How Investors May Respond To Agricultural Bank of China (SEHK:1288) Strengthening Capital Base with RMB35 Billion Tier 2 Notes

Reviewed by Sasha Jovanovic

- On November 20, 2025, Agricultural Bank of China completed the issuance of RMB35.0 billion in Tier 2 capital notes across 10-year and 15-year tranches in the National Interbank Bond Market, with interest rates of 2.14% and 2.40% respectively and conditional redemption rights at specified anniversaries.

- This substantial capital raising strengthens the bank's regulatory capital base and highlights both robust investor demand and consistent regulatory support for its growth and risk management plans.

- We’ll explore how this successful Tier 2 capital issuance further enhances Agricultural Bank of China’s capital adequacy and investment outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Agricultural Bank of China Investment Narrative Recap

For shareholders of Agricultural Bank of China, confidence hinges on the bank's ability to balance its strong government-backed rural lending focus with effective risk management and stable earnings. The recent RMB35.0 billion Tier 2 capital notes issuance further supports its capital adequacy, but doesn’t materially affect the biggest short-term catalysts, policy-driven rural loan growth, or the key risk, persistent pressure on net interest margins amid a low-rate environment. A closely related development is the RMB40.0 billion undated Additional Tier 1 Capital Bonds issued in late October. Both moves point to a consistent effort to reinforce capital buffers, ensuring ABC can pursue policy-led growth initiatives without compromising risk controls. But while capital strength continues to build, what investors should be aware of is the growing challenge posed by...

Read the full narrative on Agricultural Bank of China (it's free!)

Agricultural Bank of China's outlook anticipates CN¥844.5 billion in revenue and CN¥304.7 billion in earnings by 2028. This scenario is based on annual revenue growth of 12.9% and a CN¥40.9 billion increase in earnings from the current level of CN¥263.8 billion.

Uncover how Agricultural Bank of China's forecasts yield a HK$6.24 fair value, a 8% upside to its current price.

Exploring Other Perspectives

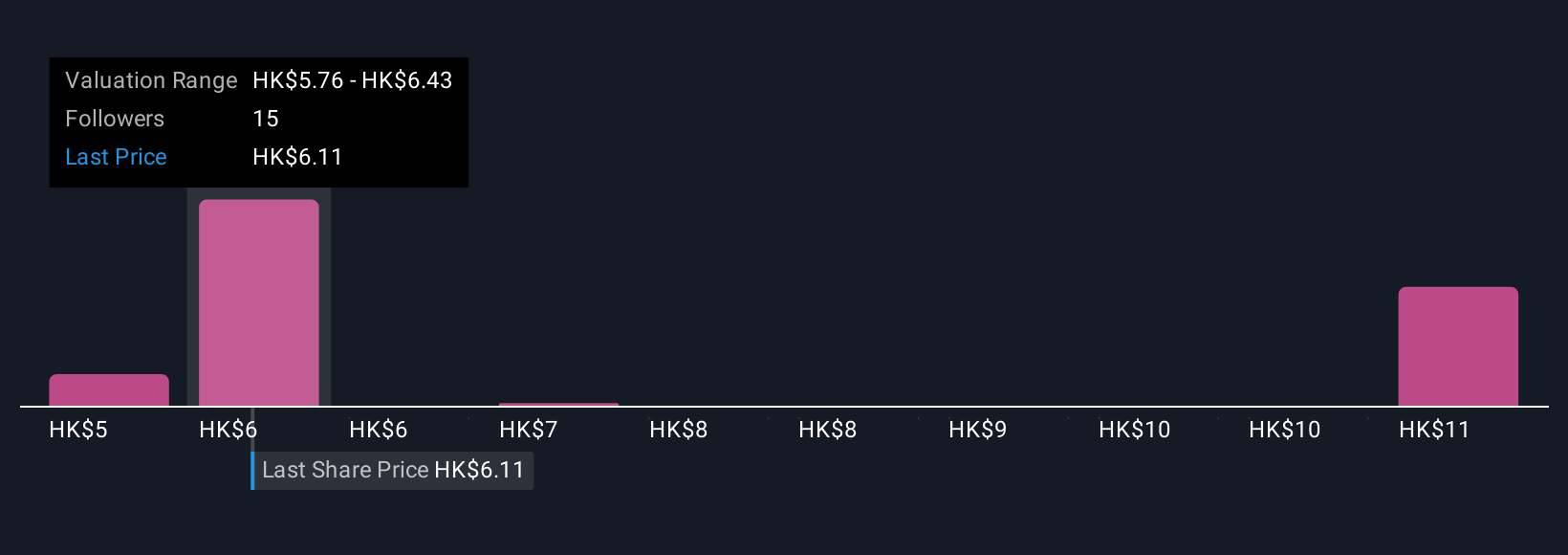

Six Simply Wall St Community members estimate ABC’s fair value from HK$5.10 to HK$11.71. In contrast, sustained margin compression remains a key concern for ongoing earnings performance, inviting you to consider differing outlooks and investment rationales.

Explore 6 other fair value estimates on Agricultural Bank of China - why the stock might be worth over 2x more than the current price!

Build Your Own Agricultural Bank of China Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Agricultural Bank of China research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Agricultural Bank of China research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Agricultural Bank of China's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1288

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success