- Hong Kong

- /

- Diversified Financial

- /

- SEHK:1273

Read This Before You Buy Hong Kong Finance Group Limited (HKG:1273) Because Of Its P/E Ratio

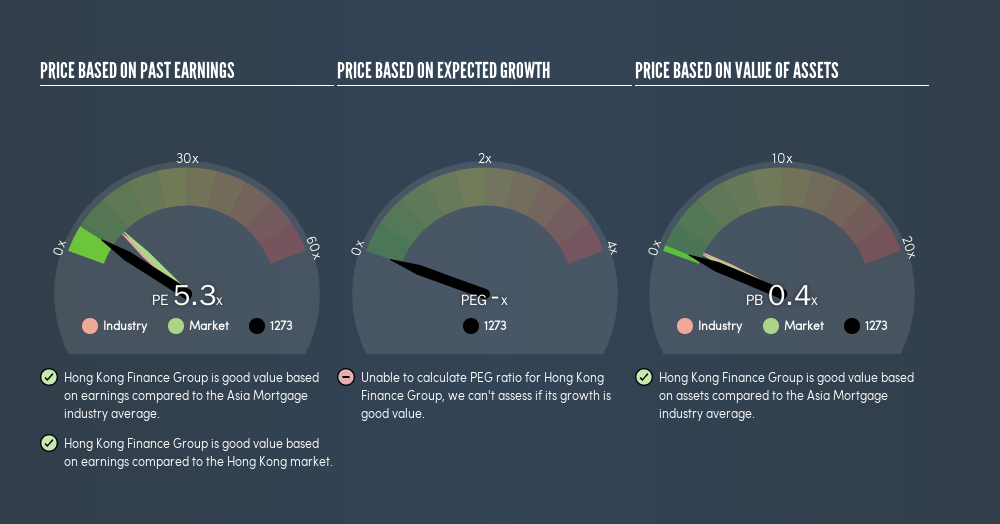

This article is for investors who would like to improve their understanding of price to earnings ratios (P/E ratios). We'll apply a basic P/E ratio analysis to Hong Kong Finance Group Limited's (HKG:1273), to help you decide if the stock is worth further research. Looking at earnings over the last twelve months, Hong Kong Finance Group has a P/E ratio of 5.31. In other words, at today's prices, investors are paying HK$5.31 for every HK$1 in prior year profit.

See our latest analysis for Hong Kong Finance Group

How Do You Calculate A P/E Ratio?

The formula for P/E is:

Price to Earnings Ratio = Share Price ÷ Earnings per Share (EPS)

Or for Hong Kong Finance Group:

P/E of 5.31 = HK$0.54 ÷ HK$0.10 (Based on the year to March 2019.)

Is A High Price-to-Earnings Ratio Good?

A higher P/E ratio means that buyers have to pay a higher price for each HK$1 the company has earned over the last year. That isn't necessarily good or bad, but a high P/E implies relatively high expectations of what a company can achieve in the future.

Does Hong Kong Finance Group Have A Relatively High Or Low P/E For Its Industry?

The P/E ratio indicates whether the market has higher or lower expectations of a company. If you look at the image below, you can see Hong Kong Finance Group has a lower P/E than the average (9.8) in the mortgage industry classification.

Its relatively low P/E ratio indicates that Hong Kong Finance Group shareholders think it will struggle to do as well as other companies in its industry classification.

How Growth Rates Impact P/E Ratios

If earnings fall then in the future the 'E' will be lower. Therefore, even if you pay a low multiple of earnings now, that multiple will become higher in the future. Then, a higher P/E might scare off shareholders, pushing the share price down.

Hong Kong Finance Group saw earnings per share decrease by 16% last year. And it has shrunk its earnings per share by 2.2% per year over the last five years. This growth rate might warrant a below average P/E ratio.

Remember: P/E Ratios Don't Consider The Balance Sheet

One drawback of using a P/E ratio is that it considers market capitalization, but not the balance sheet. That means it doesn't take debt or cash into account. Hypothetically, a company could reduce its future P/E ratio by spending its cash (or taking on debt) to achieve higher earnings.

Such spending might be good or bad, overall, but the key point here is that you need to look at debt to understand the P/E ratio in context.

Hong Kong Finance Group's Balance Sheet

Hong Kong Finance Group has net debt worth a very significant 236% of its market capitalization. If you want to compare its P/E ratio to other companies, you must keep in mind that these debt levels would usually warrant a relatively low P/E.

The Bottom Line On Hong Kong Finance Group's P/E Ratio

Hong Kong Finance Group has a P/E of 5.3. That's below the average in the HK market, which is 10.6. When you consider that the company has significant debt, and didn't grow EPS last year, it isn't surprising that the market has muted expectations.

Investors have an opportunity when market expectations about a stock are wrong. As value investor Benjamin Graham famously said, 'In the short run, the market is a voting machine but in the long run, it is a weighing machine.' We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

But note: Hong Kong Finance Group may not be the best stock to buy. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20).

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:1273

Hong Kong Finance Group

An investment holding company, provides property mortgage and personal loans under the Hong Kong Finance brand name in Hong Kong.

Good value with adequate balance sheet.

Market Insights

Community Narratives