Can Postal Savings Bank of China (SEHK:1658) Sustain Profit Stability as Net Interest Income Softens?

Reviewed by Sasha Jovanovic

- Postal Savings Bank of China recently announced its third quarter and nine-month earnings, reporting net income of CNY 27.33 billion for the quarter and CNY 76.56 billion for the nine months ended September 30, 2025.

- The results revealed relatively stable profits despite slight decreases in net interest income and earnings per share compared to the previous year.

- We'll now examine how the bank's ability to maintain profit stability amid shifting interest income shapes its current investment outlook.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Postal Savings Bank of China's Investment Narrative?

To be comfortable as a shareholder in Postal Savings Bank of China right now, I think the key belief is in the bank’s steady profit generation and broad customer base, even when the income from interest shifts up or down. The latest earnings report delivered a subtle reminder of this, showing that while net interest income saw mild declines for both the quarter and nine months, overall net income crept higher year-on-year. Importantly, this result came with a slight dip in earnings per share, but it was not drastic enough to suggest any urgent concerns in the near term. The recent board and governance changes, as well as amendments to company rules, add some moving parts, yet the bank has experienced leadership in place. Based on price movements and available analysis, the recent earnings news is unlikely to change the bank’s biggest catalysts or risks in a material way, it mostly confirms what investors already knew: profit stability remains the name of the game, but so does the challenge of sustaining momentum amid mild margin pressure and ongoing board turnover.

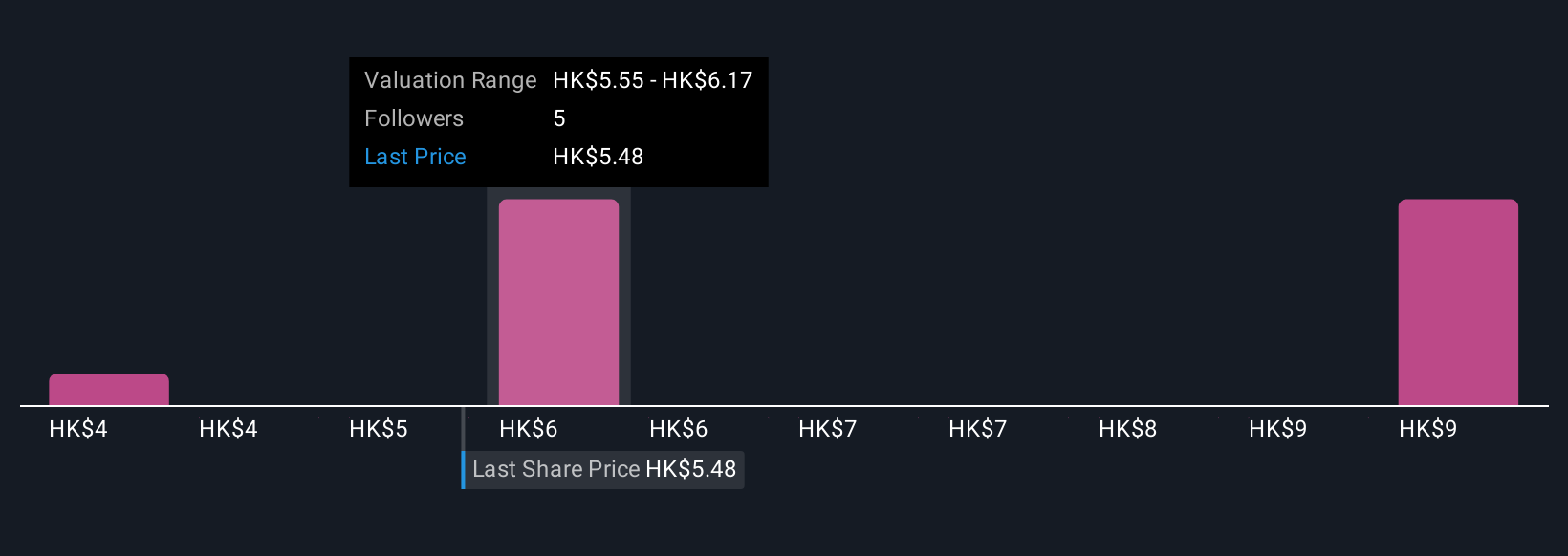

On the other hand, board independence and turnover remain risks investors should keep in mind. Postal Savings Bank of China's shares have been on the rise but are still potentially undervalued by 42%. Find out what it's worth.Exploring Other Perspectives

Explore 3 other fair value estimates on Postal Savings Bank of China - why the stock might be worth as much as 72% more than the current price!

Build Your Own Postal Savings Bank of China Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Postal Savings Bank of China research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Postal Savings Bank of China research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Postal Savings Bank of China's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1658

Postal Savings Bank of China

Provides various banking products and services for retail and corporate customers in the People’s Republic of China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives