 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1748

Xin Yuan Enterprises Group

An investment holding company, provides asphalt tanker and bulk carrier chartering services in the People’s Republic of China, Hong Kong, and Singapore.

Flawless balance sheet with acceptable track record.