What Agricultural Bank of China (SEHK:1288)'s Strong Net Income Despite Lower Interest Earnings Means For Shareholders

Reviewed by Sasha Jovanovic

- Agricultural Bank of China recently reported its third quarter and nine-month 2025 earnings, posting net income of CNY 81.35 billion for the quarter, alongside basic earnings per share of CNY 0.22, despite a slight year-on-year decline in net interest income.

- The bank’s higher profitability metrics came even as its core net interest income edged lower, underscoring improved efficiency or cost management in recent performance.

- We’ll explore how Agricultural Bank of China’s increased net income, despite reduced net interest income, reframes its investment outlook among analyst expectations.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

Agricultural Bank of China Investment Narrative Recap

Shareholders in Agricultural Bank of China generally need to trust in the enduring role of state-backed policy support and the bank’s ability to balance rural lending priorities with efficient cost management. The recent earnings release showed higher net income despite a slight decline in core net interest income, which is positive, though it does not materially alter the key short-term catalyst, profitability resilience in a continued low interest rate climate, or meaningfully shift the highest risk: asset quality tied to rural and priority sector exposures.

Of recent developments, the expiry of Ms. Leung Ko May Yee’s term as an independent non-executive director is notable but does not directly impact the core catalysts from the latest results. While stability in key risk monitoring roles supports investor confidence, catalysts such as government support for rural modernization and digital transformation efforts remain more relevant to forward-looking performance.

Yet, against improved near-term profitability, it remains important for investors to be alert to risks around asset quality in rural lending, especially if ...

Read the full narrative on Agricultural Bank of China (it's free!)

Agricultural Bank of China's outlook projects CN¥844.5 billion in revenue and CN¥304.7 billion in earnings by 2028. This is based on a forecast annual revenue growth rate of 12.9% and represents a CN¥40.9 billion increase in earnings from the current CN¥263.8 billion.

Uncover how Agricultural Bank of China's forecasts yield a HK$6.06 fair value, in line with its current price.

Exploring Other Perspectives

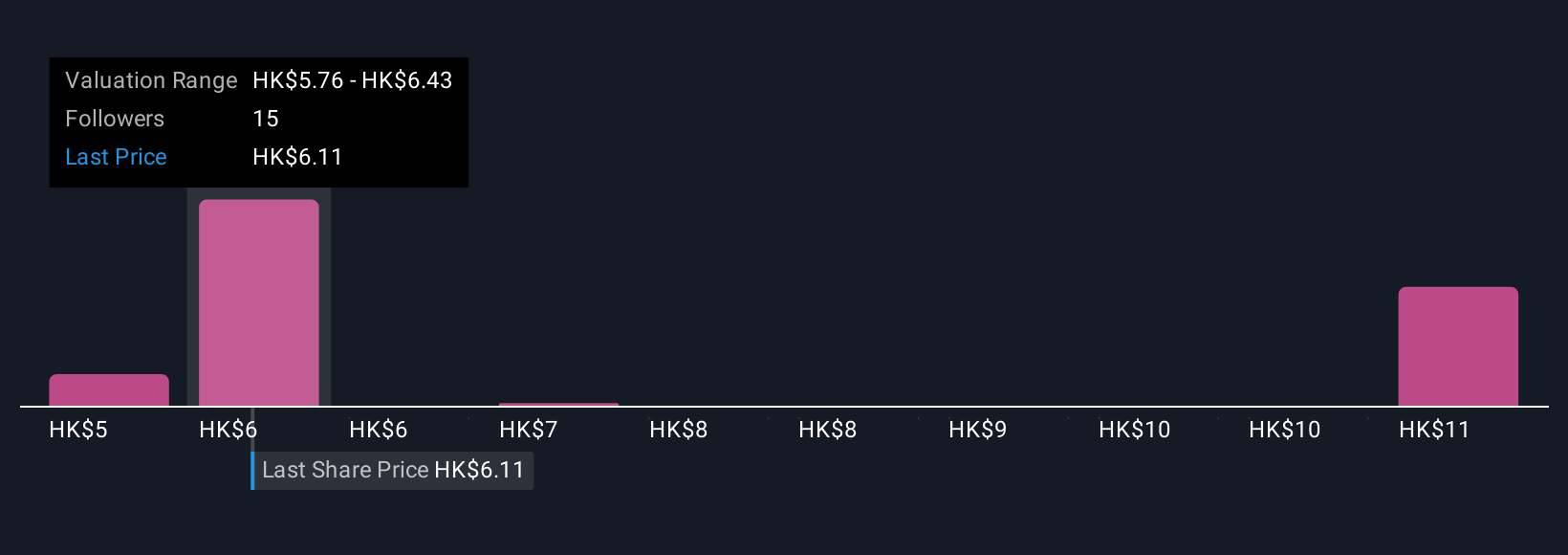

Simply Wall St Community members' fair value estimates for Agricultural Bank of China range from HK$5.10 to HK$11.53, reflecting six different viewpoints. While profitability appears resilient, concerns about pressure on net interest margins could still shape the stock’s outlook, review these varied opinions for a fuller picture.

Explore 6 other fair value estimates on Agricultural Bank of China - why the stock might be worth as much as 91% more than the current price!

Build Your Own Agricultural Bank of China Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Agricultural Bank of China research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Agricultural Bank of China research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Agricultural Bank of China's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1288

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives