- Hong Kong

- /

- Consumer Durables

- /

- SEHK:1999

Discover 3 SEHK Dividend Stocks Yielding Up To 6.9%

Reviewed by Simply Wall St

As global markets navigate mixed economic signals and inflation trends, the Hong Kong market has shown resilience with the Hang Seng Index gaining 2.14%. In this context, dividend stocks can offer a stable income stream and potential for capital appreciation. When evaluating dividend stocks, it is essential to consider factors such as consistent earnings, strong cash flow, and a history of reliable dividend payments.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.49% | ★★★★★★ |

| Luk Fook Holdings (International) (SEHK:590) | 9.56% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 7.55% | ★★★★★☆ |

| Chow Tai Fook Jewellery Group (SEHK:1929) | 8.73% | ★★★★★☆ |

| China Construction Bank (SEHK:939) | 8.02% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 5.41% | ★★★★★☆ |

| PC Partner Group (SEHK:1263) | 9.30% | ★★★★★☆ |

| Zhongsheng Group Holdings (SEHK:881) | 8.51% | ★★★★★☆ |

| Zhejiang Expressway (SEHK:576) | 7.04% | ★★★★★☆ |

| China Electronics Huada Technology (SEHK:85) | 9.91% | ★★★★★☆ |

Click here to see the full list of 73 stocks from our Top SEHK Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

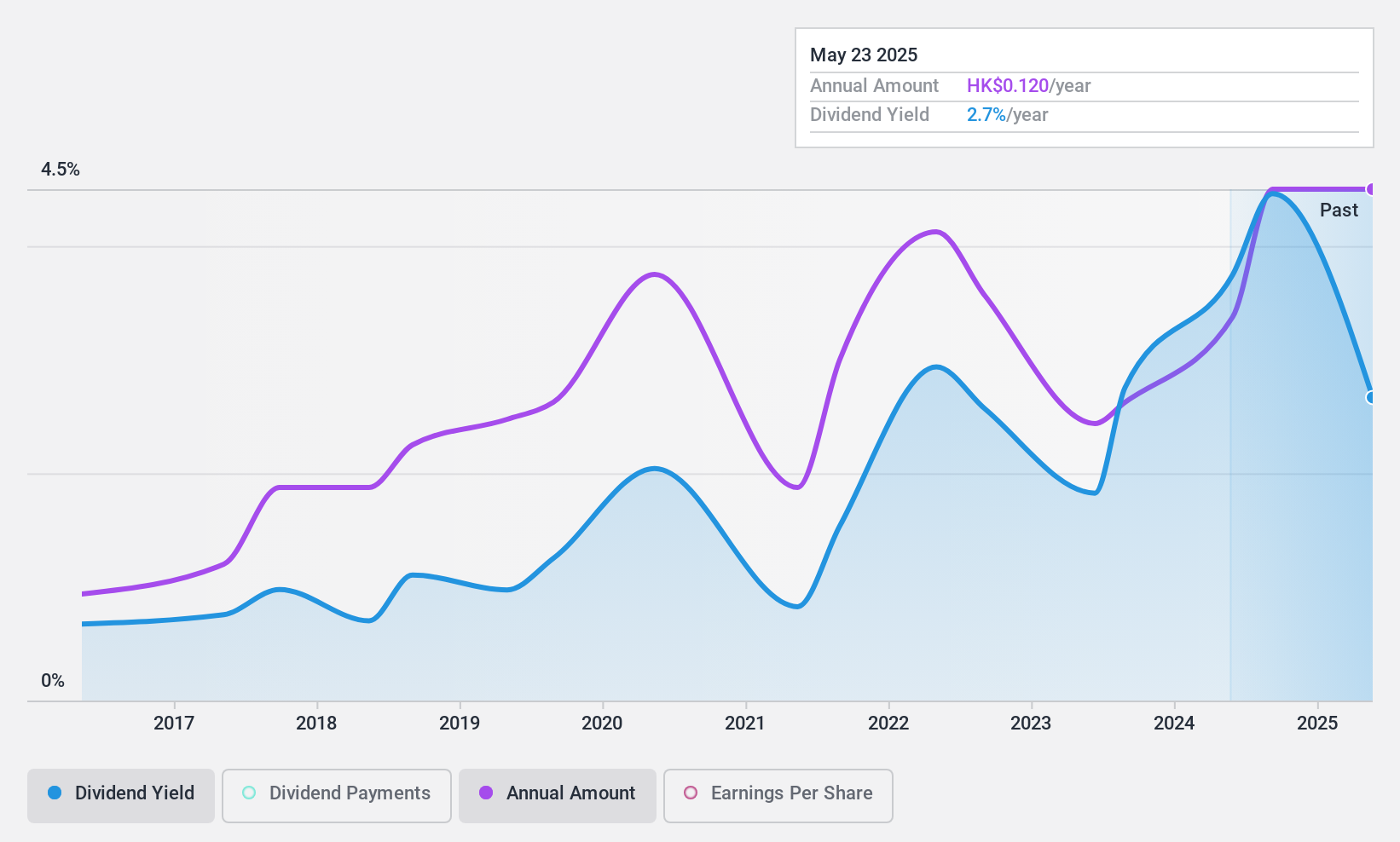

Essex Bio-Technology (SEHK:1061)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Essex Bio-Technology Limited is an investment holding company that develops, manufactures, distributes, and sells bio-pharmaceutical products in the People’s Republic of China, Hong Kong, and internationally with a market cap of HK$1.33 billion.

Operations: Essex Bio-Technology Limited generates revenue primarily from its Surgical segment (HK$871.44 million) and Ophthalmology segment (HK$747.39 million).

Dividend Yield: 5.1%

Essex Bio-Technology's dividend payments are well covered by both earnings (22.7% payout ratio) and cash flows (32.3% cash payout ratio), despite a history of volatility over the past decade. The company recently declared an interim dividend of HK$0.06 per share for H1 2024, amidst share repurchases aimed at enhancing net asset value and earnings per share. However, its current yield (5.13%) remains below the top tier in Hong Kong's market, and recent earnings showed a slight decline compared to last year.

- Navigate through the intricacies of Essex Bio-Technology with our comprehensive dividend report here.

- Our valuation report unveils the possibility Essex Bio-Technology's shares may be trading at a premium.

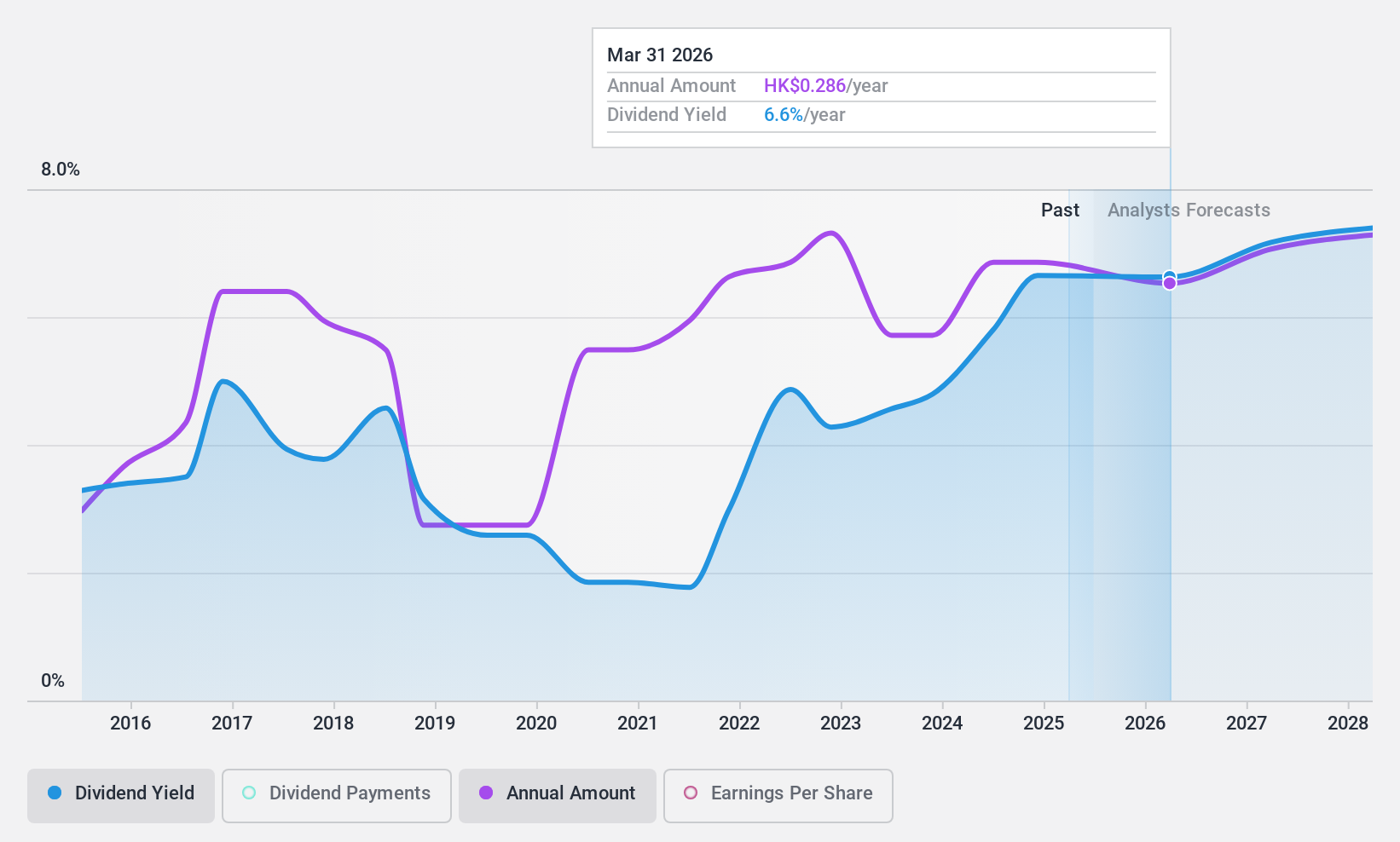

Man Wah Holdings (SEHK:1999)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Man Wah Holdings Limited is an investment holding company involved in the manufacture, wholesale, trading, and distribution of sofas and ancillary products across China, Europe, Vietnam, Mexico, and internationally with a market cap of HK$17.72 billion.

Operations: Man Wah Holdings Limited generates revenue primarily from Sofa and Ancillary Products (HK$12.66 billion), Bedding and Ancillary Products (HK$2.99 billion), Home Group Business (HK$674.14 million), Other Products (HK$1.82 billion), and Other Businesses (HK$270.78 million).

Dividend Yield: 6.6%

Man Wah Holdings recently approved a final dividend of HK$0.15 per share for the year ended 31 March 2024, to be paid by 22 July 2024. Despite a volatile dividend history over the past decade, dividends are covered by earnings (50.8% payout ratio) and cash flows (84.4% cash payout ratio). The company's earnings grew by 20.2% last year, though its current yield (6.56%) is below the top quartile in Hong Kong's market.

- Delve into the full analysis dividend report here for a deeper understanding of Man Wah Holdings.

- Upon reviewing our latest valuation report, Man Wah Holdings' share price might be too optimistic.

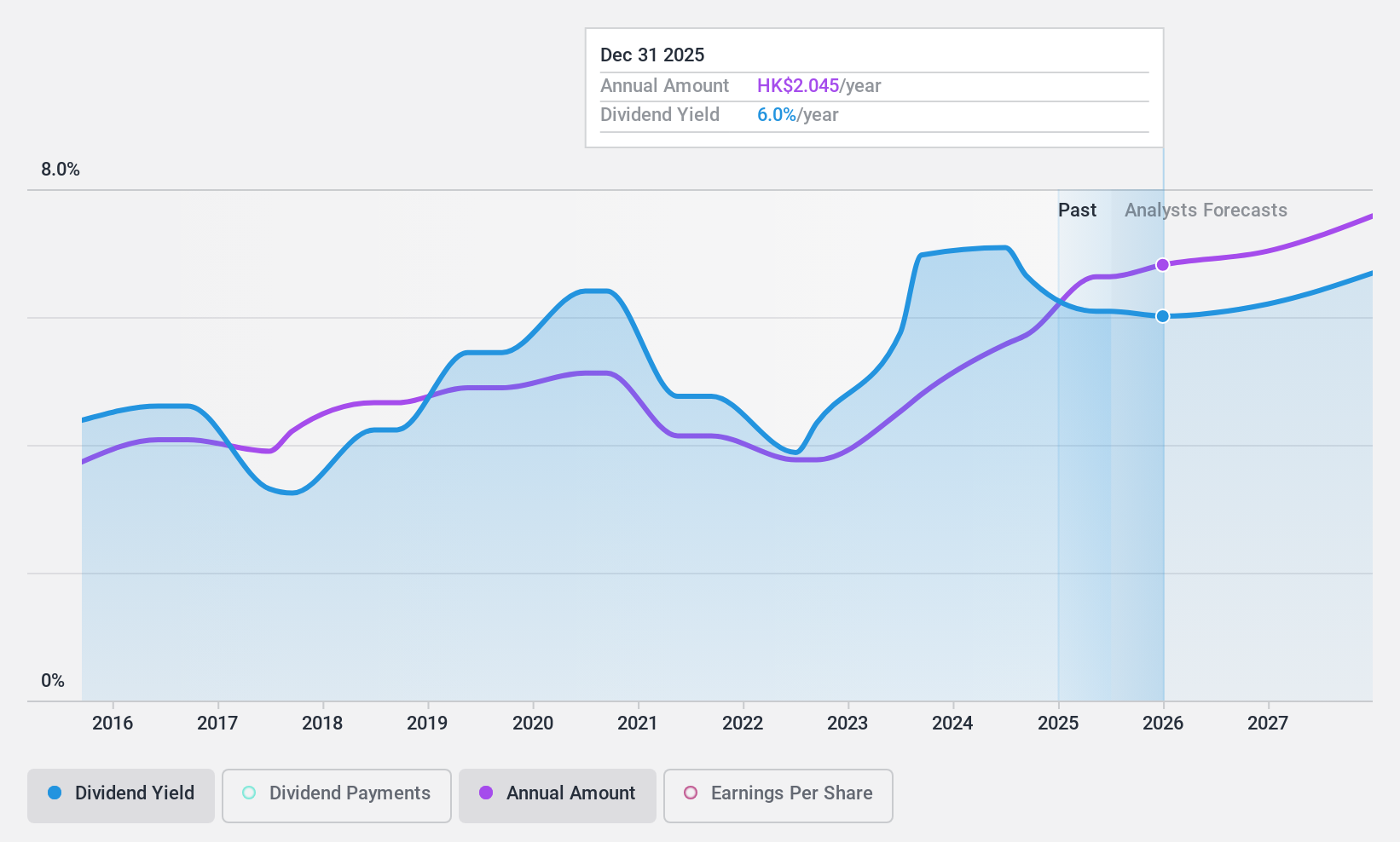

BOC Hong Kong (Holdings) (SEHK:2388)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BOC Hong Kong (Holdings) Limited is an investment holding company offering banking and financial services to corporate and individual customers in Hong Kong, China, and internationally, with a market cap of HK$254.28 billion.

Operations: BOC Hong Kong (Holdings) Limited generates revenue through several key segments including Personal Banking (HK$23.39 billion), Corporate Banking (HK$18.46 billion), Treasury (HK$13.62 billion), and Insurance (HK$1.50 billion).

Dividend Yield: 7.0%

BOC Hong Kong (Holdings) announced an interim dividend of HK$0.57 per share for H1 2024, with a payment date of 27 September 2024. The company's net income rose to HK$20.04 billion from HK$17.69 billion a year ago, indicating strong earnings growth. Despite the dividend yield being lower than the top quartile in Hong Kong, dividends are covered by earnings (50.7% payout ratio). However, its dividend history has been volatile over the past decade.

- Unlock comprehensive insights into our analysis of BOC Hong Kong (Holdings) stock in this dividend report.

- Our valuation report here indicates BOC Hong Kong (Holdings) may be overvalued.

Seize The Opportunity

- Embark on your investment journey to our 73 Top SEHK Dividend Stocks selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1999

Man Wah Holdings

An investment holding company, engages in the manufacture, wholesale, trading, and distribution of sofas and ancillary products in the People's Republic of China, Europe, Vietnam, Mexico, and internationally.

Flawless balance sheet with solid track record and pays a dividend.